Active pays off in June quarter… at least for growth managers

Frontier Advisors has analysed the performance of equities fund managers across the final quarter of the 2019-20 financial year. In a note released to its clients, Frontier reported that growth-focussed managers outstripped value managers by a considerable margin over the quarter, particularly across international markets where some very strong results were recorded.

While the underperformance of the value style, which has been going on for at least eight years in Australia and internationally, is continuing, the gap between the two has narrowed, the Frontier research suggests. The good results during the June quarter typically came from managers holding technology-related stocks which have fared relatively well through COVID- 19. With the ASX 300 up 16.8 per cent for the quarter, individual stock selection had a marked impact on performance for managers in Australia with exposure to technology, energy and consumer discretionary sectors each delivering double-digit performance, Frontier said. In a flip of the previous quarter, healthcare, consumer staples and utilities provided a drag on performance for the period despite being among the best performers for the full twelve months.

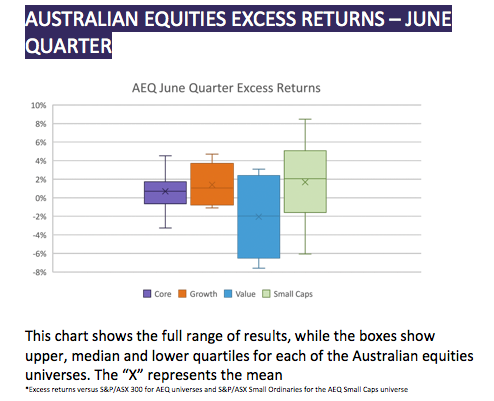

Simone Gavin, a Frontier senior consultant said: “Growth managers continued to outperform core and value managers in relative terms, although this difference was less significant than in the March quarter. Active managers broadly provided an excess return over the benchmark for investors with cyclical stocks rallying and defensives generally underperforming.”

Globally, the performance across sectors was quite different. Only the technology, consumer discretionary and material sectors registered a positive result for the quarter to June. The emerging markets sector provided investors with slightly less joy relative to developed markets for both the quarter and the year. China exposure and industry biases had a major impact on manager performance with those high in tech and e-commerce among the best performers.

Active management paid off for those managers investing to a growth style; however, most core and value managers across international portfolios underperformed. Active management in emerging markets produced mixed results.

“High growth, technology-focussed managers continued to generate extremely strong returns for the quarter with a small number returning in excess of 40 per cent for the period. Broadly, we saw global growth managers achieve a mean over 10 per cent for the quarter compared with a 2 per cent loss on average for their value manager counterparts,” Gavin said.

Frontier’s analysis demonstrates the wild ride investors have taken over the first six months of calendar year 2020, with the financial year 2019/20 results demonstrating active strategies with a growth focus were able to generate a positive outcome for investors, while those with a more defensive and value-aligned approach were more likely to finish the year in the red.

Frontier is currently holding its annual client conference via a series of webinars held over a two-week period, which started last Wednesday (July 15). For details and access go to: