-

Sort By

-

Newest

-

Newest

-

Oldest

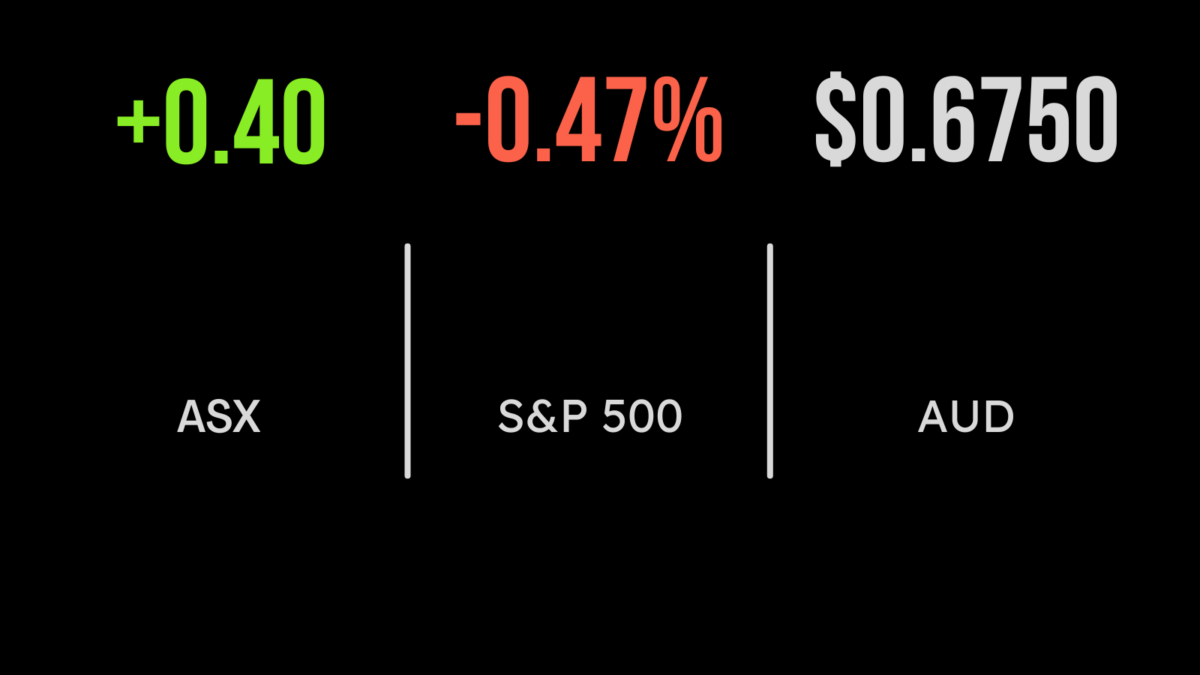

Optimism for mining stocks battled a downturn in the big banks in deciding the direction for the Australian share market on Wednesday, with the banks prevailing just enough to see the benchmark S&P/ASX 200 close 6.8 points, or 0.1 per cent, lower at 7251.6, while the broader All Ordinaries Index retreated 1.9 points to 7456.1. The bullishness for the miners…

Australian retail sales rebounded in January as household spending defied inflation and higher borrowing costs, strengthening the case for the Reserve Bank to keep raising interest rates, and run a “higher for longer” rates scenario, taking its cue from its central bank peers in the US and Europe. Retail sales rose 1.9 per cent in January after…

Local investors had the weekend to digest Friday night’s alarming report of the Federal Reserve’s preferred inflation metric, and they decided they didn’t like it. On Friday night Australian time, the US personal consumption expenditure (PCE) figure showed that US consumer spending rose 4.7 per cent in the year to January, well above the market…

