Geoff Hodge, founder and chair of Milestone Group, one of the Australian fintech success stories of the past 20 years, is to finally cash out. BNY Mellon is to acquire the now-global business. The two companies announced the transaction last Friday (July 9 Australian time), saying that it would benefit the existing clients of both…

Just as ESG investing has largely won its battle to convince investors returns don’t suffer, so too is impact investing making progress to the same end. Impact has become institutionalised. According to some of the world’s largest practitioners in the impact investing space, including the US$450 billion CalPERS public pension fund, impact funds are starting…

Multi-sector fixed income strategies are looking increasingly attractive as investors grapple with the implications of the global interest rate landscape. Manager selection is not so easy. A client paper by global manager search and research firm bfinance, titled ‘Multi-Sector Fixed Income: Back in Focus‘, details the complexity of the asset sub-class mix, even with the…

It’s difficult enough for big investors to decide on a China strategy, even after they recognise the necessity of having one. And then there’s the throng of implementation options to sift through. In the melee, one China manager stands out: China AMC. According to a landmark report by bfinance – Rethinking China’s Role in Emerging…

Kim Ivey and friends Alastair Sloan and David Gray, all experienced industry professionals in the alternatives space, have co-founded a Global Macro strategy through a boutique investment company, Albany Capital. The firm starts with offices in Sydney and London and a mandate to manage $US50 million from a New York investor. It is in the…

The Future Fund has come first out of the world’s 100 largest sovereign and public pension funds in the latest ranking by the Global SWF group on governance, sustainability and resilience. It is the second year in a row that the Australian fund has been the only one to score positively in all of the…

Asia and Australia are outstripping most of the rest of the world for growth in private capital raisings. But private equity managers, especially big buyout firms, are finding deals to be slow to bring to fruition. In its first special report on alternatives in the Asia Pacific region, Preqin provides more detailed analysis of private…

The rapid adoption of ESG strategies, particularly in the wholesale market segment, should prompt a rethink of portfolio construction, according to Janus Henderson Investors. Adding ESG to the mix can cause unexpected tilts. In a global media webinar series last month (June 23-24), Adam Hetts, the manager’s US-based global head of portfolio construction and strategy,…

The ICGN, arguably the oldest and among the largest investor governance organisations in the world, will next month (July 8) launch a definitive guide to governance for asset managers and asset owners. In the form of a 210-page e-book, titled ‘Governance, Stewardship and Sustainability: Theory, Practice and Evidence’, the guide seeks to add to the…

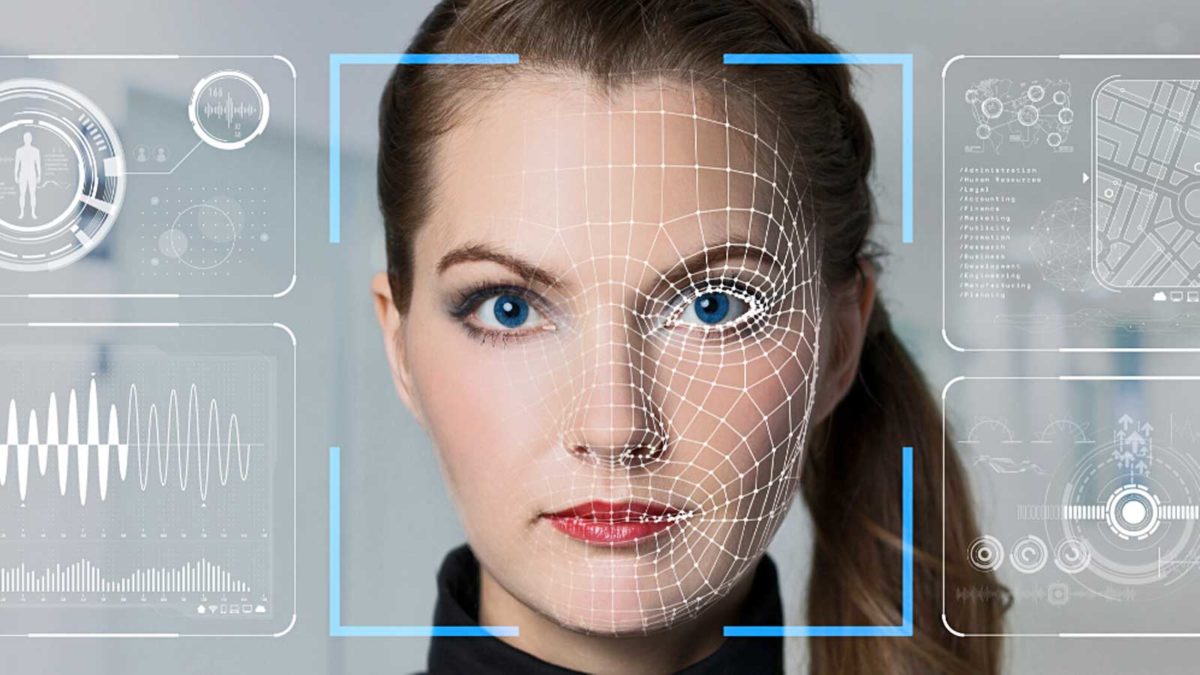

NZ Super and Australia’s Perpetual Investments have joined a group of global investors in an engagement program involving human rights and the use of facial recognition technology. They are the only Australasian members of a group of 50 fiduciary investors which speak for about US$4.5 trillion (A$5.9 trillion) under management. The initiative was launched by…