ASX gains, but down 1.7 per cent for the week, Healius sells assets as iron ore surges

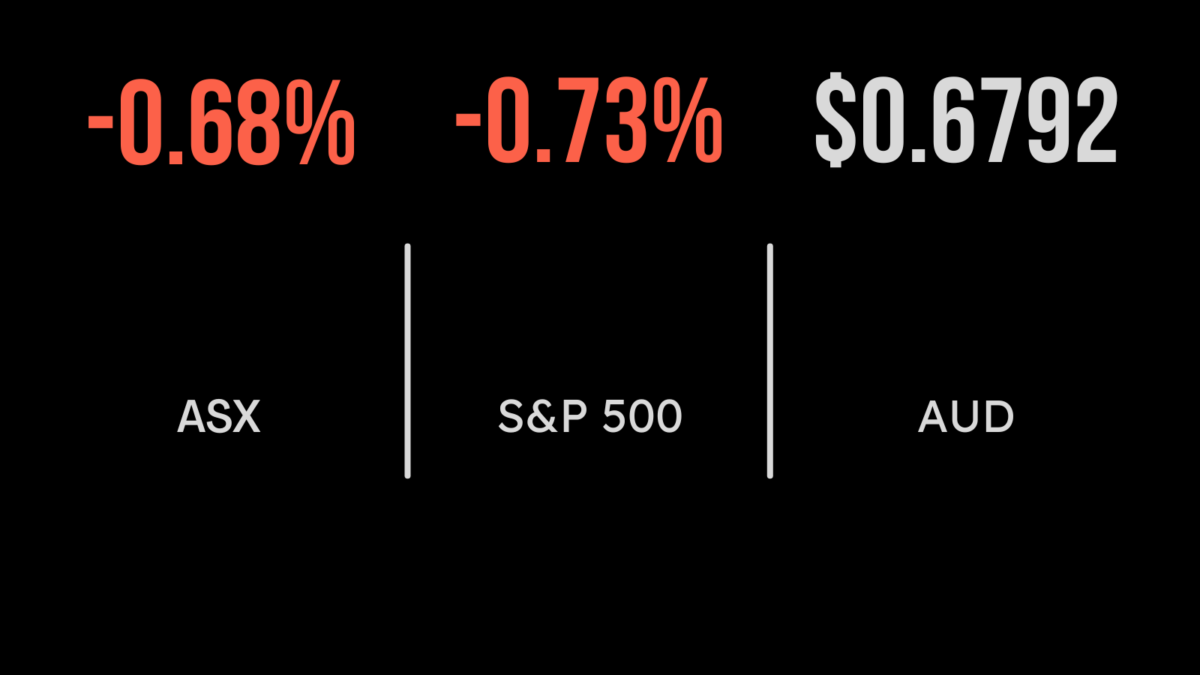

The local market managed to end the week on a positive note, adding 0.5 per cent, as continued strength in the iron ore price sent the materials sector close to 2 per cent higher. The rally was led by BHP (ASX: BHP) which gained 2.7 per cent, and Fortescue (ASX: FMG) which added 2.8 per cent, with the technology sector not far behind, adding 1 per cent on Friday. Shares in Nitro (ASX: NTO) gained 3.4 per cent after the company received a new $2 per share from acquirer Potentia, while Pinnacle (ASX: PNI) shares tanked on weaker profit expectations. The company which owns stakes in multiple fund managers indicated performance fees would fall from close to $7 million to around $1 million in the current year as outperformance wanes and high-water markets are missed due to the weaker sharemarket backdrop. Shares in Healius (ASX: HLS) were flat despite announcing the sale of their Monserrat day hospitals for around $138 million. Over the week, materials and iron ore led the way, with Champion Iron (ASX: CIA) gaining 8.8 per cent and Fortescue 8.7 per cent, with Downer EDI (ASX: DOW) sinking 2 per cent after flagging ‘accounting irregularities’ within their utilities business.

S&P500 snaps two weeks of gains, Microsoft under pressure, inflation ahead

All three US benchmarks suffered a weaker day on Friday, with the Dow Jones leading the way, falling 0.9 per cent, amid concern that producer price inflation had come in higher than most had expected. The S&P500 and Nasdaq both fell 0.7 per cent with the energy sector the main difference between the two. Shares in Microsoft (NYSE: MSFT) remain under pressure after the company confirmed it was facing court action from the competition regulator relating to its purchase of gaming designer Activision Blizzard (NYSE: ATVI). On Friday the company announced it has acquired Lumenisity, which makes hollow core fibre solutions as the group seeks to add further diversification to its business. Shares in Walt Disney (NYSE: DIS) were slightly better, gaining 0.8 per cent after the company announced its ad-supported Disney+ service will be made available in the US shortly. Over the week, the Dow Jones fell 2.8, the S&P500 3.4 and the Nasdaq 4 per cent as two straight weeks of gains were reversed.

China’s policy switch, acquisitions replace IPOs, funds management remains tough

China’s abrupt policy switch is set to be the most important factor for global growth in the year ahead. With lockdowns set to come to an end, spending and people movement is likely to return to normal, with fiscal support also expected as the government seeks to maintain the economic momentum. This positive news has seen the iron ore price rally significantly, supporting the AUD and Australian miners; could China save the day again? Pinnacle’s confirmation that performance fees were set to reduce reflects how difficult funds management has become in such a unique and challenging environment. The group relies on its managers outperforming their benchmarks to see an additional boost in profit, but with high growth manager struggling and fixed income remaining difficult, 2022 was always going to be tough. Finally, it seems clear that acquisitions will dominate the news flow in 2023 as opposed to the flurry of IPOs in recent years. News that Rinehart was set to buy Warrego energy comes after a similar deal between BHP and OZ Minerals, with the tech and retail sectors unlikely to be immune.