Market consolidates, Ansell tanks on downgrade, ARB jumps

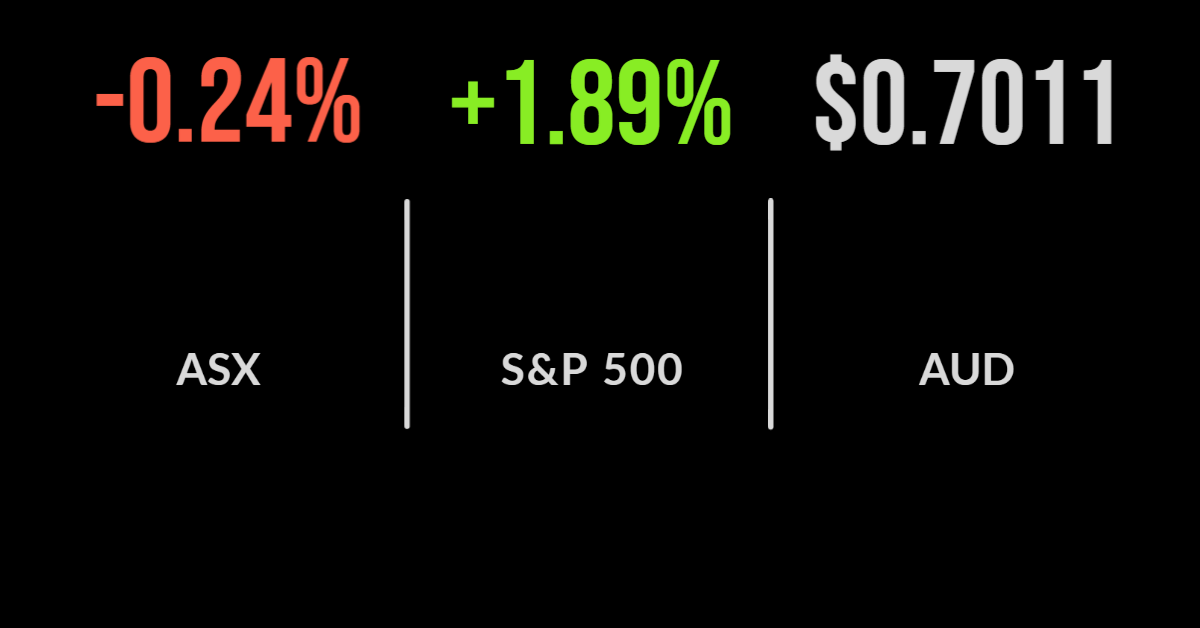

The S&P/ASX200 wasn’t able to capitalise on the strong finish in the US on Friday, continuing to underperform the world’s largest market falling 0.2%.

Financials were the biggest detractor falling 1.8% with the likes of Commonwealth Bank (ASX: CBA) and Macquarie (ASX: MQG) falling 2% each.

The rally was squarely in the beaten-down technology and retailing sector, up 3.7 and 1.3% with Zip Co (ASX: Z1P) and Square Payments (ASX: SQ2) up 7.5 and 8.1%.

But all eyes were on ‘blue chip’ healthcare product supplier Ansell (ASX: ANN) with shares tanking by more than 14% after delivering an earnings downgrade.

Supply chain disruptions and challenging comparables for disposable glove sales were central to the downgrade with earnings now expected to be between $1.25 and $1.45 per share, down from $1.75 to $1.95 for the financial year.

Margins are also coming under pressure from higher manufacturing and input costs and broadly weaker demand.

Shares in BHP (ASX: BHP) fell 1.2% despite the iron ore price once again moving above US$150 per tonne as the Chinese are expected to ramp up steel production post the Lunar New Year celebrations.

Real estate strengthens, ARB improves despite car shortage, Origin delivers strong quarter

Shares in Origin Energy gained 1.6% after the group reported that three shipments were made from their APLNG project, benefitting from the soaring LNG prices available in Asia; five more are expected in the March quarter.

The result was a 33% jump in sales to $2.25 billion, sending first-half revenue up 91% on the previous year and setting the company up for a strong year.

The average LNG price realised surged to US$11.80 MMBTU, still well below the US$28 prices available in North Asia but a near doubling of domestic prices. Production increased just 2%.

ARB Corporation (ASX: ARBP) has been able to overcome a shortage of new cars to report a 26% increase in sales compared to 2021’s record level, hitting $359 million for the first half.

Profit is expected to be between $90 and $92 million, with improved inventory levels combined with strong customer orders both contributing.

Struggling hedge fund manager VGI Partners (ASX: VGI) is set to merge with small-cap specialist Regal Funds.

US markets finish January strongly, semiconductors surge, Spotify capitulates

All three US benchmarks closed the most volatile month in over a year on a positive note, with the Nasdaq outperforming, gaining 3.4% on the back of a surge in the semiconductor sector.

It wasn’t enough to reverse the worst monthly return since March 2020.

The most important group of companies in the world has fallen into a correction on supply shortages and valuation concerns but managed to rally behind NVIDIA (NYSE: NVDA) and Intel (NYSE: INTC) which gained 7 and 2% respectively.

Shares in Moderna (NYSE: MRNA) also gained more than 6% after the company received full approval of their COVID-19 vaccine.

The S&P500 and Dow Jones underperformed, gaining 1.9 and 1.2% but reversing some of the 10 and 6% losses suffered in January thus far.

According to Bloomberg some 81% of the 172 S&P500 companies reporting so far have met or exceeded expectations.

Shares in Spotify (NYSE: SPOT) gained more than 13% reversing losses that were driven by growing boycotts of the platform over popular podcaster Joe Rogan’s vaccination views.

The group will now include content warnings and more balanced guests.