APRA has no view on fund size despite ‘sustainability challenges’: Cole

It was at CMSF 2021 that former APRA deputy chair Helen Rowell made the now-infamous remark that funds under $30 billion FUM were likely to be uncompetitive in a rapidly changing superannuation landscape. In March, APRA released internal research that found that funds needed to be above the $50 billion threshold to unlock those elusive economies of scale – the ability to lower fees by spreading them across a larger member base.

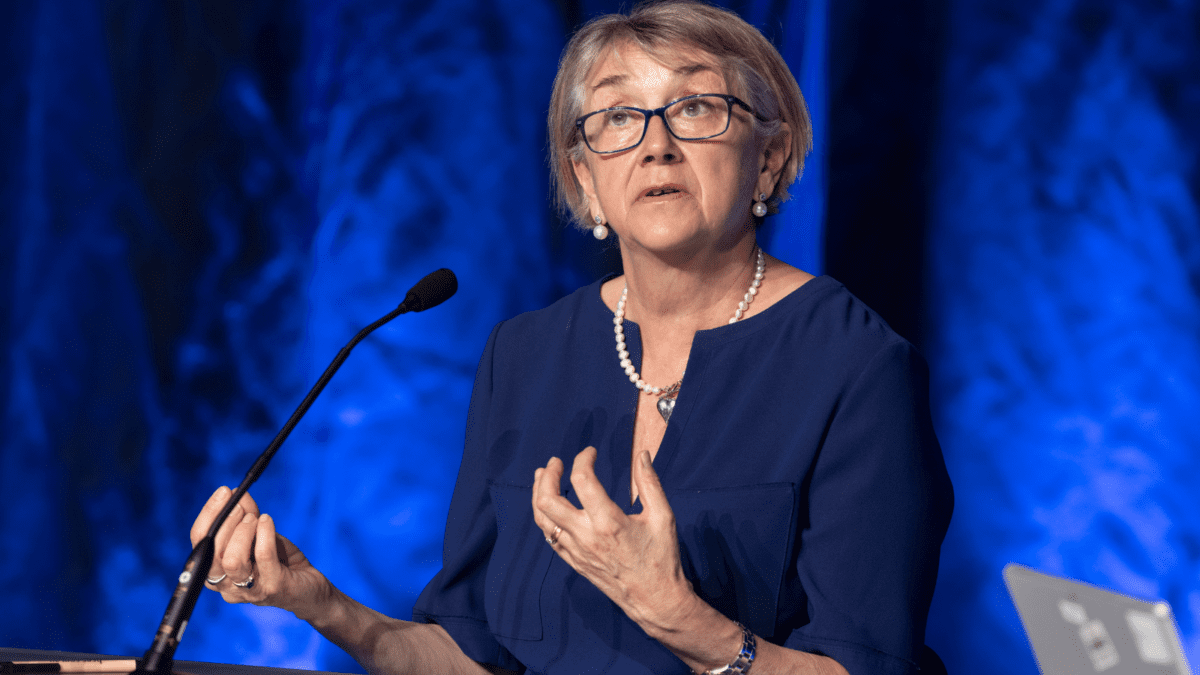

But at CMSF 2022, APRA’s new superannuation chief Margaret Cole tempered some of the rhetoric that has come out of government and the regulators around the future size of the industry, saying that the regulator has not taken a view on how many funds there could or should be in the future.

“Nor have we ever said that super funds under a certain size of FUM won’t survive,” Cole told CMSF on Wednesday (September 7). “We do say, however, that there’s clear evidence from our own research that shows that funds under a certain size are more likely to face sustainability challenges unless they have some other form of competitive advantage.”

“And we also say, and will carry on saying, without apology, that members have the right to have their savings in well governed and high-performing super funds. It’s a competitive market out there… performance tests and stapling are driving change, and what will determine which funds remain competitive and stable and which funds become footnotes in financial history will depend on trustees finding opportunities for growth and innovation.”

Still, the number of funds has fallen, and Cole said that if the superannuation industry were to be designed today “on a blank piece of paper from scratch” it’s unlikely it would look the way it does today, with 110 of the 140 APRA-regulated funds collectively managing only 10 per cent of the assets.

“We don’t want to replicate the banking sector, but we’re very far from that. And those were the words that the minister said this morning… the future shape of the superannuation industry isn’t for me or APRA (to decide) – it depends on you. There’s so much at stake here for Australian retirees and for the prosperity of the country. I think myths are really unhelpful and I just wanted to bust a few today.”

Not that APRA’s regulatory efforts will be slowing down. It will continue to publish its heatmaps on MySuper and choice products and push into areas like governance – investment and otherwise – business planning, and frameworks for decision making around expenditure, on which it has already “had some great feedback from trustees”. And at roughly the same time Cole was giving her speech, Treasury released its draft consultation on the Your Future Your Super reforms.

“We always want to get smarter and better about the way we go about our work, and the review will give (funds) an opportunity to feed in their thoughts and have a say on the future evolution of the test,” Cole said. “We very much agree that having that review of the test after two cycles makes very good sense.”

The new draft consultation paper canvasses for views on the efficacy of the performance test, the suitability of the benchmarks, the consequences of a test failure, stapling, and the best financial interests duty.