CBA hits new high, ASX gains, EML jumps on Chairman’s departure

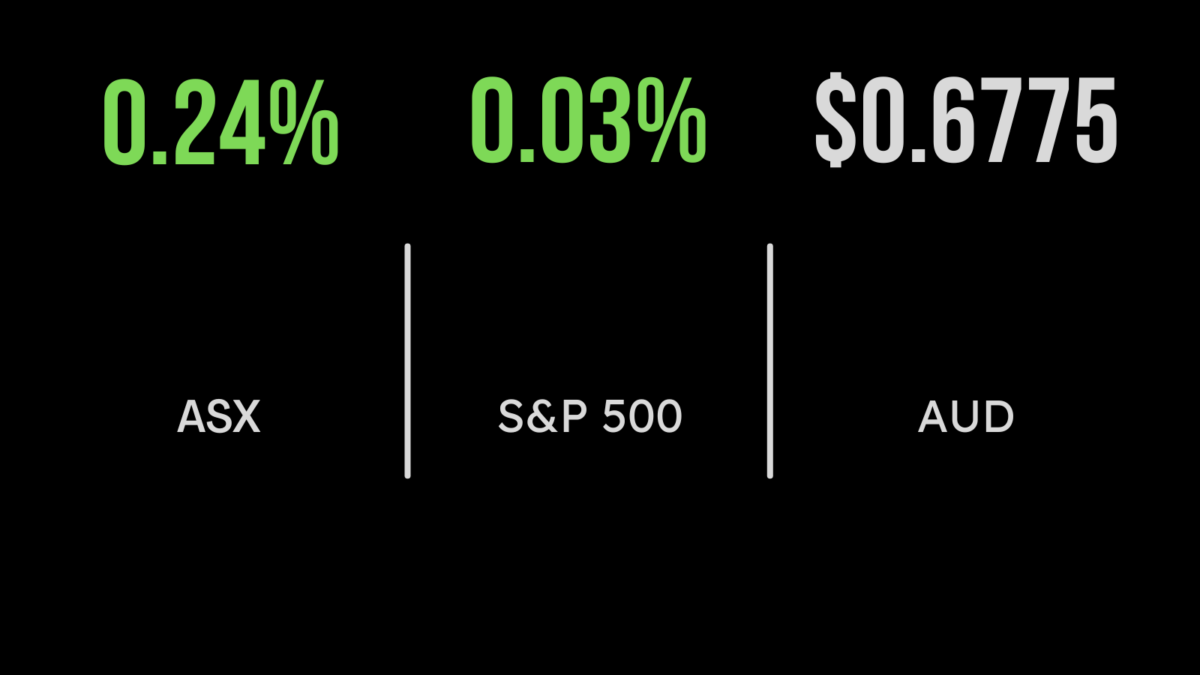

The local sharemarket finished the week on a positive note, with the S&P/ASX200 gaining 0.2 per cent as more than half of listed companies gained. The standouts were property, utilities and the retail sector all of which finished 1.1 per cent higher. Among the biggest contributors though, was the Commonwealth Bank (ASX: CBA) which gained 1.1 per cent and finishing the week at a one year high, as investors gain greater confidence that the economy could avoid a significant recession in 2023. Retailer City Chic (ASX: CCX) fell by close to 30 per cent after the company announced sales growth of just 2 per cent and cuts to margins as discounting is required across their global businesses to stimulate sales and remove excess inventory. It was the opposite story for EML Payments (ASX: EML) the gift card provider that has been in front of regulators in Ireland, with shares gaining 22 per cent. The key trigger was the ousting of Chairman Peter Martin at the AGM and hopes that a takeover offer could be on the cards again. The market gained 1.5 per cent across the week with Nanosonics (ASX: NAN) and Ramelius (ASX: RML) gaining 11 and 7 per cent each and lithium miners Allkem (ASX: AKE) and Pilbara (ASX: PLS) falling 8 and 6 per cent.

Shortened trading limits market moves, China stimulates, Black Friday in focus

It was a mixed day for US markets with the Dow Jones gaining 0.5 per cent but both the S&P500 and Nasdaq falling 0.1 and 0.5 per cent respectively. With little volume and shortened trading session there was little in the way of direction from economic data, but the retailing sector remains in focus as shopped flock to post Thanksgiving Black Friday sales. Amazon (NYSE: AMZN) fell slightly while Walmart (NYSE: WMT) gained. Apple‘s (NYSE: AAPL) struggles in China continue to grow with shortages of iPhone inputs worsening and likely to crimp growth in 2023 and beyond, shares fell 2 per cent. Video game maker Activision Blizzard (NYSE: ATVI) fell more than 4 per cent after the release of a report that suggested the takeover by Microsoft may be blocked. The positive trend continued across the week with the Dow Jones up 1.8 per cent over the five days, the S&P500 1.5 and the Nasdaq 0.7 per cent.

Say one thing and do another, retail not dead yet, crypto catastrophe

The release of the Federal Reserve’s November meeting minutes provided little in the way of clarity. In fact, the board seems to be contradicting its internal views when speaking publicly with the minutes suggesting the pace of rate hikes was likely to slow very soon, at the same time multiple board members talk of ever higher rates as they seek to combat inflation. The significant surprises from both Nick Scali and Harvey Norman provided the latest evidence that the economy isn’t dead yet and that a recession is never a sure thing. Yes, property prices may hit confidence, but the people continue to spend both on experiences and whitegoods, or so it seems, which may bode well for the economy in 2022. After an incredible boom in 2020 and 2021 things couldn’t get worse for the crypto sector in 2022 as more news is released about the collapse of FTX and the use of funds by the unregulated exchange. Bitcoin continues to hold up but an entire ecosystem appears to be under significant pressure.