Off the road but the show goes on(line)

by David Chaplin

It was like BT in its heyday; BT when BT was Bankers Trust. But if the Auckland leg of the Magellan Australasian roadshow was a blast of nostalgia for funds industry veterans it also marked an end point. Magellan is the best at these things. It will be sad to see them go into self-isolation.

The Magellan event, which crammed 750 plus investors and advisors into the ‘Great Room’ at Auckland’s Cordis Hotel on March 3, was both the largest gathering of its kind in NZ – maybe ever – and the last for an indefinite period of time.

In the days and weeks (just three) since the regular flow of offshore funds managers to NZ has ceased, first as voluntary precaution kicked in and then by government-mandated border closures.

While Heathcote Investment Partners, a third-party marketing firm, squeezed in its regular ‘meet the managers’ national tour ahead of the global shutdown, all other subsequent live shows have been cut. Australian multi-affiliate firm Pinnacle, for example, cancelled a number of trans-Tasman trips for underlying fund managers in March as the border lock-down loomed. Instead, Pinnacle has produced a library of materials ranging from in-depth podcasts to concise notes from some of its managers including Coolabah Capital, Firetrail and Antipodes.

All other live-action industry meetings planned over the next few months are also under threat, including the October Financial Advice NZ annual conference in Christchurch that has been pushed out tentatively to February next year. Its worse in Australia, of course.

However, as 3-D physical meetings disappear from the map the financial services industry is naturally turning to greater online engagement. In what may be the first of many digital pivots to come, AML Solutions last week reformatted its annual conference – set down for April 30 to May 1 – as ‘virtual’ event.

The AML compliance firm says that while the conference would “now be available online only”, the digital switch has enabled it “to expand content and incorporate a wider range of speakers and topics”.

Also last week, Harbour Asset Management transferred its roadshow to webinar version in light of recent developments.

Elsewhere, industry bodies like the Financial Services Council (FSC) are exploring online options to guide members and consumers through the COVID-19 disruption.

“One of the ways we are looking to deliver that support and connect with our community is through technology,” the FSC said in a release last week. “It is important that we continue to work together as a community for our customers and teams alike. We are looking at ways to get the financial services community together virtually and will let you know when we have developed our program.”

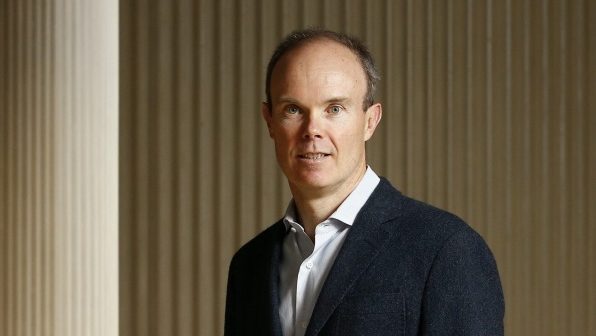

Financial services are probably more adaptable to business online than many others but face-to-face gatherings have always been an important part of the mix. In his Auckland performance, Magellan chief, Hamish Douglass, was reasonably upbeat about the long-term market impact of coronavirus – picking a two- to six-month period of high volatility would be followed by a recovery in a world of even lower interest rates.

Last week, Douglass painted a much gloomier picture of a “near total shutdown of the world’s economy over the next two to six months”. “Over the past week, we have taken steps to increase the defensiveness of the Global Equity portfolio and have increased cash in the strategy from approximately 6 per cent to approximately 15 per cent” he says in a note. “All cash is held in US dollars.”

As those familiar with the underground history of financial services will know, BT made its name in Australia – ironically of a firm that later traded on the ‘it’s time in the market, not timing the market’ slogan – on shifting to cash just ahead of the 1987 crash. BT enjoyed a ‘halo effect’ for several years after.

Magellan continued another long-standing industry tradition of unknown origin, handing out free branded umbrellas to crowd members flowing out of the Auckland hotel. Bad timing, perhaps: It had been a particularly long dry spell in the north island. But, it rained the next day. That’s New Zealand.

– Investment News, NZ