ASX rallies after two-session slide

AGL CEO had enough, Brambles keeps shipping, markets break losing streak

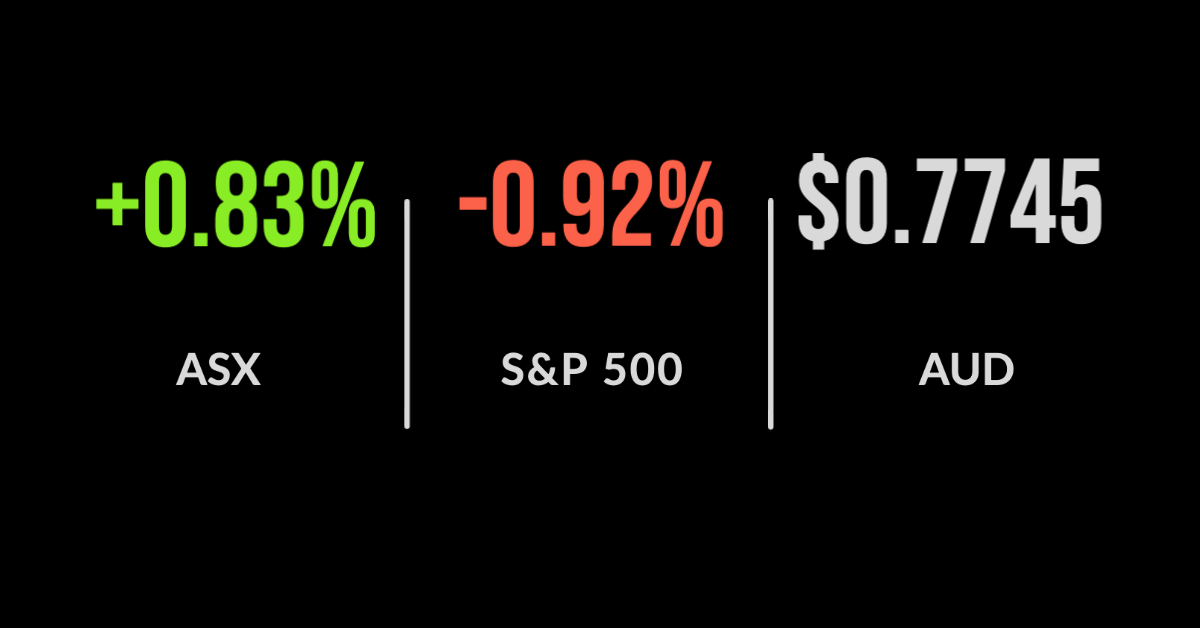

The ASX200 (ASX:XJO) broke a two-day losing streak, shooting 0.8% higher as business conditions and investment intentions hit their highest level in 27 years.

The energy and IT sectors were the main laggards, with energy falling 0.6% as India reported the highest number of new cases since the pandemic began.

On the positive side, healthcare and real estate rallied strongly up 1.7% and 1.3% respectively on signs of further government support in this year’s budget.

AGL Energy (ASX:AGL) was among the biggest detractors from the index, falling 2.9% after their CEO Brett Redman, who has been with the company for 15 years, announced his unexpected retirement.

Despite being only 50 years of age, the reasons given suggested he could not make the long-term commitment required to turn the company around.

Embattled fund manager AMP (ASX:AMP) continues to hit new lows, falling 3.4%, despite reporting a $1.6 billion increase in assets under management.

Looking beyond the headlines, the group lost another $1.5 billion in cash outflows, or $1 billion when pension payments are excluded; the new CEO faces a tough turnaround.

Copper miner hit by higher costs, Brambles maturity on show, Redbubble set to give up profit

Copper and gold miner Oz Minerals reported exceptionally strong growth, producing a further 20% of copper on 2020 levels, hitting 26,842 tonnes.

Gold production delivered a similarly strong result. However, the stronger AUD and lack of staff are clearly having an impact on costs, adding 1% during the quarter, sending the share price 1.1% lower.

The company is benefitted from incredibly strong copper prices, with production the key risk in the year ahead.

Chep pallet distributor Brambles (ASX:BXB) showed its resilience, reporting 8% growth in nine-month sales to US$3.8 billion. The growth came despite volumes increasing only 3%. Management guided to full-year sales growth of 4 to 6% and profit growth of 5 to 7%.

Whilst the revenue growth rate is no comparison to the likes of Afterpay, it shows the sheer resilience, maturity, and defensive nature of the company; shares finished 2.4% higher on the news.

Popular design and consumer product marketplace Redbubble (ASX:RBL) is targeting $1 billion in revenue in the mid-term, but management indicated they will need to give up profit to achieve this.

Specifically, they flagged a further reduction in an already skinny profit margin of 9.5%; the news sent the shares down 23%.

US markets drop on tax proposal, Intel misses expectations, China to cut coal consumption

US markets fell across the board with all three benchmarks down over 0.9% in the extended session. This was the biggest fall in over five weeks with all major industry groups falling, particularly materials and energy.

President Biden is set to propose a near doubling of the capital gains tax rate for those earning over US$1 million to 39.6% in an effort to meet his ‘tax the rich’ election policies.

Intel (NYSE:INTC) suffered a decline in sales which pushed quarterly profit down to US$3.4 billion from US$5.6 billion in the prior year, revenue was broadly flat.

The company reported strong growth in client or home computing with sales up 8%, but its key data centre division saw a 20% drop in revenue as competition increased from its rivals; shares fell 1.8%.

China has vowed to significantly reduce coal consumption in the 2026 to 2030 period with suggestions the major user will see peak demand in 2025.

AT&T (NYSE:TO) shares jumped 4.1% after reporting the company’s HBO Max streaming business had grown subscribers by 3 million to 44.2 million and delivered a 9.4% increase in mobility or mobile revenue.