Food innovation: Investing to feed our future

I am not an expert on climate change. Therefore, I will leave it to those experts and environmental, social and governance (ESG) specialists to talk in detail about the impacts of climate change on our food system and which government policies are required to address or decrease impacts. I am looking at the future of food and the innovation and technology that will be needed to safely produce and distribute the food we need from the perspective of an investor. That said, it is clear the food system-which makes up 10% of the global economy5- is increasingly a major driver of climate change, and at the same time is disrupted by climate change. This disruption will impact global investors across asset classes-in equities alone, food makes up US$4.9 trillion or approximately 4% of global market capitalization.6 So, it’s critical that we think about how investors respond-whether they focus on ESG or not-to identify opportunities in the market and potentially avoid risk that could materially impact their portfolios.

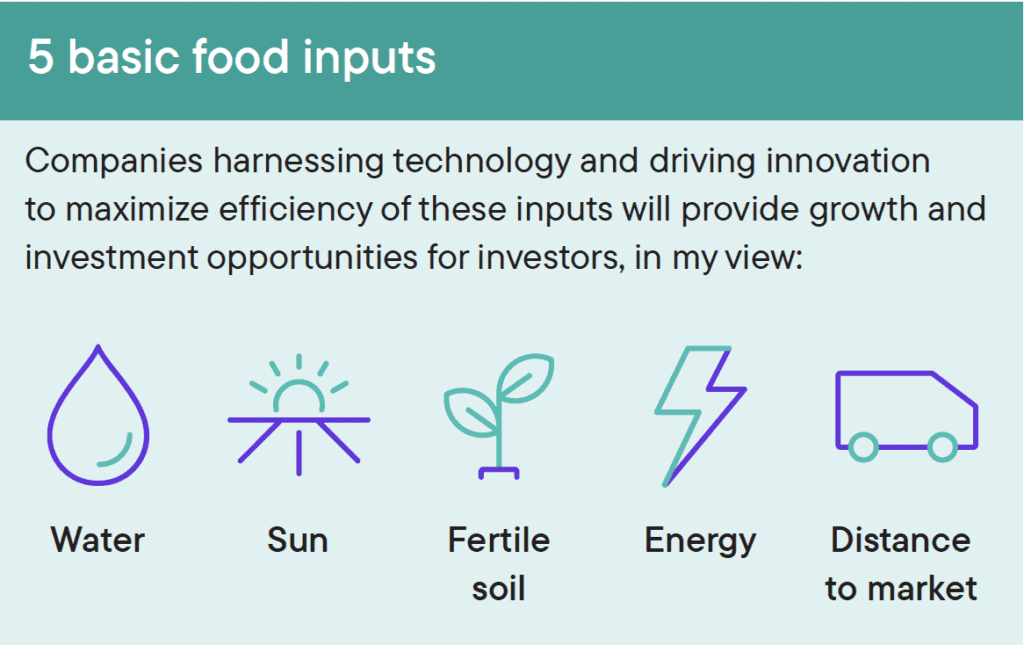

I have some history in agriculture being from a fourth generation ranching family in Montana. Anyone associated with a ranching family gains a lifelong education on the food supply chain, commodity prices, and the challenges ranchers and farmers face every day to get their product-whether it’s a cow or a bushel of wheat-to market. Despite this experience, I am somewhat surprised by the level of sophistication in today’s food business. Food is no longer a story just about land, water and weather; it is a story about technology, innovation and the future. It’s clear to me that food innovation, and the future of food production, will play a major role in markets over the coming decades.

By Stephen H. Dover, CFA Chief Market Strategist Head of Franklin Templeton Institute.