-

Sort By

-

Newest

-

Newest

-

Oldest

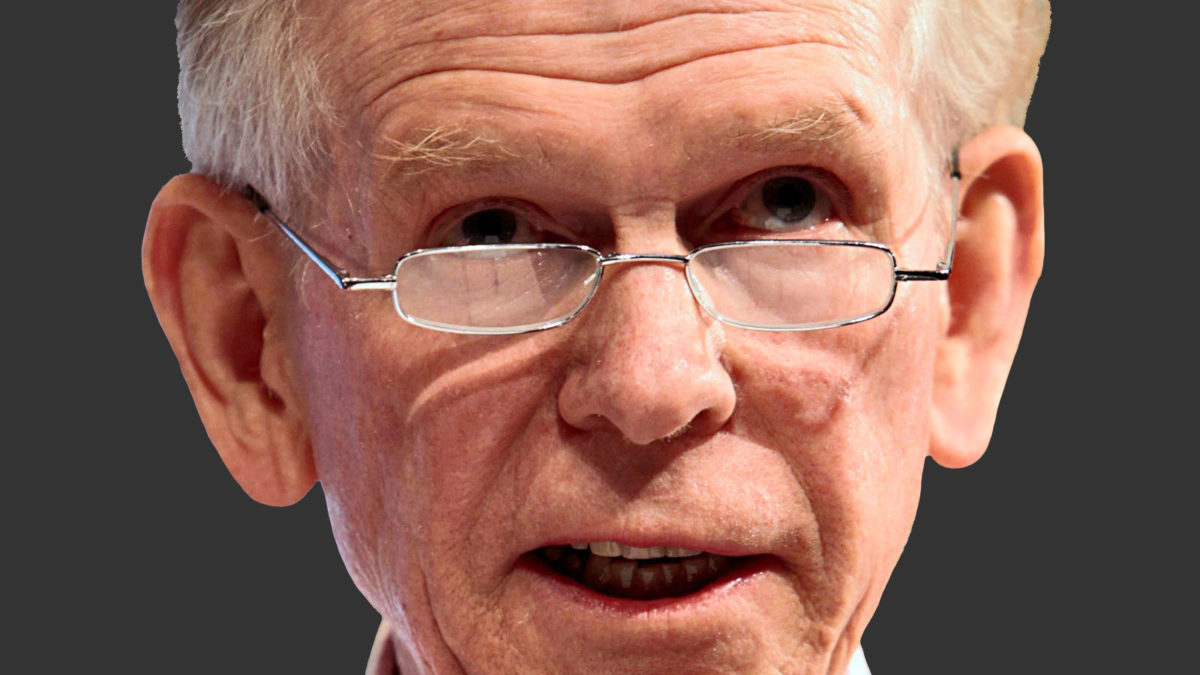

Renowned US hedge fund Bridgewater Associates is tipping a messy market transition as inflation and interest rate changes wash through the global financial system this year. Bridgewater, founded by Ray Dalio (photo at top), warns that while extraordinary COVID-era global monetary stimulus measures have finally kick-started the real economy, investors remain overly optimistic about the…

For investors trying to figure out how to navigate inflation volatility, an infamous shipwreck might hold the answers. The question of whether inflation is transitory or structural is likely the wrong question to be asking.UK-based investment house Ruffer believes that it’s both: that the inflation tide will come in and go back out repeatedly, bringing…

As investors speculate on whether the bubble will pop or already has, there’s fewer and fewer safe havens to be found. But it’s worth remembering that it’s not necessarily the end of the world. Yes, the bubble is going to pop, has popped, or is popping. Investors are either about to feel the pain or…

The Future Fund’s unbroken run of robust returns is about to the face a tough new investment paradigm. A stronger bent to “skill-based investments” might help them weather the storm. There’s a strong argument for the Future Fund being one of the wonders of the investing world. Seeded with $60 billion 13 years ago, it’s…

Some “Tiger-ish confidence” is warranted for China investors as regulatory upheaval eases and authorities target economic growth and stability. “After roaring back from the initial COVID outbreak, the Chinese economy has been through a more difficult spell,” writes Ninety One in its latest China report, titled “Tiger, Tiger: What investors can expect in the Chinese…

The RBA is lagging its global peers with light touch monetary policy and lax guidance that will hinder, rather than help, markets and the economy. “The RBA had a good first 18 months of Covid and then it came off the rails a bit towards the end of last year and into this year,” Stephen…

Uncertainty has returned to the market after a bumper 2020, fuelled by persistent inflation and a pandemic that never really went away. But in its latest alternatives outlook, JPMorgan warns that investors aren’t seeing the forest for the trees. “Up close, the “trees” in the 2022 outlook are clear,” writes Anton Pil, global head of…

A storm has hit global equity markets. But investors should ignore the blood on the floor and focus instead on the big structural changes that will underpin earnings for decades to come. “The storm that’s hit Australian equity markets in the last couple of days is a storm we’ve been sitting in for the best…

Despite the popularity of that old adage, it’s never as simple as “buy low, sell high”. But if it’s not true, what are investors to do? “Everyone is familiar with the old saw that’s supposed to capture investing’s basic proposition: “buy low, sell high”,” writes Oaktree Capital founder Howard Marks in his latest memo, ‘Selling…

Jeremy Grantham believes the “superbubble” he’s been warning about for years is now on the brink of collapse – and that the “wild rumpus” can begin at any time. Calling the collapse of a market bubble is anybody’s game. One needs only to know that it exists – something now patently obvious to any investor…

Emerging markets have languished for years despite their explosive economic growth. But the new inflationary epoch – and a burgeoning focus on ESG – might turn all that around. Emerging markets can be a tough game. A decade of lackluster performance compared to their developed market counterparts has culminated in massive regulatory upheaval in China,…

The problems with Your Future Your Super (YFYS) run deep – among them, how super funds will manage ESG within the confines of low tracking error strategies. But it’s not the end of the road. Under the YFYS reforms, implementation manager Parametric believes tracking error will face downwards pressure as funds try to stay on…