Investors will have to retune expectations in line with changing market harmonics, global consultancy firm Oliver Wyman notes in part three of a five-paper opus delivered earlier this year. Based on data covering a 150-year period, the Oliver Wyman series concludes that investors must turn to more sophisticated tools to appreciate the complex tones of…

Investment strategies yoked to indices face the most risk as the 30-year global economic détente unravels, according to UK-based economist, Andrew Hunt. Hunt told a Nikko Asset Management webinar audience last week that index investors benefited over the previous three decades from “chasing liquidity” and themes predicated on growing economic collaboration across the world. But…

Factor-specialist Northern Trust Asset Management (NTAM) has established a quantitative investment team targeting the Asia-Pacific region. Australia-based, Scott Bennett, will head the new NTAM APAC quant unit across the dual locations of Melbourne and Hong Kong. Bennett joined NTAM in 2018 as head of quant research for Australia and NZ. Before moving to NTAM, Bennett…

Commodities and active cross-asset ‘trend-based’ strategies should provide the most effective bulwark against entrenched high inflation if history holds true, an award-winning study has found. Based on almost 100 years of market data from the US, UK and Japan, the paper, titled ‘The best strategies for inflationary times‘, picked up the 2022 Bernstein Fabozzi/Jacobs Levy Awards as…

Renowned US hedge fund Bridgewater Associates is tipping a messy market transition as inflation and interest rate changes wash through the global financial system this year. Bridgewater, founded by Ray Dalio (photo at top), warns that while extraordinary COVID-era global monetary stimulus measures have finally kick-started the real economy, investors remain overly optimistic about the…

Investor time horizons pulled back slightly while corporate capital allocators took a much longer view during 2020, according to a new study. The analysis from institutional think-tank, Focusing Capital on the Long Term (FCLTGlobal), found investor time horizons shrank by 2.3 per cent last year as companies pushed out their expected capital return timeframes by…

The Australian financial regulator has urged institutional investors trading on the ASX to better prepare for future market blackouts in the wake of a meltdown on the exchange last November. In a new report charting a series of ASX operational incidents during the week starting November 16 last year, ASIC (chaired by Joe Longo, pictured)…

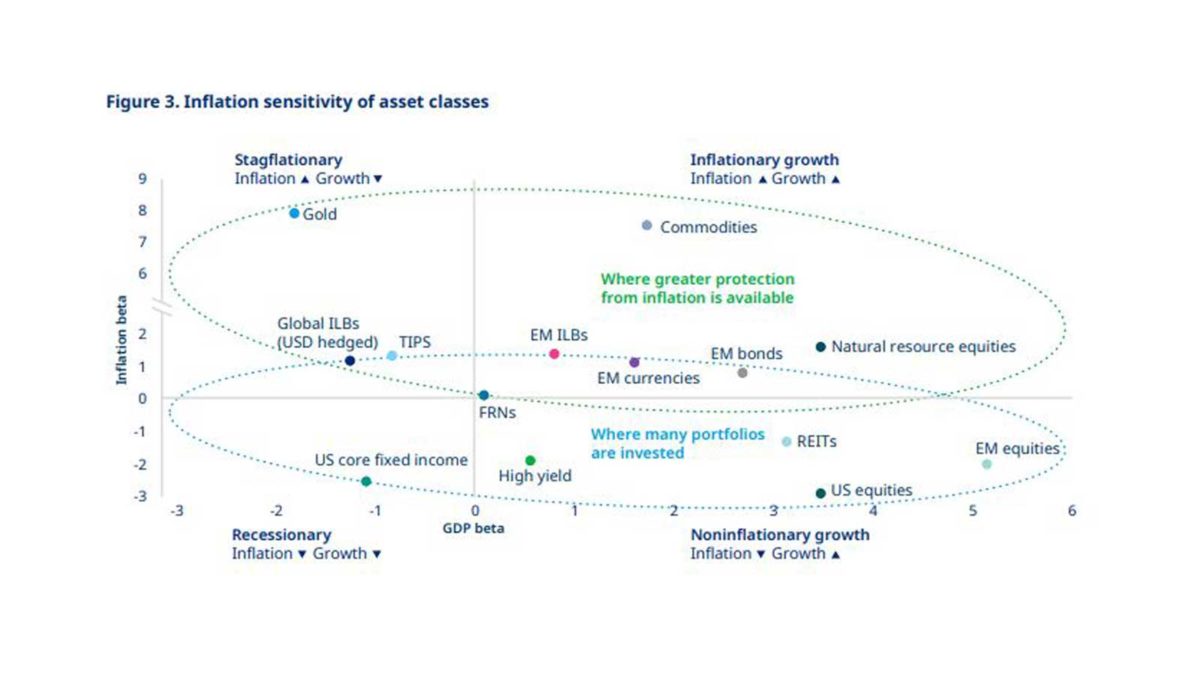

Mercer has urged investors to consider a wider range of inflation scenarios in portfolio design plans as price uncertainty ramps up across the world. In a new paper, the global multi-manager and consultancy firm says investors now face more complicated decisions amid confusing inflation signals. “Adding a less predictable inflation environment now increases complexity for…

AMP Capital will continue in a A$29 billion investment management gig with Resolution Life after selling down its stake in the insurer last week. According to an AMP spokesperson, there has been “no change to the [Resolution] mandate for AMP Capital” post the agreement to offload its over 19 per cent holding in the life…

Local equities fund shops have increasingly allocated to Australian shares over the last four years, a new Mercer NZ analysis has found, partly to ease pressure from ballooning assets under management. The Mercer study of a dozen NZ fund managers found Australian shares now represent 34 per cent of their collective portfolios compared to 26…