Australian market struggling for energy

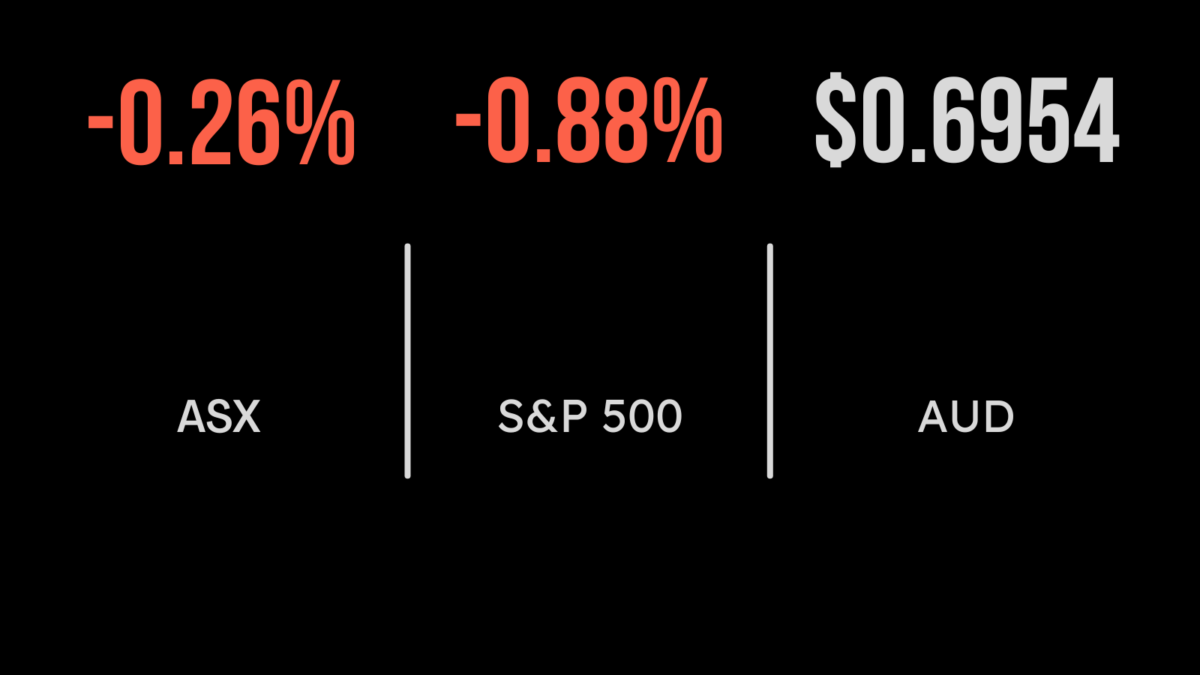

The benchmark S&P/ASX 200 Index fell 39.8 points, or 0.5 per cent on Thursday to 7490.3; while the broader All Ordinaries index dropped 44.7 points, or 0.6 per cent, to 7695.8.

Energy was in the spotlight, with the Mike Cannon-Brookes-backed AGL Energy plunging 82 cents, or 10 per cent, to $7.12 after the company downgraded full-year earnings guidance, cut its dividend and reported a fall in operating cashflow.

The coal stocks were pounded, with Whitehaven Coal slumping 50 cents, or 5.9 per cent, to $8.04; New Hope Corporation sliding 30 cents, or 4.9 per cent, to $5.81; Coronado Global Resources down 13 cents, or 6 per cent, to $2.02; Yancoal Australia losing 27 cents, or 4.5 per cent, to $5.79; and Terracom 3.5 cents, or 4 per cent, weaker at 83 cents. Oil and gas giant Woodside Energy firmed 8 cents, or 0.2 per cent, to $36.47.

Among the major miners, BHP Group rose 2¢ to $48.12; and Rio Tinto fell 34 cents, or 0.3 per cent, to $123.85; but Fortescue Metals managed a 4 cent, or 0.2 per cent, rise to $22.52. Gold miner Newcrest Mining slid 38 cents, or 1.5 per cent, to $25.22, in its first losing day since receiving a $24.5 billion takeover offer from US gold heavyweight Newmont Corporation, the world’s largest gold miner, at the weekend. Newcrest is still up 12.8 per cent since the bid. Gold explorer De Grey Mining was up 4.5 cents, or 3.2 per cent, to $1.46, after telling the market that it had received proposals from 14 potential lenders to finance its Mallina mine in Western Australia’s Kimberley region.

In lithium, Pilbara Minerals slipped 16 cents, or 3.2 per cent, to $4.78, and fellow producer Allkem retreated 54 cents, or 4 per cent, to $12.78. IGO, which mines nickel and lithium, declined 9 cents, or 0.6 per cent, to $14.64l; while Mineral Resources, which produces iron ore as well as lithium, was down 23 cents, or 0.2 per cent, to $90.99.

Among the lithium project developers, Liontown Resources gave up 6.5 cents, or 4.3 per cent, to $1.46; and Core Lithium retreated 3.5 cents, or 3.3 per cent, to $1.04. Rare earths producer Lynas lost 16 cents, or 1.7 per cent, to $9.06.

In the wake of this week’s rate rise, Commonwealth Bank eased 11 cents, or 0.1 per cent to $110.21; National Australia Bank also shed 11 cents, in its case 0.3 per cent, to $31.95; Westpac was unchanged on the day, at $23.90; while ANZ bucked the trend, rising 13 cents, or 0.5 per cent, to $25.92.

US yield curve inversion nears 42-year record

On Wall Street, earnings season and interest-rate concerns vied for influence. The 30-stock Dow Jones Industrial Average lost 249.13 points, or 0.7 per cent, to close at 33,699.88; the broader S&P 500 eased 36.36 points, or 0.9 per cent, to end at 4,081.5, and the tech-heavy Nasdaq Composite gave up 120.94 points, or 1 per cent, to close at 11,789.58. The tech gauge was weighed down by a 4 per cent slide in Google’s parent, Alphabet, and a 3 per cent fall in Meta.

In the bond market, the Treasury yield-curve inversion reached its widest point since the early 1980s, with the 2-year yield exceeding the 10-year yield by as much as 86 basis points (0.86 per cent). Many in the market expect the inversion to reach one full percentage point, exceeding that reached in October 1981. The 2-year Treasury rate is considered more sensitive to Federal Reserve policy; the inversion shows that investors expect further near-term Fed rate hikes. The 10-year yield ended the session at 3.63 per cent, while the 2-year yield closed at 4.484 per cent.

Gold was steady at US$1,861.70 an ounce, while in oil, the benchmark Brent crude eased 88 cents, or 1 per cent, to US$84.21 a barrel and West Texas Intermediate retreated 41 cents, or 0.5 per cent, to US$78.06 a barrel.

The Australian dollar is buying 69.34 US cents this morning, down from 69.55 cents at the local close on Thursday.