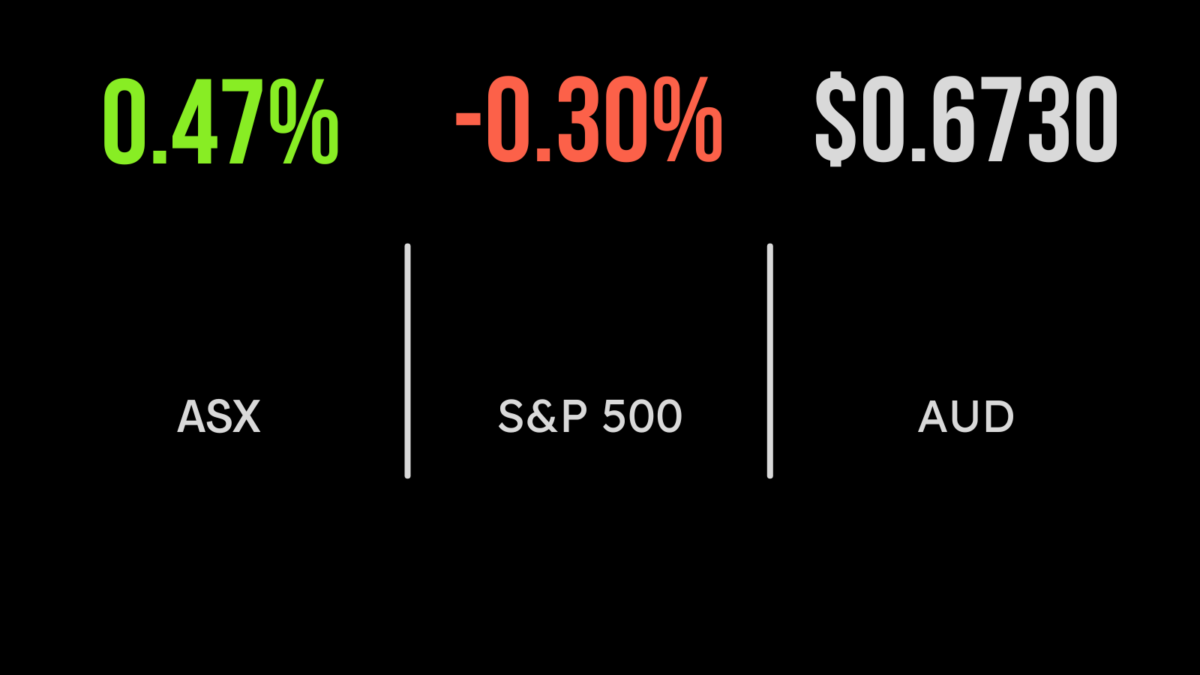

The busiest week of reporting season ended on a positive note, with the industrials and technology sectors, up 1.4 and 2.4 per cent respectively, contributing to a 0.3 per cent gain for the market. The materials sector was the main detractor, falling 1.2 per cent as Rio Tinto (ASX:RIO) dropped 3.6 per cent as the…

A significant rally in the utilities sector, which gained 4.8 per cent on Wednesday on the back of a renewed bid for Origin Energy (ASX:ORG) wasn’t enough to offset the selling pressure. The S&P/ASX200 fell by 0.3 per cent with the consumer discretionary sector among the largest detractors. News the Origin suitors Brookfield and EIG…

The S&P/ASX200 weakened a further 0.2 per cent on Tuesday, with little in the way of a lead from US markets. The materials and energy sectors stood out, gaining 0.4 and 0.6 per cent, while each of the technology, communications and staples sectors dropped by more than 1 per cent as reporting season stepped up…

Markets remained mix to open the week, with concerns around the peak in energy prices and the upward march of interest rates pushing both the energy and property sectors down 1 per cent each. Bendigo Bank (ASX:BEN) buoyed the financial sector with a solid profit result, gaining 1.9 per cent and sending the sector 0.9…

The local market finished the week 1.1 per cent lower, as the S&P/ASX200 dropped 0.9 per cent on Friday, marking the third straight week of declines. Earnings season remains as varied as any in recent history, with significant sector and stock level dispersion. Technology and property were the largest detractors on Friday, down 2.3 and…

