Investor concerns on surveillance cameras

NZ Super and Australia’s Perpetual Investments have joined a group of global investors in an engagement program involving human rights and the use of facial recognition technology.

They are the only Australasian members of a group of 50 fiduciary investors which speak for about US$4.5 trillion (A$5.9 trillion) under management.

The initiative was launched by fund manager Candriam, an affiliate of New York Life.

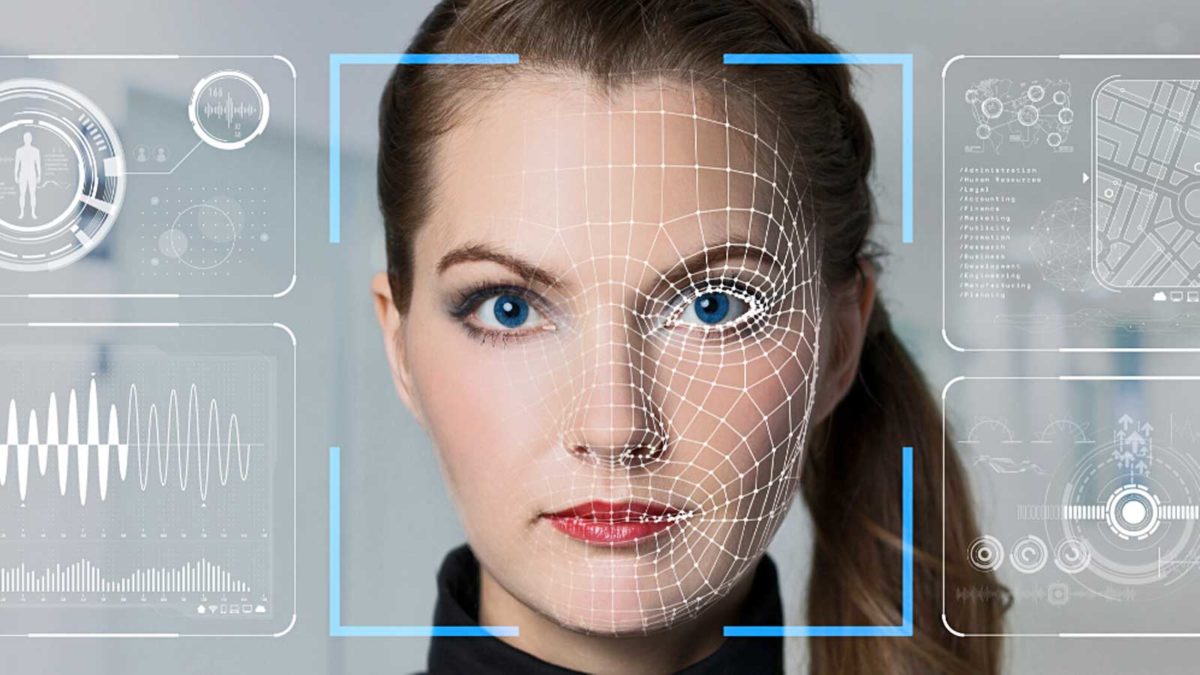

The two-year collaborative engagement program aims to prioritise human rights in relation to use of facial recognition technology and “seeks constructive dialogue with global companies developing or using the technology”, NZ Super said last week in a regular note to stakeholders (see separate report on the fund’s tussle with an Israeli lobby group this edition).

The facial recognition program has been welcomed by the UN’s PRI. It advocates for adequate risk management and improved corporate disclosure of the technology’s use.

The United Nations has estimated that there are about one billion surveillance cameras in operation around the world.

Candriam says on its website: “The United Nations Guiding Principles on Business and Human Rights (UNGPs) urge companies to respect human rights and correct abuses when they occur.

“They call on companies to conduct human rights due diligence to ‘know and show’ they respect human rights through their own activities, and the activities directly linked to their products, services, operations, and through their business relationships.”

The Perpetual involvement in the program is via one of its US subsidiary managers, Trillium Asset Management, an ESG specialist firm which it acquired last year. Trillium was founded in 1982 to focus exclusively on responsible investing. It has about US$4.5 billion under management.

Candriam says that with facial recognition, the lack of permission, lack of oversight, the rate of error, and the gender and racial biases in the misidentifications are among the controversies which must be clarified. “Investors must ask the questions, before we try to determine any directions.”

The US manager says: “Facial recognition technology (FRT) in its present form lacks consent of those photographed and lacks official oversight. In many cases, we are under FRT surveillance without our knowledge. Misidentification is far more frequent than one might expect and occurs more systematically among certain ethnic groups.

“Misidentification is on the rise and has led to false arrests. In 2019, the US city of San Francisco, the birthplace of facial recognition, banned its use in law enforcement. Soon after, several large technology companies announced a one-year moratorium of the sale of their FRT products.”

Meanwhile, NZ Super is reviewing its responsible investment strategy, the fund said last week in a regular ‘Guardians Stakeholders Update’ to “ensure it is fit for the challenges of the next 10 years and beyond”.

The review, expected to be completed by the year’s end, has three workstreams:

- Emerging trends and stakeholder expectations

- Ways to improve ESG performance in global listed equity portfolios, and

- How to increase the number and scale of positive investments (investments which provide social and environmental benefits in addition to the required financial return).