Gold, coal hit the skids

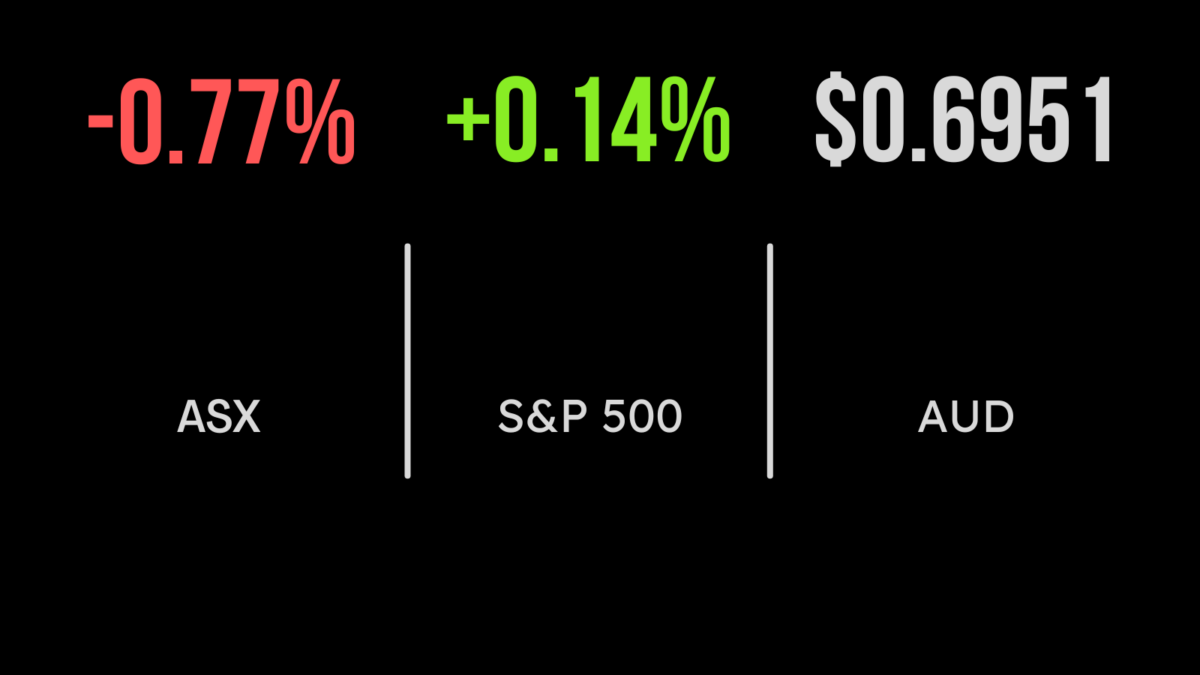

Australia’s benchmark S&P/ASX200 index closed down 56.9 points, or 0.8 per cent, on Wednesday, to 7,307.8, while the broader All Ordinaries was 58.8 points lower, also 0.8 per cent, at 7,503.9.

It was a particularly bad day for gold miners, caught in a gold price slide in the fall-out of US Federal Reserve chair Jerome Powell hinting at a 50-basis-point rate hike in March, sparking a bounce in the US dollar. That sent gold tumbling, and the miners suffered across the board. Leading the plunge was Ramelius Resources, which sank 12 cents, or 10.9 per cent, to 98 cents; while Regis Resources erased 10 cents, or 5.7 per cent, to $1.65; Gold Road Resources was down 5.5 cents, or 3.7 per cent, to $1.42; Evolution Mining retraced 12 cents, or 4.2 per cent, to $2.76; St Barbara fell 2 cents, or 3.5 per cent, to 56 cents; Newcrest lost 78 cents, or 3.3 per cent, to $23.25 and Bellevue Gold retreated 3.5 cents, or 3 per cent, to $1.14.

Among the big miners, BHP fell 30 cents, or 0.6 per cent, to $47.63; Rio Tinto eased 12 cents to $124.88; and Fortescue Metals shed 32 cents, or 1.4 per cent, to $22.20.

Newcastle coal futures were down 1.4 per cent to $US179.25 a tonne, compared to about $US392.82 a tonne at the start of the year – and well down on the peak of $US450 in September. The weaker coal prices had a telling impact: Whitehaven Coal retreated 28 cents, or 3.8 per cent, to $7.03, and the big miner is now down more than 20 per cent in 2023 so far. New Hope Corporation dropped 14 cents, or 2.5 per cent, to $5.51; Coronado Global Resources backpedalled 3 cents, or 1.6 per cent, to $1.82; but Stanmore Resources went against the trend, up 3 cents, or 0.9 per cent, to $3.57.

In lithium, Allkem added 4 cents, or 0.3 per cent, to $12.12, while fellow producer Pilbara Minerals eased 6 cents, or 1.4 per cent, to $4.10. Mineral Resources, which produces iron ore as well as lithium, lost $1.38, or 1.6 per cent, to $87.35, while IGO, which mines nickel and lithium, slid 32 cents, or 2.3 per cent, to $13.43. Among the lithium project developers, Core Lithium dropped 3.5 cents, or 3.5 per cent, to 97 cents; Liontown Resources was down 3.5 cents, or 2.1 per cent, to $1.62; and US-based Piedmont Lithium plunged 4.5 cents, or 4.9 per cent, to 88 cents.

In energy, Woodside Energy lost $2.72, or 7.2 per cent, to $34.90; Santos eased 1 cent, to $7.32; and Brazilian-based producer Karoon Energy retreated 3 cents, or 1.4 per cent, to $2.17.

In the big banks, Westpac gave up 26 cents, or 1.2 per cent, to $22.11; ANZ slipped 17 cents, or 0.7 per cent, to $24.33; Commonwealth Bank lost 49 cents, or 0.5 per cent, to $98.41; and National Australia Bank slid 26 cents, or 0.9 per cent, to $29.45. Investment bank Macquarie Group fell $2.16, or 1.1 per cent, to $190.84.

In biotech, heavyweight CSL gained 20 cents to $297.10, while Mesoblast surged 13 cents, or 14 per cent, to $1.06 after reporting that the US Food and Drug Administration has accepted Mesoblast’s resubmission for its drug, remestemcel-L, in the treatment of children with steroid-refractory acute graft. At one point, Mesoblast was up almost 16 per cent.

US markets see higher rates

In the US, the market was still digesting Tuesday’s comments from Federal Reserve Chairman Jerome Powell hinting at higher interest rates for longer. The blue-chip Dow Jones Industrial Average eased 58.06 points, or 0.2 per cent, to end at 32,798.40, while the broader S&P 500 eked out a 5.6-point gain to settle at 3,992.01, and the tech-heavy Nasdaq Composite index gained 45.7 points, or 0.4 per cent, to finish at 11,576.00.

In the bond market, the US 10-year yield appreciated 2.1 basis points, to 3.99 per cent, while the more policy-sensitive 2-year yield moved 5.9 basis points higher, to 5.07 per cent.

On the commodities front, gold lost US$1.70 to US$1,818 an ounce, while the global benchmark Brent crude oil grade retraced 78 US cents, or 0.9 per cent, to US$82.51 a barrel and US West Texas Intermediate crude dipped US$1.06, or 1.4 per cent, to US$76.52.

The Australian dollar is buying 65.88 US cents this morning, a fresh four-month low and down slightly on the local Wednesday close at 65.91, which was down from 67.11 US cents on Tuesday.