Australia’s unemployment rate unexpectedly rose to 3.7 per cent in January, from 3.5 per cent in December, after 11,500 people lost work, according to the Australian Bureau of Statistics (ABS). Economists had expected the unemployment rate to hold at 3.5 per cent and 20,000 job gains. Counter-intuitively to many, the share market liked the figure,…

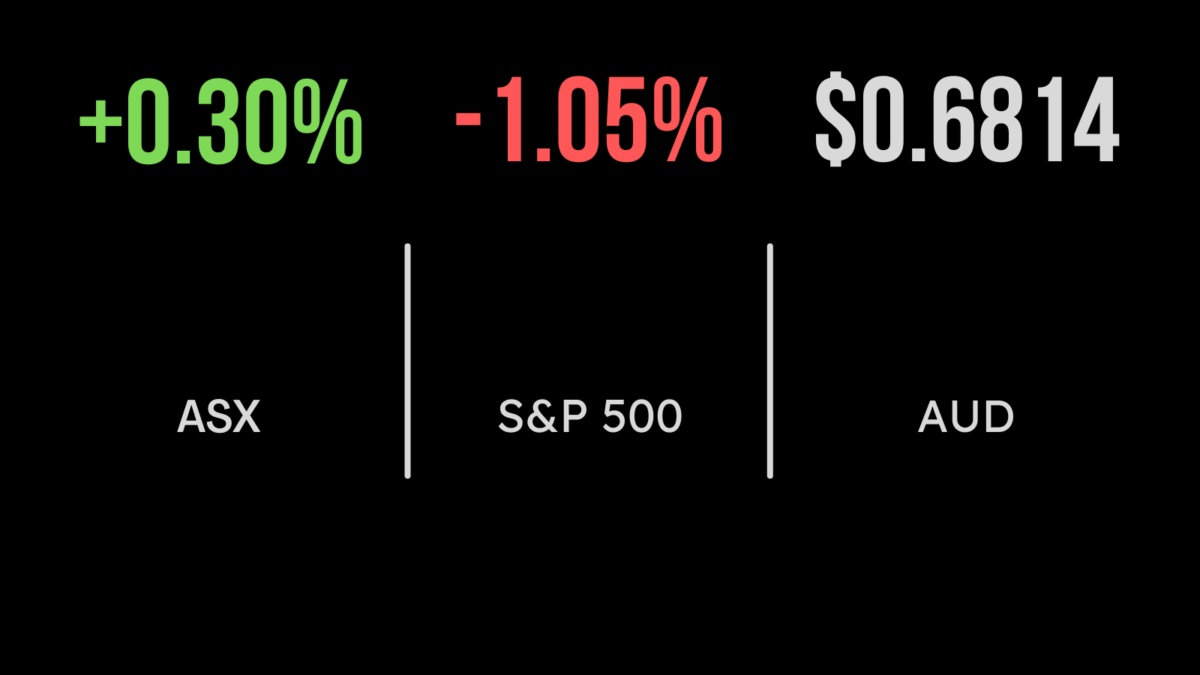

