Market rally sustained, NZ inflation hits 30 year high, Challenger, Brambles surges on upgrade

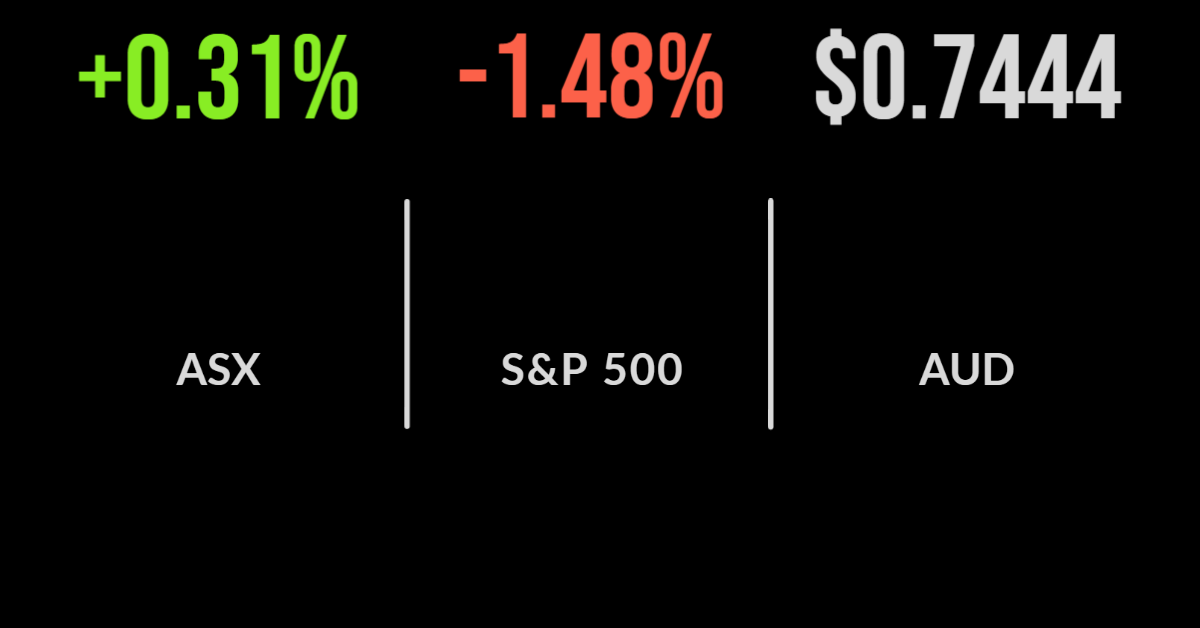

It was another positive day for the local sharemarket with retreating bond yields and more positive stock-specific news sending the S&P/ASX200 another 0.3 per cent higher.

In a surprising turn, both the materials and technology sectors underperformed, down 2.6 and 1.6 per cent respectively, while the real estate and industrial sectors added over 2 per cent.

The highlight was annuity seller and fund manager Challenger (ASX: CGF) which gained 9.8 per cent after delivering a rosy earnings update.

Real profit, not earnings, is set to be at the upper end of the forecast $430 to $480 million range, with another 10 per cent jump in lifetime annuity sales to $2.7 billion a key trigger, benefitting from higher bond rates.

It was a similar story for Brambles (ASX: BXB) owner of CHEP pallets who confirmed that the global pallet shortage is showing no signs of slowing down.

Higher input costs are generally being passed onto customers, boosting revenue to what will be 8 to 9 per cent growth, a 30 per cent upgrade, and now expected profit and free cash to follow sales higher.

Ramsay Foundation backs sale, Megaport tanks BHP’s underwhelming production

Ramsay Healthcare (ASX: RHC) gained another 3.4 per cent but remains $5 below the $88 price offered by KKR, with many suggesting it is still undervalued given the limited operating ability they have had during the pandemic.

This is a serious offer and may well bring other buyers out of the shadows.

Smaller cap technology favourite Megaport (ASX: MP1) which supports onboarding to cloud servers and private networks fell by more than 20 per cent after delivering a weak earnings update.

Revenue grew by just 5 per cent in the third quarter to $27.9 million with the market clearly concerned about the pandemic bringing forward the technology spending.

Monthly recurring revenue was similar 6 per cent higher by clearly well below expectations of at least double digits.

BHP (ASX: BHP) fell 3 per cent after an underwhelming quarterly production update with management flagging lower production of nickel and copper than anticipated, hit by workforce and COVID-19 issues in South America, which coal and iron ore remain on track.

It was the opposite story at Santos (ASX: STO) which gained 1.7 per cent after reporting a doubling of sales for the March quarter despite volume growth of just 3 per cent; higher oil prices were the sole driver.

Global markets turn on Powell comments, Tesla delivers record profit, Carvana tanks

US markets weakened once again overnight following comments from Federal Reserve Chair Jerome Powell indicating he agreed with recent comments around the need for more aggressive rate hikes.

As has been the case, the Dow Jones outperformed falling 1.1 per cent, the S&P500 fell 1.5 and the Nasdaq 2.1 per cent.

Tesla (NYSE: TSLA) was the standout with the company delivering a record quarterly profit of US$3.2 billion after-sales revenue surged 81 per cent to US$18.6 billion in March.

The group is clearly managing pandemic and supply chain issues better than their competitors. Elon Musk also highlighted the group’s current focus on a dedicated Robotaxi; shares gained more than 3 per cent.

It was the opposite story for Carvana (NASDAQ: CVNA) which may well have been one of the best examples of profitless tech.

Shares in the company fell 10 per cent after management flagged a 500 per cent increase in their net loss despite strong revenue growth, blaming their policy of investing into capacity ahead of demand, which never actually came.

On the positive, United Airlines (NYSE: UAL) gained 9 per cent after announcing they expect their first quarterly profit in several years to occur in 2022.