BNPL back in town

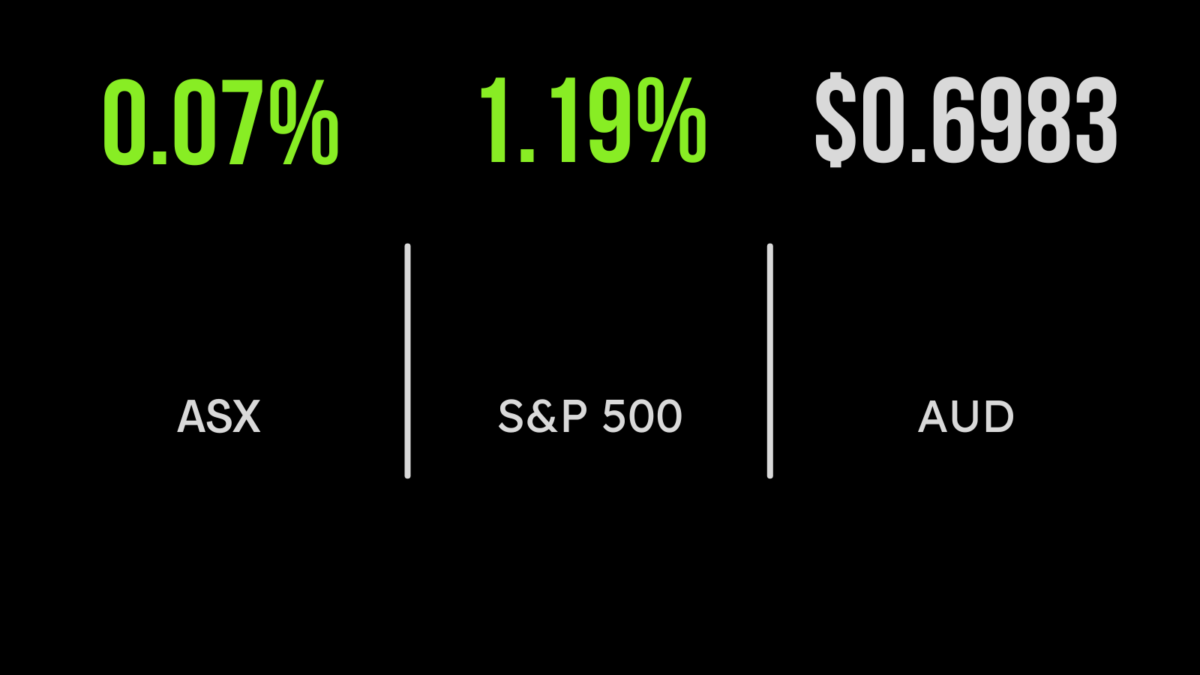

The S&P/ASX 200 continued its strong early-2023 form on Monday, advancing 5.1 points, or 0.1 per cent, to a fresh nine-month high of 7457.3 points. The broader All Ordinaries index added 7.9 points to 7,674.2.

It has been quite some time since the buy now, pay later (BNPL) stocks were on a tear, but the former darlings turned the clock back. US-based BNPL player Sezzle rocketed 21 cents, or 38.9 per cent higher, to 75 cents, on news that it turned profitable for the final two months of 2022. Zip Co jumped 15 cents, or 22.8 per cent, to 84 cents, ahead of an anticipated positive trading update this week, and Afterpay-owner Block improved $6.21, or 6.1 per cent, to $108.51.

Some energy names also did well, with Woodside Energy gaining 62 cents, or 1.7 per cent, to $37.66 and Brazilian-based producer Karoon Energy putting on 17 cents, or 7.4 per cent, to $2.32. after announcing an increase in reserves at its Santos Basin concession in Brazil. Santos struggled to join the rise, adding 1 cent, to $7.36.

Lithium lights up

The lithium space was on fire, with producer Allkem spiking 54 cents, or 4.2 per cent, to $13.34 and fellow producer Pilbara Minerals surging 28 cents, or 6.2 per cent, to $4.83. IGO, which mines nickel and lithium, gained 45 cents, or 3.1 per cent, to $15.16, while Mineral Resources, which produces iron ore and lithium, advanced $1.80, or 2 per cent, to $91.45. Among the hopeful producers, Liontown Resources jumped 9.5 cents, or 6.9 per cent, to $1.47; Core Lithium was up 6 cents, or 5.7 per cent, to $1.12; and Piedmont Lithium rose 4 cents, or 4.7 per cent, to 90 cents.

It wasn’t such a festive mood in big mining, as BHP retreated 55 cents, or 1.1 per cent, to $49.40; Rio Tinto lost 82 cents, or 0.6 per cent, to $126.38; and Fortescue Metals was down 22 cents, or 1 per cent, to $22.38.

In the big-bank world, Commonwealth Bank eased 5 cents to $108.61; National Australia Bank was down 9 cents, or 0.3 per cent, to $31.51; and Westpac shed 11 cents, or 0.5 per cent, to $23.89; but ANZ was a non-conformist, adding 17 cents, or 0.7 per cent, to $24.92.

Trying to get ahead of the Fed

US stocks rose Monday as investors awaited a busy week of corporate earnings reports, as well as GDP and consumer spending data later this week, which are expected to cause the Fed to temper its tightening mood.

The Nasdaq Composite surged 224 points, or 2 per cent, to finish at 11,364.41, while the 30-name Dow Jones Industrial Average rose 254.1 points, or 0.8 per cent, to end at 33,629.6, and the broader S&P 500 added 47.2 points, or 1.2 per cent, to settle at 4,019.8.

Gold gained US$4.43, or 0.2 per cent, to US$1,931.40, while on the energy markets, the global benchmark Brent crude oil grade rose 45 cents, or 0.5 per cent, to US$88.08 a barrel and West Texas Intermediate crude eased 2 cents to US$81.62 a barrel.

The Australian dollar is back above 70 cents ahead of December quarter inflation data on Wednesday and the likelihood of another rate rise next week: the Aussie is buying 70.26 cents, up 69.78 US cents at last night’s close.