ASX down 0.6%, Fortescue soars on jet fuel deal

ASX falls, unemployment jumps, Ramsay, Nearmap struggle

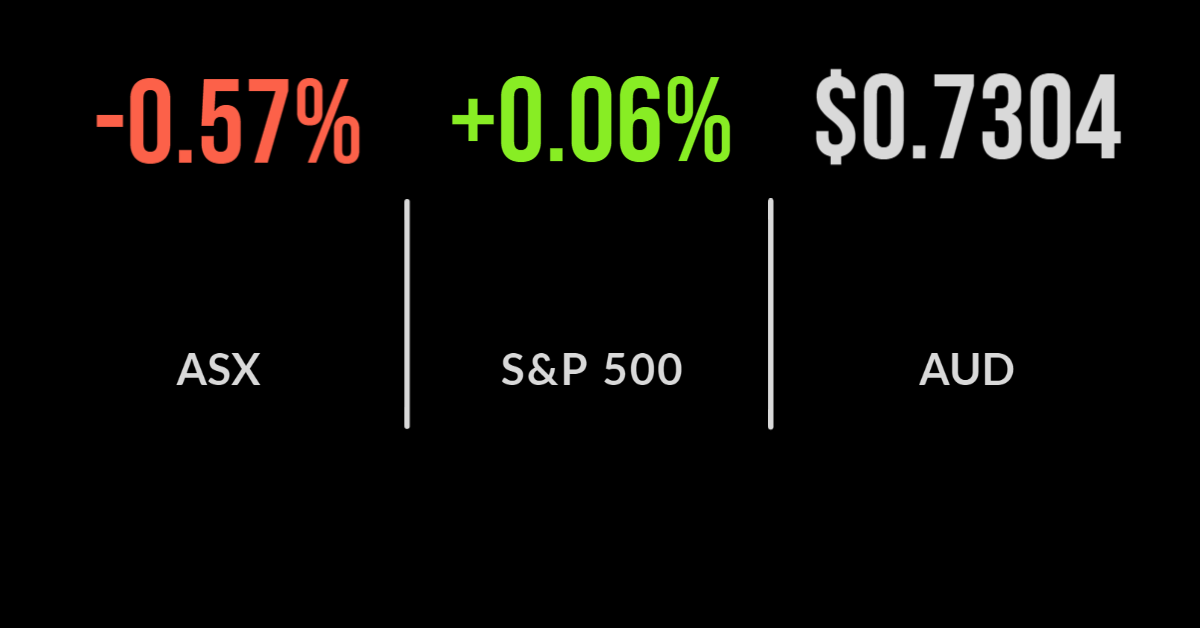

The S&P500/ASX200 (ASX: XJO) fell throughout the session ultimately finishing 0.6 per cent lower with Fortescue (ASX: FMG) a rare standout.

The company gained over 8 per cent after the CEO delivered a speech highlighted the huge green energy opportunity and dry powder that Fortescue Future Industries had available.

The rally supported the materials sector which gained 2.3 per cent with communications the only other sector finishing higher.

Every other sector finished lower following the difficult US lead, with technology, healthcare and energy all dropping by over 2 per cent.

Tech darling Xero (ASX: XRO) fell over 6 per cent despite delivering another quarter of revenue growth exceeding 20 per cent.

Investors were clearly concerned about a reversal in profitability, which fell to a NZ$5.7 million loss and a slowdown in subscriber growth which grew 23 per cent for the year to over 3 million.

Nearmap (ASX: NEA) which provides geospatial imaging fell another 12 per cent after management flagged another $30 million in cash to be invested into growth opportunities whilst confirming annualised contract revenue would only be 12 per cent higher in 2021.

Advertising rebounds for Nine, Ramsay hit by surgery shutdowns, Orica issues

GrainCorp (ASX: GNC) was broadly flat despite delivering a rebound in profit on the back of a bumper east coast grain season.

The company reported an $139 million profit, a significant turnaround from last year’s $16 million loss.

Nine Entertainment (ASX: NEC) has followed the lead of News Corp (ASX: NWS) with the company confirming profit is tracking over 10 per cent higher than 2020 levels, as advertising revenue in both television and publications including Australian Financial Review continue to recover.

Eyeballs and quality series remain key with free to air advertising revenue up 20 per cent in the September quarter alone.

Ramsay Healthcare (ASX: RHC) fell by over 5 per cent after delivering revenue growth of just 1.3 per cent.

The company had been seeing strong signs of recovery as vaccination rates in the UK, France and Australia improved, but the shutdown of elective surgeries, cancellations and higher operating costs sent earnings down close to 30 per cent.

The unemployment ‘unexpectedly’ jumped from 4.6 per cent to 5.2 per cent in October despite the end of lockdowns, with 50,000 jobs lost, compared to the 50,000 jobs gained that had been predicted by the majority of leading economists.

US equities rallied, Disney pulls Dow lower, Evergrande meets deadline

US markets were broadly higher on Thursday, overcoming an inflation induced sell off on Wednesday with materials, energy and technology keeping the S&P500 flat, the Nasdaq gained 0.5 per cent.

The Dow Jones fell 0.4 per cent after major constituent Disney (NYSE: DIS) delivered a weaker than expected result.

All eyes were on Tesla (NYSE: TSLA) after CEO Elon Musk reported the sale of some 5 million shares or US$5 billion worth in order to fund upcoming tax payments, this comes after the stock increased more than tenfold over the last 2 years.

Shares in Walt Disney were down more than 13 per cent after the company delivered weaker than expected subscriber growth and theme park revenue.

The group’s Disney+ subscribers grew just 2.1 million or 1.8 per cent in the quarter as a lack of new content struggled to attract subscribers.

Profit was positive.at US$159 million from a 2020 loss whilst theme park income doubled to US$5.45 billion on 2020 levels but remains well below prior years.

Faux meat product Beyond Meat (NASDAQ: BYND) fell over 13 per cent after reporting sales growth of just 12 per cent for the quarter and flagging transport and supply chain costs as a hit to earnings.

The gold price has continued to rally on the threat of inflation now well over US$1,850 and $2,550 in AUD.