ASX closes 0.6% higher, CBA’s fresh criminal charges

ASX rally continues, unemployment falls, Wesfarmer’s acquisition proceeding

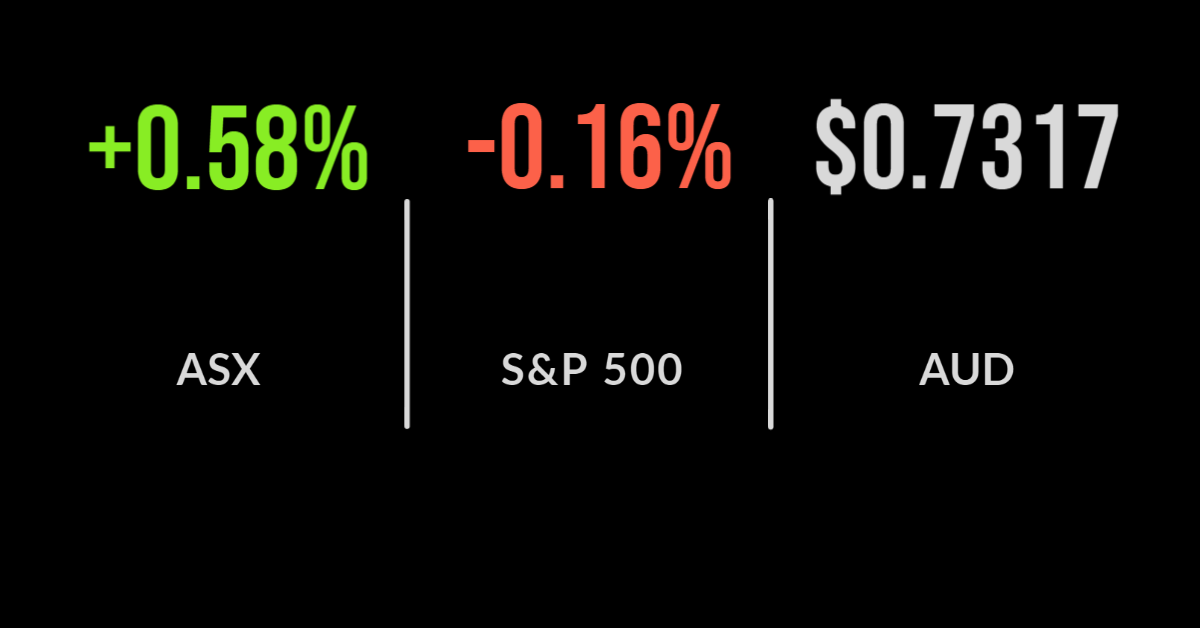

The S&P/ASX200 (ASX: XJO) rallied another 0.6% with every industry sector gaining.

The standout once again was the energy sector, which added 1.3% behind Woodside (ASX:WPL) which finished 2.5% higher after another 3% jump in the oil price.

Each of the financials and healthcare sectors also added 1.0% with the Commonwealth Bank (ASX: CBA) once again holding above $100 per share. The rally came despite a decidedly weak unemployment result.

The headline figures showed a drop in unemployment from 4.6 to 4.5%, despite over 146,000 losing jobs during the period.

A fall in the participation rate, which suggest more people have given up looking for work is a clear negative sign for the economy.

Goldman Sachs economists suggest the real unemployment rate could be as high as 9.1% when another fall in hours worked is also included.

Shares in Austal (ASX: ASB) rallied 2.7% as the ship builder is seen as a potential beneficiary of the US/UK defence deal to deliver nuclear submarines, built in Australia.

Australian Pharmaceuticals spikes, Telstra ready for growth

Shares in Australian Pharmaceuticals (ASX: API) finished 16.1% higher after Wesfarmers (ASX: WES) increase their bid for the company from $1.38 per share to $1.55.

The deal prices the company at $764 million and has the support of API’s biggest shareholder Washington H Soul Pattinson (ASX: SOL).

It marks another pivot for WES who are seeking to leverage their supply chain experience and build out a healthcare division.

Telstra’s (ASX: TLS) CEO announced the end of T22 and the beginning of T25, announcing his intention to cut another $500 million in costs from the business.

The group is now seeking to deliver growth in the high teens, with a focus on its loyalty program, 5G and expended network coverage.

Shareholders are clearly beginning to believe in Andy Penn with shares 0.5% higher. Myer (ASX: MYR) shares rallied 16.7% despite management withholding their dividend once again.

Profit was boosted by Job Keeper and rent waivers growing to $46 million, an improvement on a loss of $172 million in 2020.

In a positive sign, sales were 5.5% higher across the business, with July half up 38% and online sales now representing 20% of the total.

Mixed economic data holds back market, retail sales grow, big tech gains

US markets were mixed with both the S&P 500 and Dow Jones falling 0.2% overnight.

The Nasdaq continued its positive run, adding 0.1% as Amazon (NYSE: AMZN) gained 0.4% on stronger than expected retail sales.

The result was significantly better than expected, with retail sales up 0.7% in August, turning around the expected result of a 0.7% fall.

Excluding vehicle sales growth was 1.8% however worrying trends are emerging as both restaurant and bar spending continues to flatline, likely holding back the recovery.

And why not when it was reported overnight that one in 500 American’s have died from COVID-19.

Meme stock king AMC Entertainment (NYSE: AMC) fell 1.7% despite announcing their intention to accept Bitcoin for movie ticket purchases before Christmas whilst shares in Cisco (NYSE:CIS) were flat despite forecasting revenue growth of 5 to 7% over the next four years.