Energy reversal hits market, inflation drags ASX lower, Atlas Arteria falls

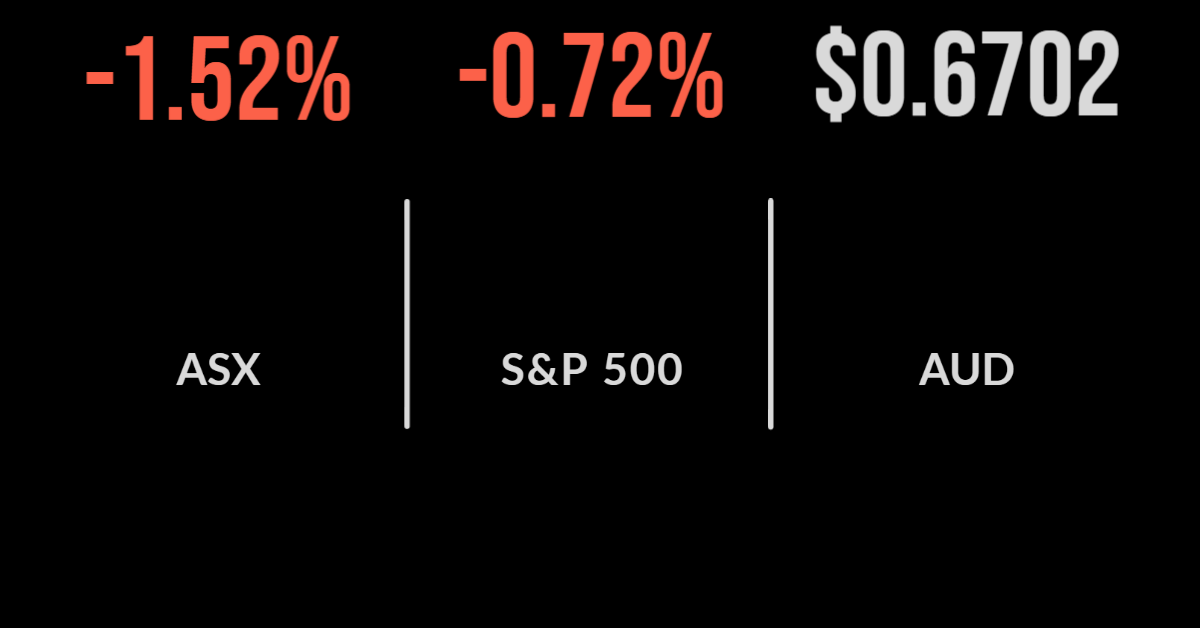

It was a sea of red on the S&P/ASX200, with the market closing down 1.5 per cent on Friday, resulting in a 2.1 per cent loss for the week.

A reversal in the energy sector, triggered by a resolution of potential railroad strikes sent the energy sector down 3 per cent, with Whitehaven Coal (ASX:WHC) single 2.7 per cent.

It was a similar story for materials, which fell 2.8 per cent after the iron ore price took another hit, dragging BHP (ASX:BHP) and Rio Tinto (ASX:RIO) off 1.8 and 2.1 per cent as the Chinese property market showed sustained signs of weakness.

No sector was immune with utilities falling just 0.4 per cent and healthcare 0.6 per cent.

Atlas Arteria (ASX:ALX) fell 15 per cent as expected after completing a $2.5 billion capital raising at $6.30 per share while Star Entertainment (ASX:SGR) and Computershare (ASX:CPU) gained 5.1 and 4.4 per cent respectively.

The former on hopes they would not lose their casino license and the latter due to the leverage the company has to higher interest rates.

Across the five days every sector finished lower led by real estate and healthcare, down 4.6 and 4.1 per cent, as the US inflation data took another bite out of valuations.

Over the week Star topped the gains, adding 9 per cent, with AMP (ASX:AMP) not far behind, gaining 7.1 per cent, while Lake Resources (ASX:LKE) fell 28 and Link Admin (ASX:LNK) 22 per cent on corporate concerns.

US markets hit on FedEx recession call, General Electric hit, sentiment boost

US benchmarks finished the week on a negative tone once again, with the Dow Jones falling 0.5, the S&P500 0.7 and the Nasdaq 0.9 per cent.

The trigger was a profit warning and removal or annual guidance by courier and parcel delivery group FedEx (NYSE:FDX).

Shares in the company fell by 21.4 per cent after management forecast much lower profit on falling revenue with Europe US$500 million below expectations.

The fall was blamed on economic weakness with the CEO suggesting the US economy was headed for a recession.

This resulted in broad-based selling pressure across the sector with United Parcel Service (NYSE:UPS) down 4.5 and Amazon (NYSE:AMZN) 2.2 per cent.

It was a similar story for conglomerate General Electric (NYSE:GE) which fell 3.6 per cent after falling about sustained supply chain pressures despite some positivity around renewable energy asset sales.

On the positive side, consumer sentiment hit a five month high in the face of rate hikes, but this wasn’t enough to avert a significant fall for the week, with the three benchmarks down 4.1, 4.8 and 5.5 per cent each.

When will it break, pricing faster than ever, casinos, coal miners drive returns

The biggest question on investors lips this week is whether the global economy is nearly at breaking point.

On the one hand we saw FedEx withdraw guidance as package volumes were below expectations, on the other economists are now predicting a recession in Canada, along with the US and the UK, all triggered by higher interest rates.

Central banks are not communicating any potential slowing despite the clear time lag.

Only time will tell where the breaking point is, so diversification remains key at this point of the cycle.

The speed at which markets price in new data accelerated once again this week, with a swift 5 per cent selloff in the Nasdaq coming on the back of just a 0.1 per cent higher than expected inflation rate.

This is the new normal, and something investors must deal with via patience and alternatives.

It remains to be seen what comes of Star and Crown, yet with both being found unfit to retain casino licenses, but still retaining them, and seeing strong share price gains this week, investors will likely be increasingly wary of what companies they provide capital to.

A similar story can be made of the resurgence of coal stocks thus far in 2022.