China stimulus news good for markets

It was a solid week last week for the Australian market, advancing on four of the five days.

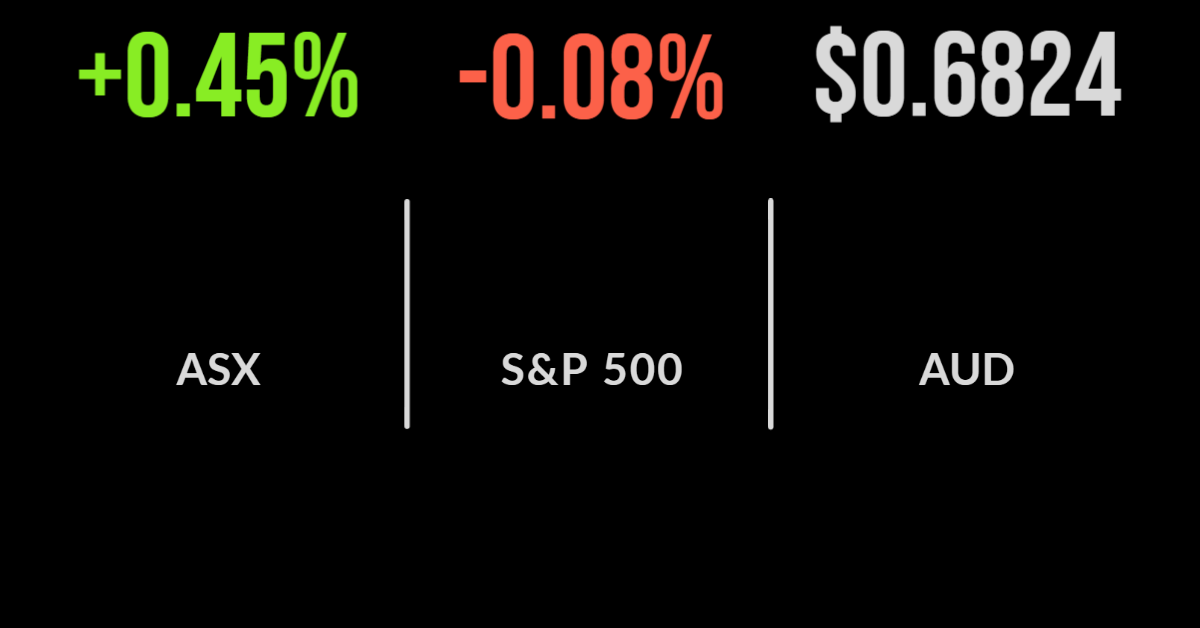

The S&P/ASX 200 gained 138.1 points, or 2.1 per cent, for the week, to end at 6,678, while the broader S&P/ASX All Ordinaries index added 156.6 points, or 2.3 per cent, to 6,877.

The All Tech index did considerably better than those, with an 8.3 per cent gain, while the Energy sub-sector eked out a 0.8 per cent gain and the Materials sub-sector went backwards to the tune of 0.8 per cent.

Both got a boost late in the week from reports that China was considering a 1.5-trillion-yuan ($327 billion) bond sale, with the proceeds expected to be used for infrastructure spending to stimulate growth.

The Chinese bond sales news lifted commodity prices and were also good for the Australian dollar, lifting it from a two-year low, to which fears of a global recession had pulled it.

Solid week for Wall Street

The local market got a mostly positive lead from the US, where the Dow Jones Industrial Average gained 2 per cent over the week, the broader S&P 500 was up 3.1 per cent and the tech-heavy Nasdaq Composite Index saw the biggest gain, up 5.7 per cent, as some of the tech bellwethers appeared over-sold to investors.

Things were also looking good elsewhere. In Europe, the Euro Stoxx 50 lifted 1.7 per cent, Germany’s DAX 40 gained 1.6 per cent, the CAC 40 in Paris added 0.8 per cent. London’s FTSE-100 edged 0.4 per cent higher.

In Asia, Japan’s Nikkei was up 1.7 per cent and the Shanghai Composite index gave up 0.8 per cent.

Gold put in its worst week in two months, losing more than US$60, or 3.8 per cent.

The gold market is being hurt by a strong US dollar index, which is taking on a lot of the safe-haven interest – traditionally gold’s role – amid rising recession fears.

Analysts say gold remains vulnerable to an even bigger selloff, as markets anticipate another aggressive hike by the Federal Reserve at its July meeting.

US jobs news hits the mark

Friday night’s jobs print in the US beat expectations, with the economy adding 372,000 positions in June.

The upbeat number has virtually convinced the markets that the Fed will proceed with another 75-basis-point hike at the July meeting in just over two weeks.

This week, markets will be closely watching June’s inflation report, with market expectations looking for the US annual headline figure to accelerate to 8.7 per cent, up from 8.6 per cent in May.

The retail number will be out on Wednesday night our time, with the wholesale number following 24 hours later.

With recessionary fears weighing on the markets, investors are also acutely conscious that second-quarter corporate earnings results begin to flow this week, which will give a reading on the health of corporate America and the broader US economy.

The June retail sales data on Friday should also bring further insight into the state of the US consumer and economy.

The new week starts with the Australian dollar buying 68.56 US cents, after a 1 per cent rise over last week, and the government ten-year bond yielding 3.47 per cent.