-

Sort By

-

Newest

-

Newest

-

Oldest

Many listed managers have been dragged back to earth in the recent spate of market volatility, but Morningstar believes some of the strongest names are oversold – and that they’ll soon mount a recovery. It’s the classic path from (somewhat) overhyped to (heavily) oversold. The share price of Magellan has fallen some 74 per cent…

It’s rare that an inquiry finds no evidence of harm from a practice and still recommends against it – but that’s the path the standing committee on economics has gone down. The standing committee on economics’ inquiry into common ownership was most notable for beingone of the few inquiries of that body that regularly ended…

Allspring Global Investments has launched an expansion into Australia and New Zealand led by new regional chief executive, Andy Sowerby. If history is a guide, the rollout of institutional funds management capabilities will be rapid. Sowerby, like Joe Sullivan, Allspring’s chairman and CEO, hails from Legg Mason, where he was the Melbourne-based regional head prior…

The “hard asset mantra” is rising to a fever pitch in an inflationary environment, but investors should be “skeptical of historical analogies.” Inflation over the coming decade is expected to be closer to the experience of the 2000s than the 2010s, ending a paradigm that has underpinned an “unusually long bull market for stocks” and…

Everybody loves a good story – investors particularly so. But sometimes a good story can lead to a crowded trade, or one that defies reality. “In finance, behaviour is driven by expectations of future returns, and expectations are often driven by stories, particularly during times of heightened uncertainty,” Charalee Hoelzl, investment manager at Ruffer, wrote…

Your Future Your Super (YFYS) is meant to improve member outcomes. But Frontier’s latest research suggests that the performance test is in dire need of tweaking if it’s to fulfil that goal. Frontier’s latest research – “The heat is on – superannuation fund performance in 2021” – aims to answer the question of whether the…

A landmark report from J.P. Morgan paints a picture of an industry racing towards a future that it doesn’t yet understand. Our big super funds look like strangers in a strange land. “What would be helpful from a regulatory perspective, or even a government perspective, is what are we actually driving towards?” says Mine Super…

Every cloud has a silver lining. In the case of literal rain clouds, it might well be positive returns. Bad weather might lead to better returns, if the findings of a recent study of institutional investor behaviours are to be believed. Lei Zhang, associate professor at the City University of Hong Kong, studied a cross-section…

From Tulip Mania to the Tech Wreck, the history of bubbles shows that they’re harder to spot than investors might think. As Ruffer investment director Lauren French notes in the latest Ruffer Review, even the smartest can fall prey to a market bubble. Isaac Newton, one of the most brilliant mathematicians in history, still lost…

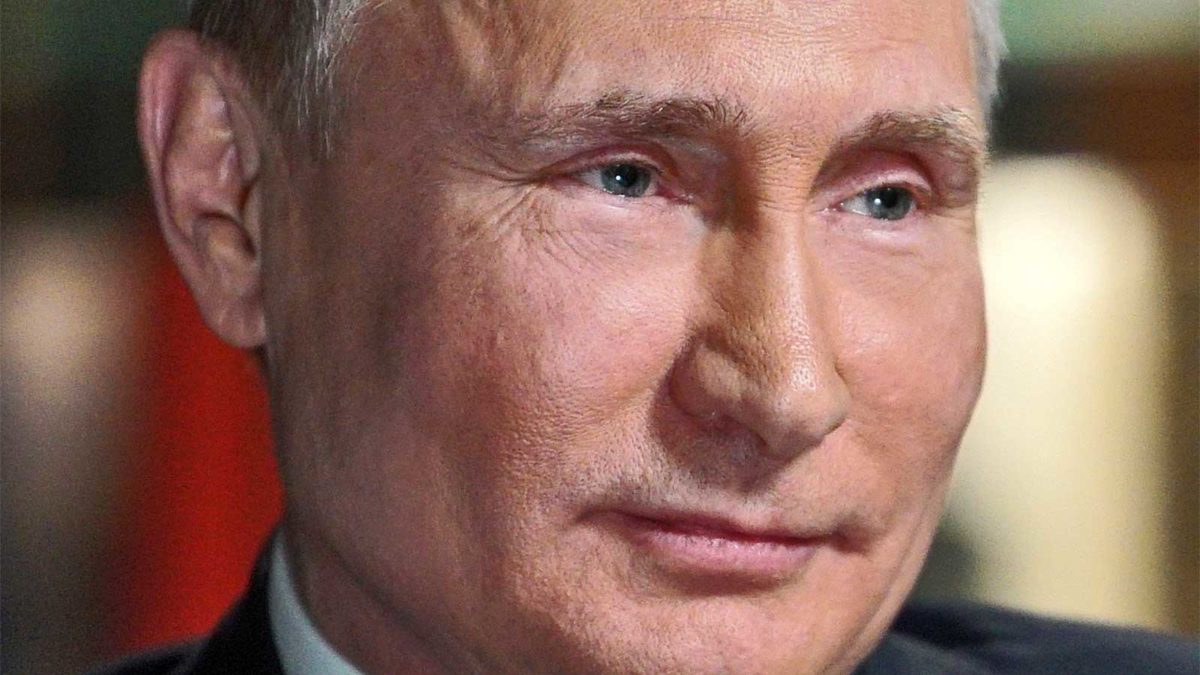

The chances of a nuclear apocalypse are allegedly higher now than during the Cold War – but from a financial perspective, investors should “largely ignore existential risk.” A note from Canada-based BCA Research warns that the world now faces a ten per cent chance of a nuclear war – but that the prospect of nuclear…

While proponents believe that cryptocurrencies will inevitably disrupt traditional finance, it’ll be harder than it seems – and less lucrative than they think. As cryptocurrencies like Bitcoin and Ethereum have shot to prominence in the last several years, it’s now being taken as a given that they will eventually disrupt traditional finance. Blockchain technology offers…

While neither Ukraine or Russia are particularly large trading partners for the West, the risks created by the conflict aren’t negligible – and could easily spill over to the global economy. “The potential economic risk (of the Ukraine conflict) has three primary transmission mechanisms: higher global energy prices, further supply chain disruptions and a European…