ASX continues strength on commodity surge, dividend payments drag, bond yields jump

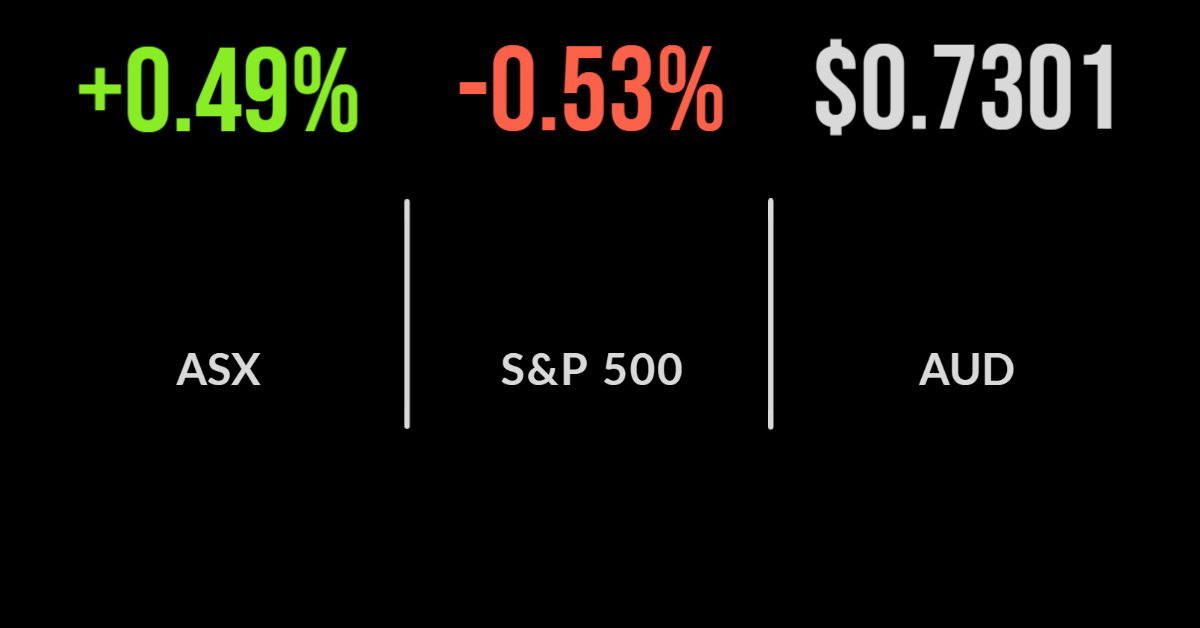

The Government bond market is now experiencing more volatility than the equity market, with the Australian 10-year yield increasing 10 basis points today, whilst the S&P/ASX200 gained 0.5 per cent once again.

Just four of the 11 key sectors were lower, led by Consumer Staples, which fell 2.3 per cent, primarily due to Coles (ASX: COL) moving to ex-dividend and falling 1.7 per cent in the session.

This is an often forgotten issue for investors, with most companies paying dividends in March, sending their share price down by the amount of said payment.

Materials and energy stocks continued to be the primary driver of the ASX’s resilience, with the price of gas in Europe hitting an all-time record overnight.

In Australia, the biggest beneficiaries were coal miner Whitehaven (ASX: WHC) and gas producer Origin (ASX: ORG) which gained 10.6 and 3.6 per cent respectively.

The materials and commodities sectors saw a significant rally as a number of announcements out of China boosted hopes for more stimulus.

The country looks like it will abandon its Zero COVID policy, whilst at the same time, the crackdown on the property sector is also set to end.

Clean energy materials including lithium and nickel were well supported; Pilbara (ASX: PLS) gained 5.3 per cent, as was BHP (ASX: BHP) which added 3.6 per cent.

OPEC+ increases output, Cimic, IAG facing legal challenges, MSCI cuts Russia

With the oil price above USD$110 per barrel, all eyes have been on the OPEC+ cartel to loosen supply and save the world from the inflation spreading throughout the economy.

Unfortunately, the group agreed to just a 400,000 per day barrel increase in supply from April, which sent the oil price up another 9 per cent alone.

This surge in commodity prices and shutdown of exploration has been key to the strength of the Australian economy with the country reporting the largest trade surplus in close to a year with coal and gas offsetting the falling iron ore price.

Cimic (ASX: CIM) shares remained flat despite a report that the group had not fulfilled obligations to staff in the since shuttered Middle East businesses, the takeover offer from majority owner Hochtief remains the focus of markets.

Insurance Australia Group (ASX: IAG) is facing its own issues with some $300 million in claims lodged against the company, which they dispute, that relate to insurance offered to bonds issued by the now failed Greensill Financing Group.

One of the world’s largest index providers, MSCI, which effectively determine where funds invested into ETFs are placed has indicated it will remove Russia from emerging market status, stating that it was uninvestable and would no longer form part of their indices.

Markets falls as oil stalls, Snowflake tanks, Kroger gains, services sector slows

Global markets have taken a breather overnight as they seek to come to terms with the flow-on effects of sanctions on Russia, their continued March forward and the ultimate outcomes of this war.

Combined with comments from the Federal Reserve, the cyclical focused Dow Jones outperformed, losing 0.3 per cent, the S&P500 fell 0.5 and the Nasdaq dropped 1.6 per cent.

Leading cloud provider Salesforce (NYSE: CRM) reported earlier this week, seeing a 25 per cent boost to cash flow from the system powering sales teams around the world.

They guided for similar growth in 2023 however, the share price continues to weaken.

It was a similar story for cloud analysis software Snowflake (NASDAQ: SNOW) which fell 15 per cent after providing lower guidance for 2023 as the threat of ‘earnings airpockets’ grows in even high-quality tech businesses.

The oil price weakened to around US$100 per barrel but with Russian oil sanctions likely next, there is little sign of a significant retracement.

The US services sector also slowed to a one year low as business and orders weakened across the economy.