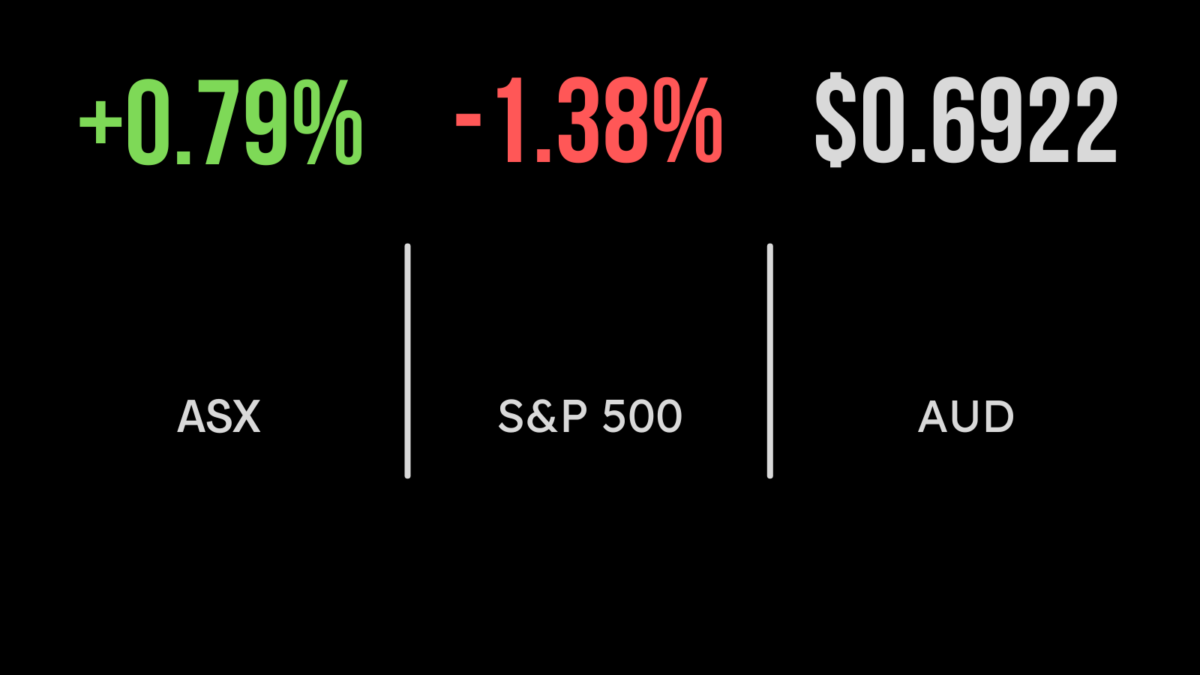

Assessing profit results is the main game on the Australian market at present, and the upshot of Wednesday’s action was the benchmark S&P/ASX 200 giving up 78.7 points, or 1.1 per cent, to 7,352.2, while the broader All Ordinaries index retreated 69.5 points, or 0.9 per cent, to 7,559.1. Commonwealth Bank reported a record half-year…

