Market drops despite massive Origin takeover bid, Xero CEO quits

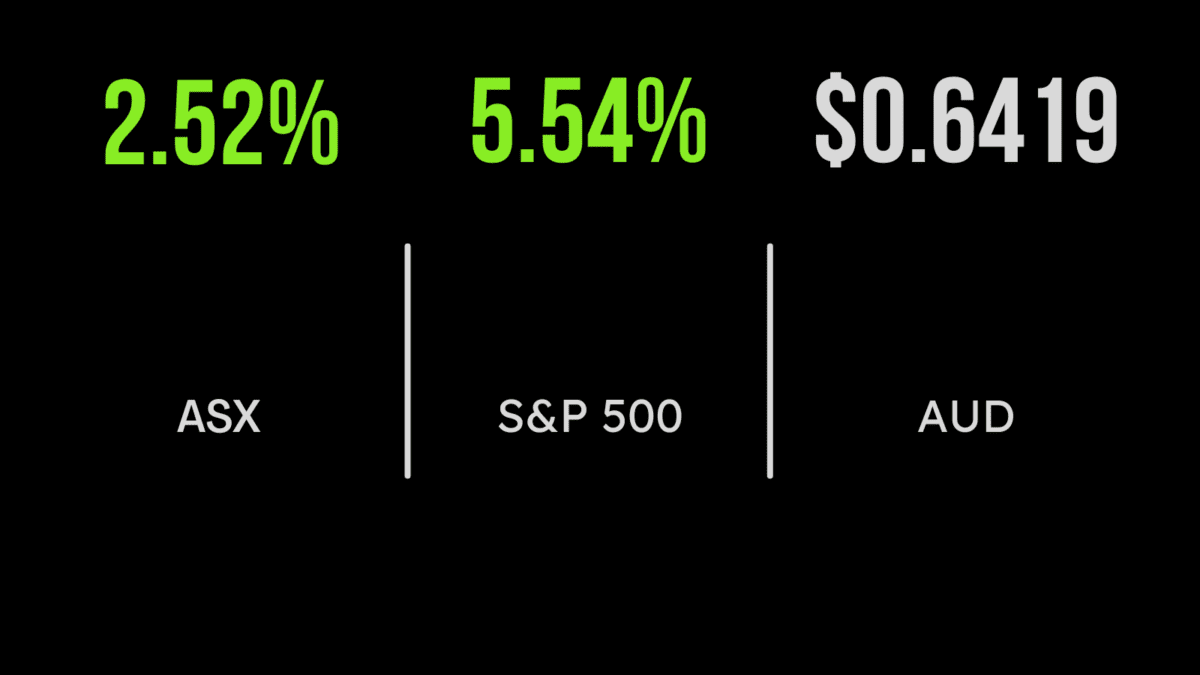

The local market weakened as crypto turbulence spread into global equity markets, with the S&P/ASX200 falling 0.5 per cent. Half of the markets sectors were lower, led by energy and technology, down 2.1 and 1.9 per cent respectively. The standout was utilities, which gained 13 per cent on the back of a massive takeover bid for Origin Energy (ASX:ORG). The energy production and retailing business released confirmation of an offer of $9 per share, valuing the company at $18 billion, lobbed by Brookfield and MidOcean Energy. Naturally, the share price responded by jumping 34 per cent, albeit well below the offer price as it will likely be subject to competition review and regulatory approval. It highlights the massive global demand for gas and energy assets at a challenging time. It was the opposite story for Xero (ASX:XRO) which fell by around 11 per cent on news that CEO Steve Vamos was resigning. The company also delivered a larger loss of NZ$16 million, despite retaining a strong profit margin of 87 per cent.

Perpetual rejects second bid, Pendal merger pushes ahead, Computershare, Nine offer guidance

Shares in Perpetual (ASX:PPT) gained more than 14 per cent after the company rejected a second bid from the Regal-led consortium of $33 per share. This was a 10 per cent increase on the prior bid, however, Pendal (ASX:PDL) the other suitor remains focused on a merger and indicated they will be pushing ahead as expected. Pendal shares fell 10.9 per cent. Ansell (ASX:ANN) shares fell 2 per cent after warning that many healthcare customers were seeking to run down inventories and cutting orders for 2023, something that would lead to a reduction in profits. On the other hand, Computershare (ASX:CPU) has upgraded guidance, as the groups margin income benefits from the recent increases in interest rates. Shares gained 4.1 per cent after the company upgraded expectations for revenue from holding dividend and related payments to US$800 million in 2023 and US$1 billion in 2024.

Market surges on falling inflation, tech shines

The US stock market delivered close to the biggest one-day gain since the worst of the pandemic, after inflation ‘unexpectedly’ fell in October. We say unexpectedly as most were forecasting inflation to remain higher despite growing signs of a weakening economy. The S&P500 added 5.5 per cent, the Dow Jones 3.6 and the Nasdaq a stunning 7.2 per cent after bond yields fell significantly on hopes that the Federal Reserve will be forced to pause it’s aggressive rate hike strategy. US inflation fell to 7.7 per cent for the month, down from 8.2 per cent with core inflation even lower at 6.3 per cent. Naturally, the US dollar weakened somewhat compared to other global currencies, which may offset some of the gains in Australia. All of the Dow‘s 30 components were trading higher led by technology companies Salesforce.com (NYSE:CRM) and Microsoft (NYSE:MSFT) up 10 and 8 per cent respectively.