ASX hits five month high, Virgin Money jumps, crypto stocks dumped

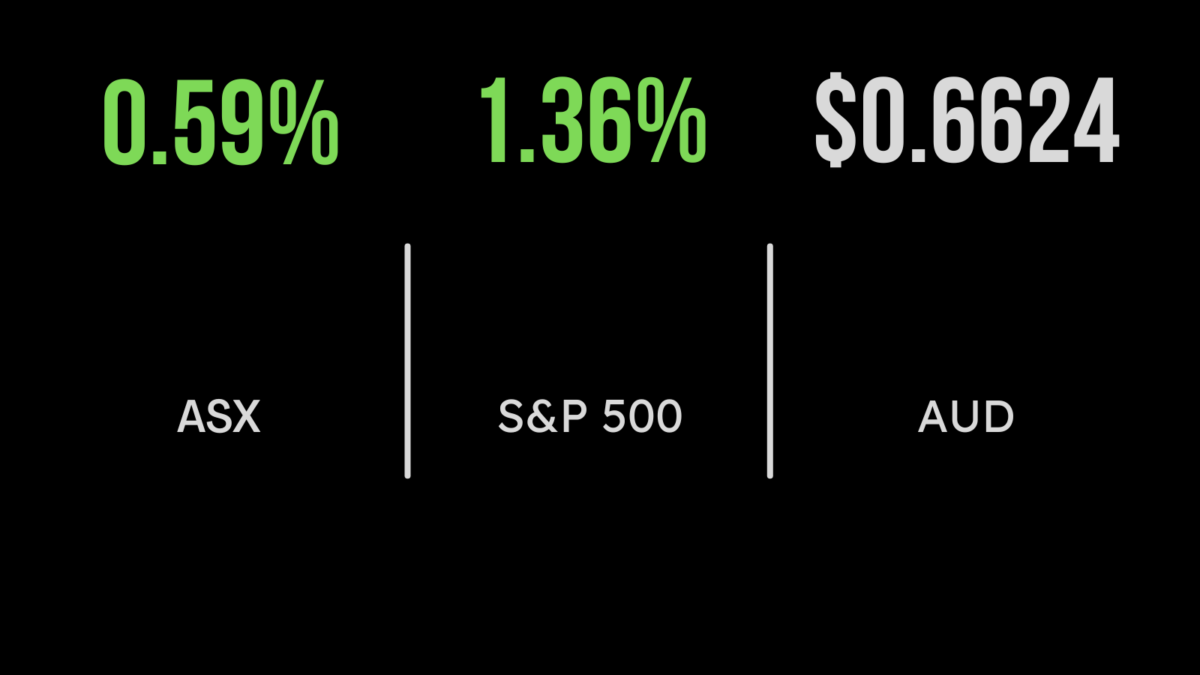

The local market reached a five month high on Tuesday, buoyed by the energy and materials sectors once again, which finished 2.6 and 1.2 per cent in the positive, the S&P/ASX200 gained 0.6 per cent.

The standouts remain in energy, or coal at least, with Whitehaven (ASX:WHC) and New Hope (ASX:NHC) up more than 7 per cent each, while oil companies including Santos (ASX:STO) gained a more muted 2 per cent. The emergence of greater COVID cases in China combined with output increases threatens to push the price of oil lower.

The standout by far, however, was UK bank Virgin Money (ASX:VUK) which gained 10.6 per cent through a combination of higher interest rates and positive currency movements.

An independent expert has determined that the updated offered for Pendal (ASX:PDL) is fair with the deal now set to move to a shareholder vote before Christmas, shares were broadly flat on the news.

BlueScope sales slow, Technology One withstands downturn, Star revenue down

BlueScope Steel (ASX:BSL) overcame what management deemed ‘customer hesitancy’ to post a 4.8 per cent gain on the day. According to the update, customers are trimming back stock levels and deliveries from their plants have reduced as a result.

Embattled casino operator Star Entertainment (ASX:SGR) fell 1.4 per cent after the pressure of in-town rival Crown (ASX:CWN) dented revenue by as much as 11 per cent while also being hit with around $35 to $45 million in remediation costs from the near loss of its gaming license.

Shares in software administration provider Technology One (ASX:TNE) rallied strongly, up more than 5 per cent, after management offered guidance that showed a rare technology company doing well in a difficult environment.

The resilience of the firms sales and customer base was on show with revenue growing 18 per cent to 30 September, contributing to a 22 per cent increase in profit.

At the opposite end of the spectrum from BlueScope was Washington H Soul Pattinson (ASX:SOL), which reported an 159 per cent increase in profit and a jump in the dividend while warning of a tougher period to come.

S&P500 rally continues despite shortened week, Dell, Best Buy surge

Another holiday shortened week and thin trading volumes saw all three US benchmarks rally strongly despite little in the way of economic or company data.

Both the Nasdaq and S&P500 gained 1.4 per cent, while the Dow Jones added 1.2 per cent as the threat of Chinese COVID-19 lockdowns emerged once again.

This comes after a few strong weeks for the massive economy, where short-term lockdowns may continue but long-term policy changes are set to be replaced.

Shares in computer and software group Dell (NYSE:DELL) gained more than 5 per cent after the company reported a better than expected fall in profit for the quarter.

Sales in each of their key product lines continue to fall after a bumper few years, led by the PC and consumer businesses.

It has been a rough week for Nasdaq-listed Iris Energy (IREN) a company touted for it’s crypto mining capabilities and popular with many Australian pre-IPO investors.

Shares have fallen more than 30 per cent this week and 93 per cent since listing in November 2021 on concerns that the company was set to default on debt held in the US.

On the positive, retailer Best Buy (NYSE:BBY) reversed the recent trend, outperforming expectations and jumping 10 per cent on a strong quarterly report.