ASX falls as tech tanks, Westpac profit flat, Xero, Novonix slump

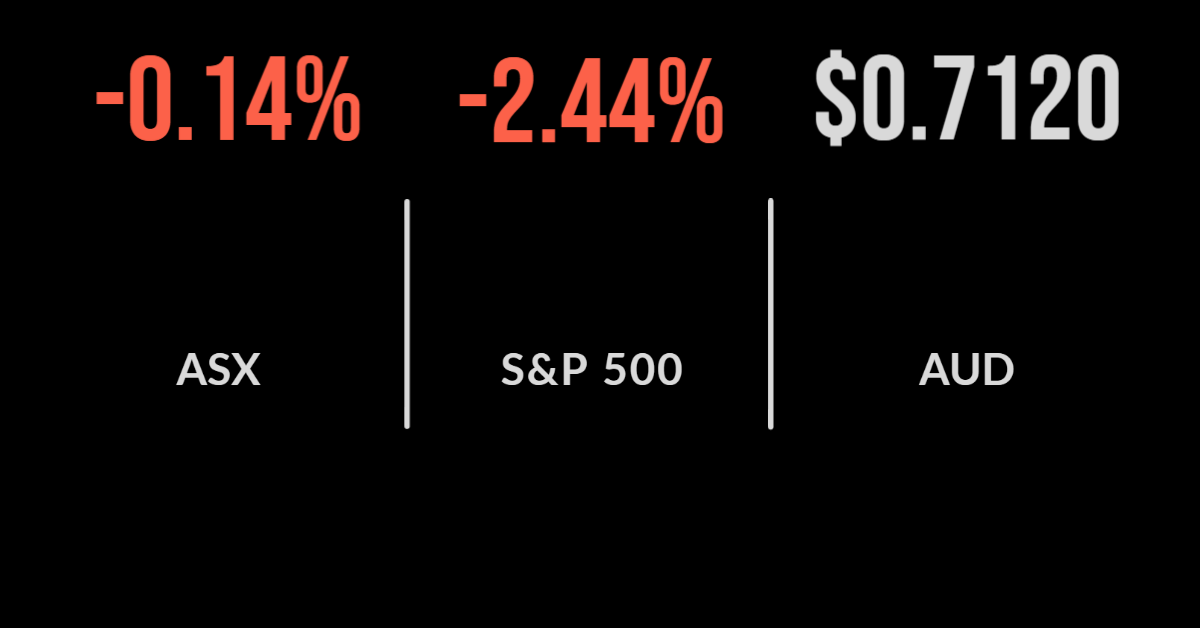

The S&P/ASX200 fell throughout the day, finishing 0.1% lower with all eyes on the Morningstar Investment Conference.

The technology sector carried most of the selling pressure, falling 5.9% in a single session, with utilities and materials the only sectors settling higher.

Popular lithium miner Novonix (ASX: NVX) fell close to 15% despite any news on the company, with numerous other technology names not far behind.

Xero (ASX: XRO) fell 5%, Wisetech (ASX: WST) 8% and Technology One (ASX: TNE) 6.6% as investors desert the once popular growth names.

Westpac (ASX: WBC) was the first bank to deliver a quarterly update, gaining 2.3% after reporting a 1% increase in cash earnings to $1.58 billion.

Investors welcomed the 7% cut to costs as the company seeks another $8 billion in reductions, however the net interest margin fell another 8 basis points to 1.91% as the RBA’s cheap funding program came to an end.

Nick Scali hit by closures, Nufarm smashes expectations

Furniture retailer Nick Scali (ASX: NCK) was the latest e-commerce winner to deliver a weaker than expected result, that said the share price managed to hold.

Revenue grew 5.4% for the half, despite 55% of its store network being closed due to the Delta lockdowns.

Earnings fell 3.7% to $55.1 million as supply chain and staffing issues eat into their profit margins.

Nufarm (ASX: NUF) was the top performing stock on the day, adding over 20% after delivering a result that smashed expectations.

The crop protection and seed provider reported a 36% jump in quarterly revenue, with the company now on track to deliver fully year growth well ahead of forecasts.

The company is booming on the back of shortages and surging prices for agricultural commodities.

Aristocrat Leisure’s (ASX: ALL) highly publicised deal to purchase UK gambling group Playtech for $3.9 billion is set to fall over, with the company not achieving a sufficient majority from current shareholders to push the deal through. Shares fell 0.5% on the news.

US stocks fall on Facebook weakness, Spotify falls, rate hikes ahead

All three US markets quickly reversed recent gains with Facebook’s parent company Meta Platforms (NYSE: FB) tanking by more than 25% in a single session.

The result was a close to 90% of Nasdaq constituents falling, dragging the index down 3.7%.

The S&P500 and Dow Jones outperformed, falling 2.4 and 1.5% respectively.

It was a difficult quarter for Facebook, a company which generates the majority of its revenue from advertising, after Apple made a number of privacy changes that impacted sales.

That said sales grew by 15% to US$33 billion for the quarter, but a reduced forecast alarmed traders.

Earnings remains strong at US$10 billion, but lower than this time last year as the likes of Tik Tok and Snap Inc. eat into Facebook’s 1.93 billion daily active users.

It is clear the pivot to the ‘metaverse’ was needed to refresh the company, but it will take some time to become profitable.

Shares in podcast and music platform Spotify (NYSE: SPOT) were also down more than 15% after the company reduced their subscriber forecasts to just 1 million than expected.

The company managed to reach US$10 billion in revenue for the first time.