-

Sort By

-

Newest

-

Newest

-

Oldest

China is a little ahead of the US in the current re-pricing of global equities. That, coupled with western geopolitical concerns, has presented a new round of opportunities.

The last few months have several famed investors convinced that the bull market is dead and buried. But how it came to life in the first place bears examining.

Wildly anomalous times are giving rise to a new inflationary paradigm, and Lazard’s Ron Temple has climate change, mitigation risk, and equity duration on his mind.

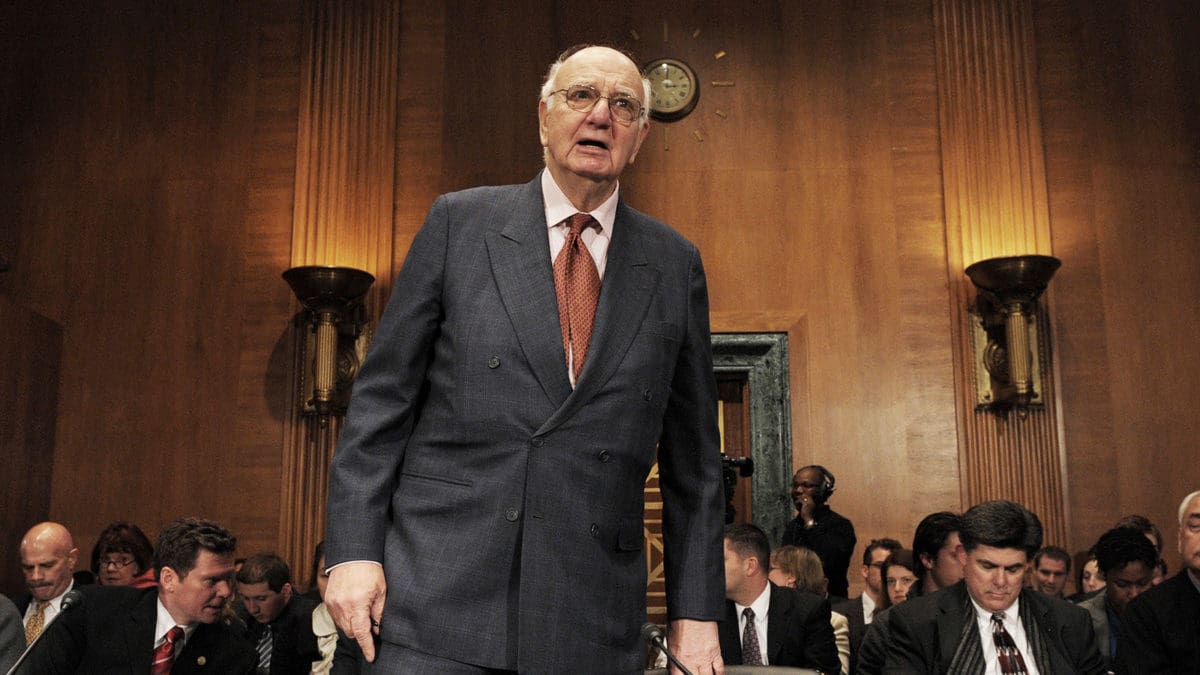

Inflation is making a latter day comeback, and a financial system “sanitized by 15 years of free money” is totally unprepared. It’s time, once again, for tough medicine.

One of the Coalition’s few surviving “super soldiers”, Andrew Bragg has called on his party to go further down the route of “flexibilising” super – if not abolishing it completely.

Passive funds have built momentum on the win-win premise of low-cost market benchmarked products but a new study confirms the undoubted winners of the seemingly unstoppable trend: indexers.

Jeremy Grantham’s “wild rumpus” appears to have well and truly begun. But it might only be the beginning of a gloomy period for markets.

The last nine years of government have been characterised by a deep-seated suspicion of the country’s largest investors. But with Labor back in power, the super wars are almost certainly over.

Instead of blindly following active share and concentrated portfolio trends to bolster pride in the face of an overwhelming shift to passive strategies, active managers need to develop a much deeper understanding of what drives their performance, according to JANA.

Institutions have another reason to resist the siren song of cryptocurrencies, with new research from PGIM refuting many of the arguments in favour of holding the highly volatile asset class.

As the emerging markets grow more economically and financially liberal, managers are unlocking a “panoply” of opportunities outside the traditional darlings of the asset class.

Once a stalking horse for a small cabal of noisy backbenchers, “Home First, Super Second” has found its way into the Coalition’s policy arsenal ahead of an unpredictable election.