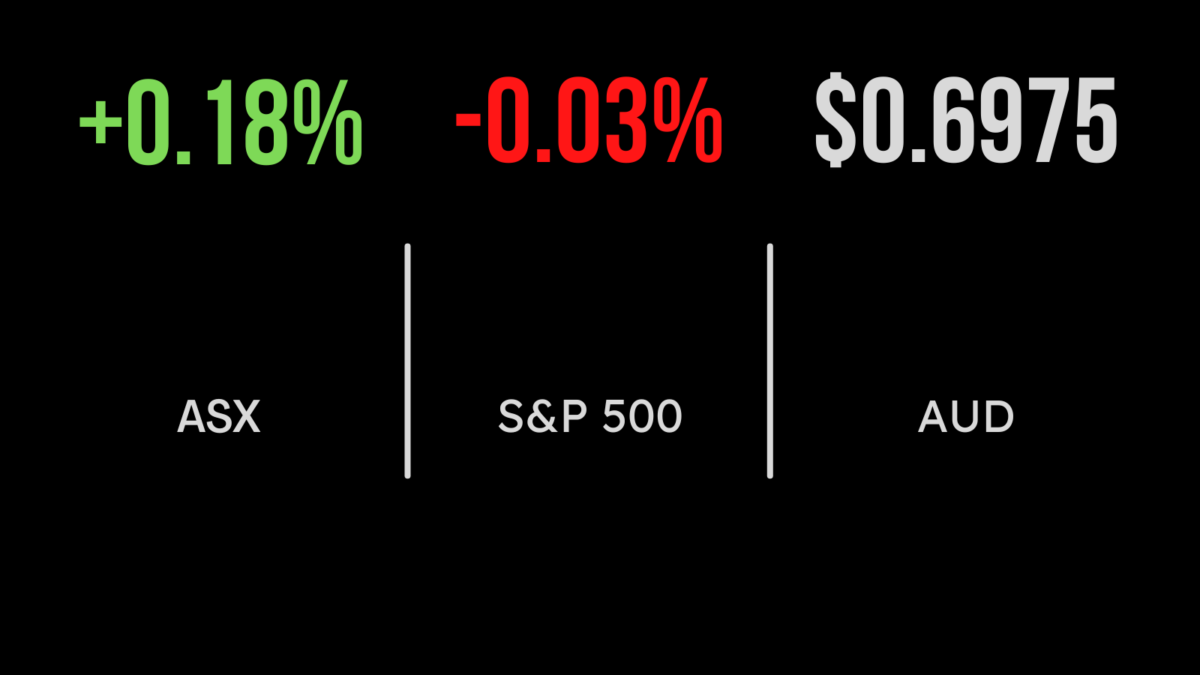

Earnings season and the need to keep a weather eye on the US inflation print competed for influence on the Australian share market on Tuesday. By the close the benchmark S&P/ASX 200 gauge had added 13.1 points, or 0.2 per cent, to 7,430.9, while the broader All Ordinaries index gained 14.1 points, or 0.2 per…

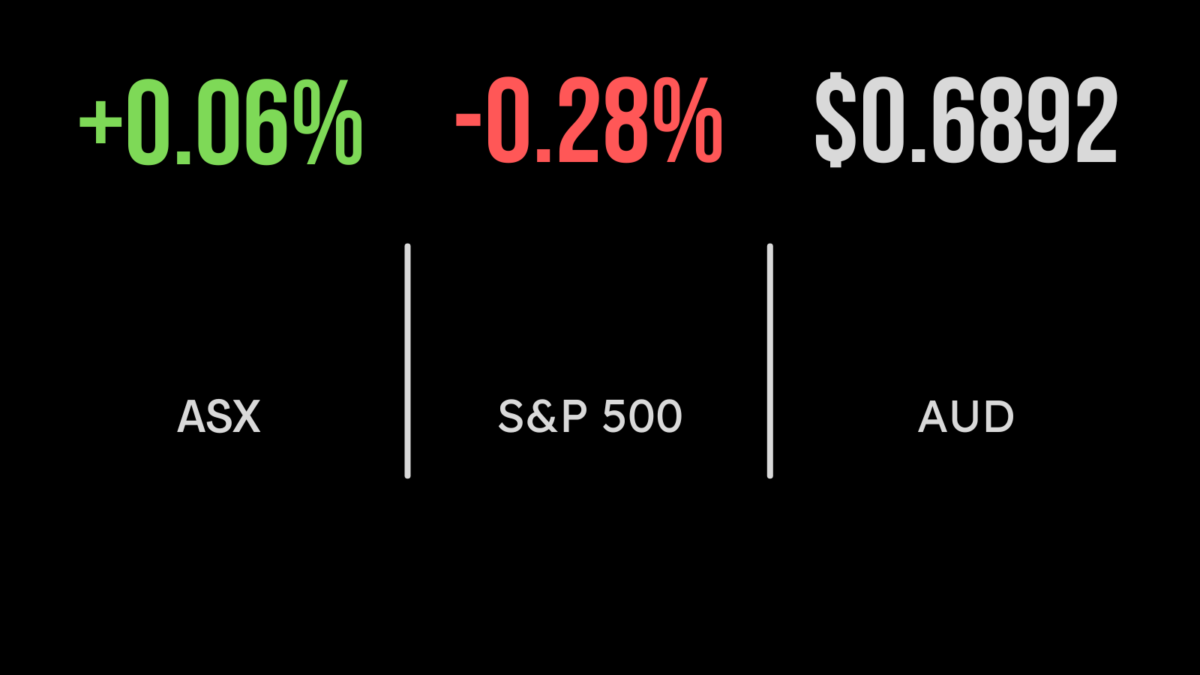

The benchmark S&P/ASX200 index eased 15.9 points, or 0.2 per cent, on Monday, to a three-week low of 7,417.8. The broader All Ordinaries fell 16.6 points, also 0.2 per cent, to 7,614.5, as earnings season moved into full swing. Electronics retailer JB Hi-Fi reported an 8.6 per cent lift in sales to $5.3 billion for…