One point, but we’ll take it

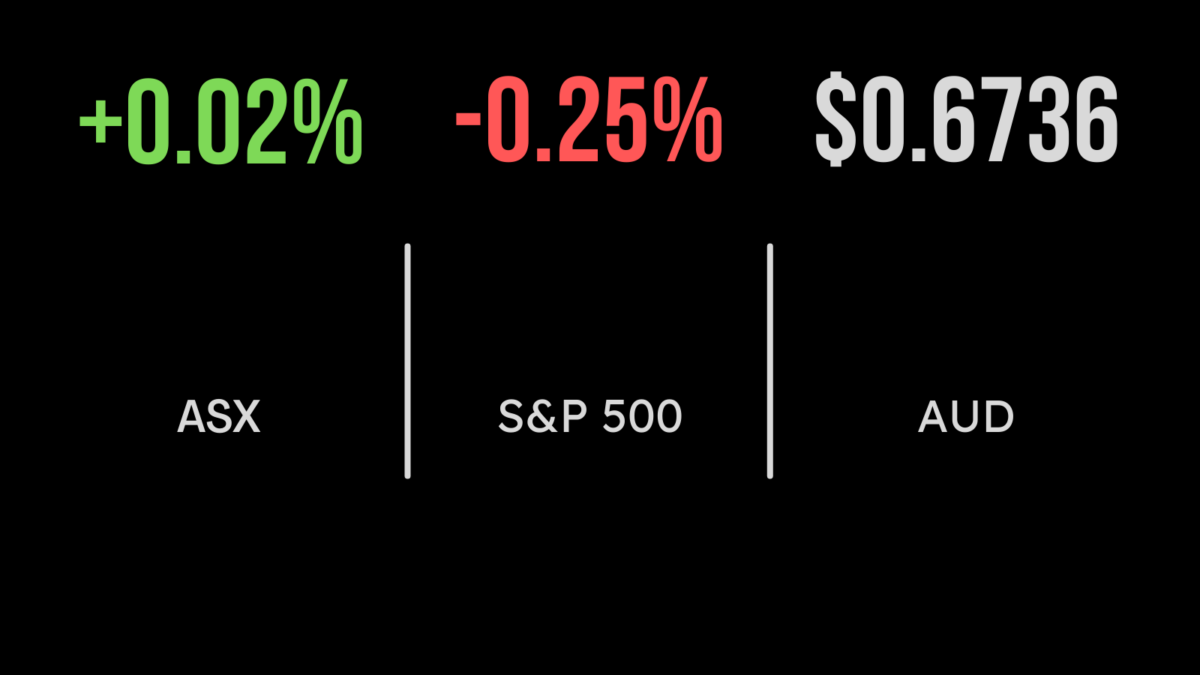

The Australian share market managed its eighth straight winning day on Wednesday, but only just; with the S&P/ASX 200 eking out a gain of 1.2 points, to 7123.2. Nor could the broader All Ordinaries index work up any momentum, ending the day 2.8 points higher at 7,434.3.

The ASX’s 11 official sectors mostly rose, with eight gaining and three sliding.

Telecommunications and the tech sectors were the biggest risers, both appreciating about 0.8 per cent, but the energy and mining sectors both lost 0.6 per cent.

Embattled fund manager Magellan Financial Group’s shares slid 35 cents, or 4.1 per cent, to $8.28 after the group revealed $3.9 billion of fund outflows in March, after two institutional clients ended mandates with its Australian equities business Airlie Funds Management.

Big US dollar earners Cochlear and CSL both rose, with COH gaining 69 cents, or 0.3 per cent, to $242.94, and CSL, up $2.13, or 0.7 per cent, to $293.60.

Of the big banks, National Australia Bank eased 3 cents to $28.04 and Westpac slipped 2 cents, to $21.78, but ANZ firmed 3 cents, to $23.30, and Commonwealth Bank rose 8 cents, to $99.06. Investment bank Macquarie Group gave up $1.29, or 0.7 per cent, to $178.17.

Among the big miners, BHP retreated 70 cents, or 1.5 per cent, to $45.24; Rio Tinto shed $1.11, or 0.9 per cent, to $116.63; and Fortescue Metals eased 29 cents, or 1.3 per cent, to $21.59.

In coal, Whitehaven Coal came back 28 cents, or 3.9 per cent, to $7.00 and New Hope Corporation lost 7 cents, or 1.2 per cent, to $5.99, Terracom eased 1.5 cents, or 2.2 per cent, to 68 cents, Stanmore Resources dropped 6 cents, or 1.8 per cent, to $3.35 Coronado Global Resources fell 4 cents, or 2.4 per cent, to $1.63.

Lithium, gold shine

Despite lithium stocks remaining pressured from weaker lithium carbonate prices in China, producer Pilbara Minerals managed a 4-cent, or 1.1 per cent, gain to $3.73, while fellow producer Allkem softened 21 cents, or 1.8 per cent, to $11.22. Among the project developers, Core Lithium jumped 6.5 cents, or 8.1 per cent, to 87 cents; Liontown Resources gained 7 cents, or 2.7 per cent, to $2.66; and Lake Resources added 1.5 cents, or 3.3 per cent, to 48 cents; but US-based Piedmont Lithium retreated 3 cents, or 3.6 per cent, to 81 cents; and Sayona Mining gave up 1 cent, or 4.9 per cent, to 20 cents.

Gold miners were keenly bought as the precious metal surged to $US2,026 an ounce after the US dollar weakened following softer-than-expected US jobs data. The last time gold traded for more than $US2,000 was in March 2020, at the start of the pandemic. In Australian dollar terms, the yellow metal pushed through $3,000 an ounce for the first time ever on Wednesday, ending at $3,022.06 an ounce.

Newcrest gained 83 cents, or 3.1 per cent, to a 12-month high of $28.03; Northern Star firmed 39 cents, or 3.1 per cent, to $12.99; Evolution added 13 cents, or 4 per cent, to $3.35; and Gold Road Resources rose 7 cents, also 4 per cent, to $1.80.

Oil rally loses steam

In the US, it was mostly a downward session for the indices, but a healthcare boost helped the 30-stock Dow Jones Industrial Average advance 80.3 points, or 0.2 per cent, to 33,482.72. However, the broad S&P 500 index eased 10.2 points, or 0.3 per cent, to 4,090.38, and the tech-heavy Nasdaq Composite index slipped 129.46 points, or 1.1 per cent, to 11,996.86.

In the bond market, the US 10-year yield was unchanged at 3.309 per cent, with the more policy-sensitive 2-year yield down 3.3 basis points to 3.805 per cent.

The oil rally earlier in the week is largely petering out, but the global benchmark Brent crude oil added 5 cents to US$84.99 a barrel, while US West Texas Intermediate slid 14 cents to US$80.47 a barrel. Gold is down 60 cents, at US$2,019.40 an ounce, or $3,002.75 in A$ terms.

The Australian dollar is buying 67.24 US cents this morning, down from 67.32 US cents at the local close on Wednesday.