ASX down but positive week

ASX down but positive week, energy shines, asset management dispersion

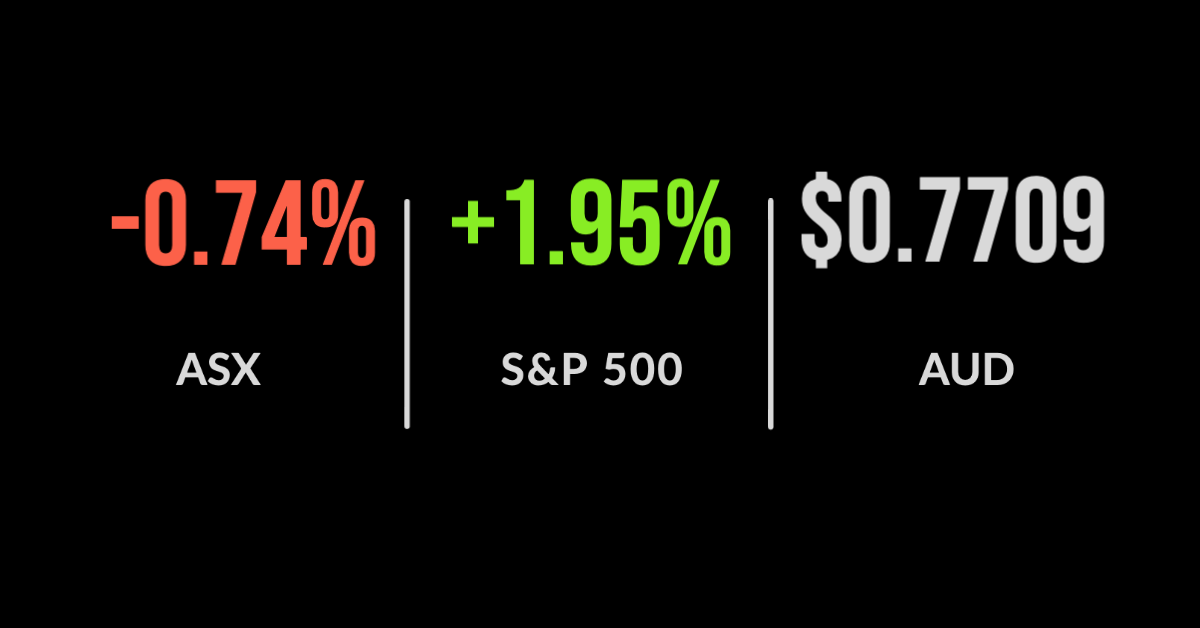

The ASX200 (ASX:XJO) fell 0.7% on Friday but managed to deliver a positive return for the week, finishing 0.6% higher.

The commodities sector was hardest hit on Friday, falling 2.0%, with the IT sector continuing to fall as valuations are reset in response to higher bond rates.

Over the week financials were the biggest beneficiary of higher interest rates, the sector was up 4.8% behind ANZ Banking Group (ASX:ANZ) which jumped 10.2%.

The OPEC cartel unexpectedly extended recent supply cuts for a further month sending oil prices higher, benefitting Woodside Petroleum (ASX:WPL) and Origin Energy (ASX:ORG) which added 3.1% and 2.8% respectively.

The highly popular BNPL and rare earths sector fell heavily during the week as the focus turned to capital preservation, with Zip Co (ASX:Z1P) down 7.6% for the week.

Crown’s (ASX:CWN) year from hell continued with the WA Government announcing an inquiry into the group’s suitability to operate the Crown Perth Casino, but shares remain resilient adding 0.1%.

Both Magellan Financial Group (ASX: MFG) and Platinum Asset Management (ASX:PTM) reported their latest assets under management with MFG adding another $703 million and PTM losing $350 million from retail investors.

Interestingly, PTM has significantly outperformed MFG in recent months but is not yet seeing the resultant inflows.

US markets finish strongly on jobs data, unemployment falls to 6.2%

US markets staged the biggest intraday recovery in close to a year, with the Nasdaq finishing 1.6% higher and both the Dow Jones and S&P500 gaining 1.9% to finish the week.

Every sector improved after news that the US economy had added another 379,000 jobs in February sending the unemployment rate down to 6.2%.

Despite headlines suggesting the bull market was over as bond rates spiked, the tech-heavy Nasdaq finished down just 2.1% for the week, the Dow 1.8%, and the S&P500 0.8%.

That doesn’t mean there isn’t significant pain around, with Tesla losing US$234 billion in value in the last four weeks, which is more than double the market capitalisation of the Commonwealth Bank of Australia (ASX:CBA) for some aspect of scale.

Moving back to government bond rates, the Australian Composite Bond Index suffered its worst monthly loss in history during February, with the ‘low risk’ assets falling 3.6%.

Similarly, US government bonds have delivered one of their worst beginnings to a year since 1830, down 4.7% year to date, after returning close to 11% in 2020.

Accept uncertainty, M&A the key source of growth, regulator getting active

Listening to Magellan’s webinar this week offered a reminder that markets don’t move in straight lines.

Whilst the headlines are fixated on two issues, the first being the strength of the economic recovery, and the second bond rates sending market valuations lower, neither of these events are certainties despite the number of experts talking about them.

This week was an important reminder that markets are delicately balanced, and investors best have a strategy in place that is resilient to both environments.

Merger and acquisition activity is looking like the only source of real growth for businesses coming out of the pandemic, with the likes of Challenger (ASX:CGF), Xero (ASX:XRO), and Cleanaway (ASX:CWY) all on the hunt to solidify their revenue base ahead of an inevitable slowdown of the global economy as stimulus runs off.

The financial services regulator had a busy week, announcing cases against no fewer than four major institutions; CommSec facing accusations of excess brokerage charges, REST Super for pressuring members not to leave their fund, and Dover Financial Advisers for issues raised during the Royal Commission.