Rate rise rocks market

The local sharemarket copped its biggest fall in five weeks on Tuesday after the Reserve Bank of Australia (RBA) delivered a ninth consecutive rate rise, and for good measure, poured cold water on hopes of an imminent pause in its tightening cycle. RBA governor Philip Lowe warned that further increases will be needed in the months ahead to ensure that inflation returns to target.

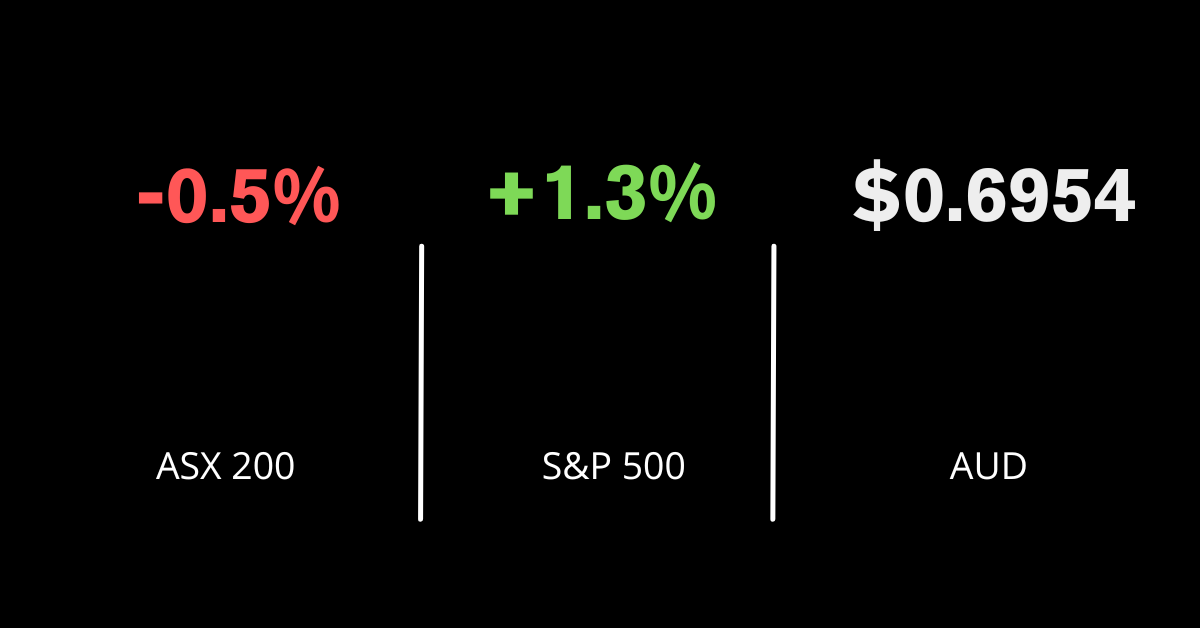

In response, the benchmark S&P/ASX 200 index fell 34.9 points, or 0.5 per cent, to 7504.1, while the broader All Ordinaries index slipped 32.8 points, or 0.4 per cent, to 7,713.1.

The major banks mostly eased after the rate decision, with Commonwealth down 45 cents, or 0.4 per cent, to $110.30, NAB closing 15 cents lower, or 0.5 per cent, to $31.73, and Westpac also sliding 0.5 per cent, down 12 cents to $23.73, while ANZ went against the trend, adding 8 cents, or 0.3 per cent, to $25.66. Investment bank Macquarie rose $1.36, or 0.7 per cent, to $190.33.

Nuix takes off on court win

One group of shareholders cheering, however, were those in embattled investigative analytics and intelligence software provider Nuix, which rocketed 39 cents, or 43.7 per cent, higher to $1.30 after the Federal Court determined the company does not have to pay former CEO Eddie Sheehy $183 million. Mr Sheehy had claimed he was entitled to a share split that would have let him cash out during the company’s billion-dollar initial public offering (IPO) in 2020. Unfortunately for long-suffering shareholders, that IPO was done at $5.31.

Energy was the strongest sector, up almost 0.5 per cent, with Woodside gaining 11 cents, or 0.3 per cent, to $36.16, Santos up 4 cents, or 0.6 per cent, to $7.05, and Beach Energy rising 4.5 cents, or 2.9 per cent, to $1.58.

Among the major miners, BHP slid 19 cents, or 0.4 per cent, to $48.01; and Rio Tinto lost $1.11, or 0.9 per cent, to $122.90; but Fortescue Metals put on 9 cents, or 0.4 per cent, to $22.05. Goldminer Newcrest added another 42 cents, or 1.7 per cent, to $24.95, taking its gain to almost 12 per cent since it received a $24.5 billion takeover offer from US gold heavyweight Newmont Corporation, the world’s largest gold miner, at the weekend.

In lithium, Allkem declined 6 cents, or 0.5 per cent, to $12.94, and fellow producer Pilbara Minerals lost 1 cent to $4.76. Mineral Resources, which produces iron ore as well as lithium, rose 49 cents, or 0.6 per cent, to $89.09, while among the lithium project developers, Liontown Resources retreated 3.5 cents, or 2.3 per cent, to $1.46 and Ioneer gave up 1.5 cents, or 3.5 per cent, to 42 cents.

The coal cohort had a good day, with Whitehaven Coal gaining 16 cents, or 1.9 per cent, to $8.62; New Hope Corporation surging 22 cents, or 3.7 per cent, to $6.16; Coronado Global Resources adding 4 cents, or 1.9 per cent, to $2.16; Yancoal Australia advancing 21 cents, or 3.5 per cent, to $6.19; Stanmore Coal rising 14 cents, or 4 per cent, to $3.67; Terracom adding 4 cents, or 4.9 per cent, to 85 cents; and Bowen Coking Coal gaining 1.5 cents, or 5.4 per cent, to 30 cents.

Market leader CSL was down $3.85, or 1.2 per cent, to $308.07, while Telstra slipped 2 cents, or 0.5 per cent, to $4.12.

Fed chief buoys markets

In the US, stocks gained following Federal Reserve Chair Jerome Powell’s comments at the Economic Club of Washington indicating inflation has started easing. The 30-stock Dow Jones Industrial Average added 265.7 points, or 0.8 per cent, to finish at 34,156.7, while the broader S&P 500 lifted 52.9 points, or 1.3 per cent, to close at 4,164 points, and the tech-heavy Nasdaq Composite posted the biggest gain, rising 226.3 points, or 1.9 per cent, to end at 12,113.8.

The US 10-year Treasury yield rose 4.9 basis points to 3.681 per cent, while the more rate-sensitive 2-year note was up 1.7 basis points to 4.473 per cent.

In commodities, gold is up US$3.90, or 0.2 per cent, to US$1.872.30 an ounce, the global benchmark Brent crude oil grade rose US$2.89, or 3.6 per cent, to US$83.88 a barrel, and West Texas Intermediate oil surged US3.21, or 4.3 per cent, to US$77.32 a barrel.

The Australian dollar is buying 69.54 US cents this morning, up from 69.4 cents at the local close yesterday.