BHP cash river pours onto market

Tuesday’s market highlight came before the opening, when diversified miner BHP reported a bumper half-year result.

Strong commodity prices – in particular, record iron ore and coking (steelmaking) coal prices, and buoyant copper prices – enabled BHP to pay a record interim dividend for the third straight year.

Revenue rose by 27%, to US$30.5 billion ($42.7 billion), while underlying net profit surged 57% to US$9.7 billion ($13.6 billion), enabling the mining heavyweight to lift its interim dividend by 49 US cents, or 49%, to $US1.50 ($2.10) a share, fully franked.

But BHP warned investors that it was also grappling with record costs, and the stock managed to lose ground for the day, easing 15 cents, or 0.3%, to $48.18.

Rio Tinto fell 2.3% to $118.75, and Fortescue Metals Group was down 5.1% to $21.59.

Despite BHP’s largesse, investors focused on iron ore futures prices, which fell as much as 13% in Singapore on signs that authorities in China will ramp up efforts to squash surging prices – up 60% since mid-November – by cracking down on speculation and hoarding.

The market also saw the minutes of the first Reserve Bank of Australia (RBA) board meeting of the year, released on Tuesday, in which the RBA acknowledged that most market economists were now “expecting the first increase towards the latter part of 2022.”

Sims off the scrap heap, Brambles on the block?

Scrap metal recycler Sims brought out a stellar half-year result, with revenue up 74% to $4.27 billion, and net profit more than quadrupling, to $253.2 million, as Sims enjoyed a 72% increase in average selling prices for its Australian products.

Operating cash flow increased by 95%, to $290.8 million. That enabled Sims to more than triple its interim dividend, to 41 cents, 44% franked.

In response, investors pushed Sims shares $2.05, or 13.7% higher, to $17.04.

Meanwhile, pallets, crates and containers heavyweight Brambles jumped 58 cents, or 6.2%, to $10, following a report in the Australian Financial Review that said global private equity giants including KKR & Co were “running numbers on the Australian pallets group to see if they can make a $15 billion-plus buyout stack up.”

Shares of beauty and personal care products specialist Adore Beauty plunged 8.1% to $2.48, as its second-half trading update for the first six weeks of the June reporting period indicated sales growth of 14%, healthy but below analyst expectations of 19.9%.

Russian pullback helps bourses

US markets breathed a sigh of relief after Russia announced that it would withdraw some troops from the Ukraine border, saying the personnel had “completed their drills.”

The Kremlin stressed that major military exercises along the frontier would continue, but stocks grabbed at the news, rationalising that it was a welcome winding-back of tensions.

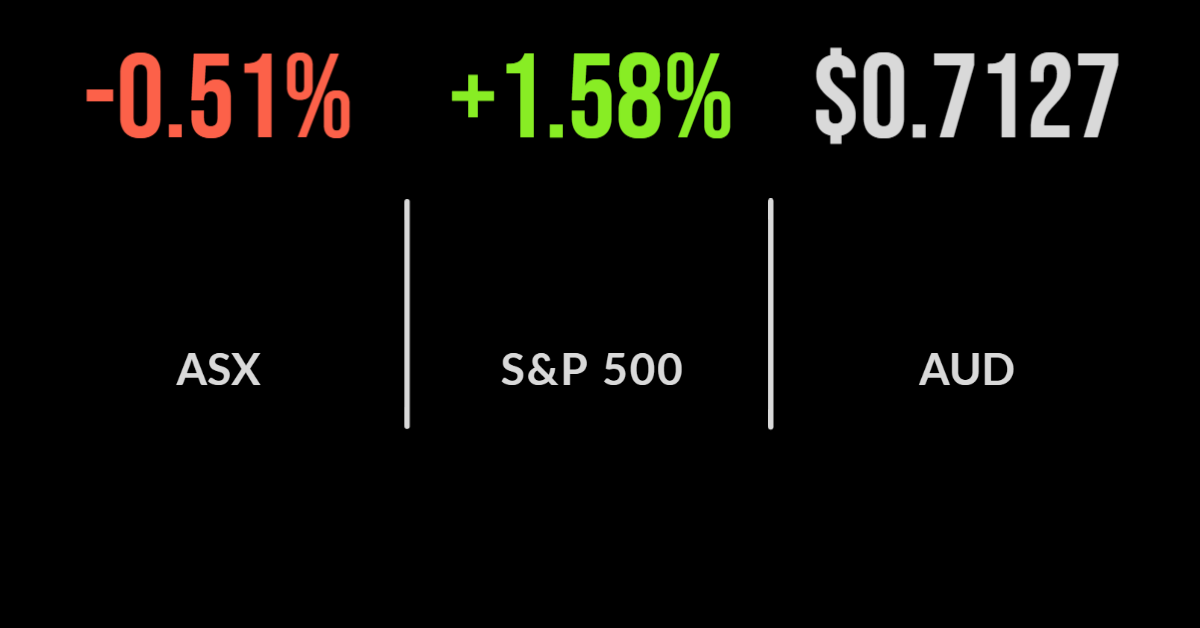

The White House still says that a Russian invasion is “distinctly possible,” but signs of potential de-escalation helped the US gauges reverse a three-day losing streak, with the S&P 500 index gaining 69.4 points or 1.6%, to 4,471.1.

While the 30-stock Dow Jones Industrial Average climbed 422.7 points, or 1.2%, to 34,988.8 and the tech-heavy Nasdaq Composite index jumped 348.8 points, or 2.5%, to 14,139.8.

US oil futures slid 3.7% on the news, to just under US$92 a barrel.

It’s not that oil traders want war – it’s just that concerns over how armed conflict might impact supply, and the general sensitivity of energy stocks to geopolitical concern, saw some profit-taking while the opportunity was there.

Yet oil inventories remain tight, and the market is still bullish on oil.

Gold is in a similar boat; it jumps on bad geopolitical news, because of its traditional role as a safe haven, but the relatively good news out of Russia took US$15.40 off the price, or 0.8%, to US$1,854 an ounce.

The Australian dollar is slightly stronger against the greenback this morning, buying 71.52 US cents, up 0.27 cents.