Sharemarket gains despite energy weakness, Webjet recovery continues, Seek guidance on track

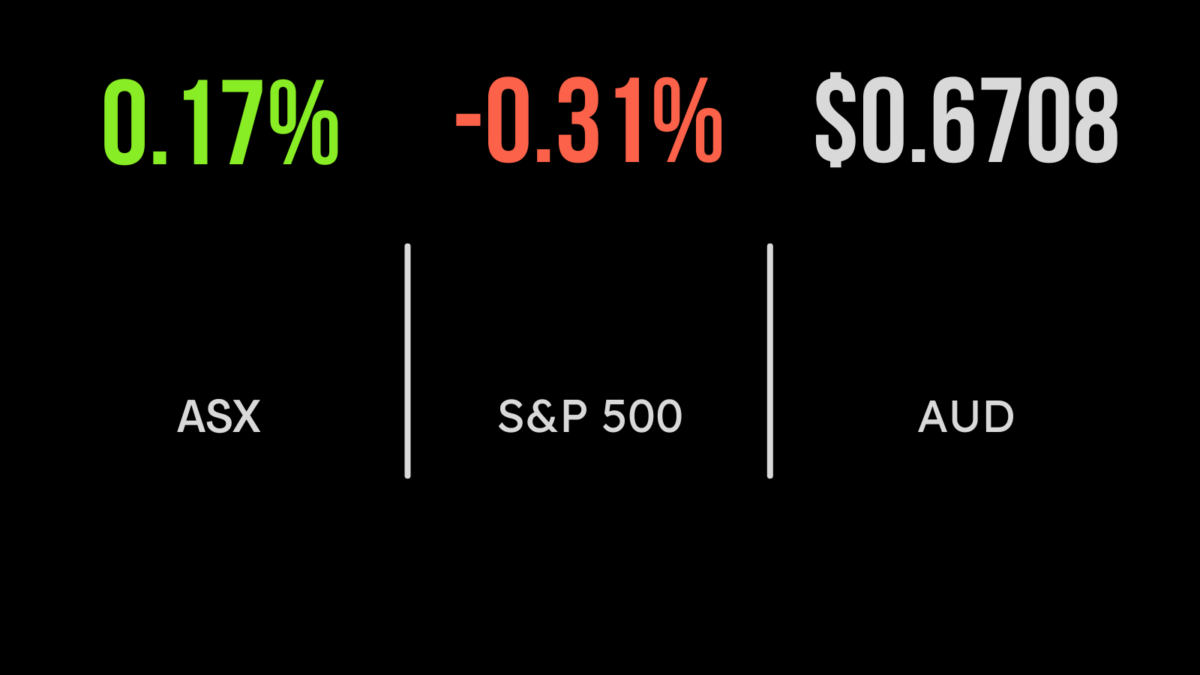

The S&P/ASX200 managed another small gain on Thursday, adding 0.2 per cent as strength in all sectors barring energy and materials, down 2.1 and 1.2 per cent each, managed to offset losses in the coal mining companies. The biggest detractors were New Hope (ASX: NHC) and Whitehaven Coal (ASX: WHC) which lost more than 6 per cent each as coal prices continued to weaken. On the positive side, the consumer sectors both posted gains, with staples up 1.9 and retailers 1.3 per cent on the back of a 10 per cent jump in Webjet (ASX: WEB). The online travel booking platform confirmed that total bookings reached 101 per cent of pre-pandemic levels in the six months to September, with the company swinging to a small $4 million profit on a more than doubling of transactions undertaken. Shares in Seek (ASX: SEK) gained 1.7 per cent, after the company confirmed it’s recent guidance for earnings between $560 and $590 million, with profit to sit between $250 and $270 million for the financial year. This came as the unemployment rate fell once again to just 3.4 per cent.

China economy growing, splitting the Pendal-Perpetual deal

The Chinese economy is expected to grow just 3.1 per cent in 2022 but continues to recover in 2023 with growth set to reach 4.6 per cent according to forecasters, this bodes well for the domestic commodity sector. Shares in ASX (ASX: ASX) were only slightly lower despite ASIC and the Reserve Bank releasing a statement highlighting concerns with the rollout of the CHESS replacement project. The group also wrote down $245 million in software investments and is facing significant challenges ahead of the next project update set for February 2023. Shares in Pendal (ASX:PDL) gained more than 10 per cent while acquirer Perpetual (ASX: PPT) fell by more than 12 per cent after updated terms of the merger proposal were provided to the market. Under the deal, Pendal shareholders will receive one Perpetual share for every seven they own, plus $1.65 in cash per share. Shares in struggling retailer Cettire (ASX: CTT) were broadly flat after the company reported an 80 per cent increase in sales in October.

S&P500 drops for second day, Macy’s jumps on sales growth, NVIDIA delivers

The Nasdaq once again led global markets lower, falling 0.4 per cent overnight despite a strong result from semiconductor chip manufacturer NVIDIA (NYSE: NVDA). It was a similar story for the S&P500 and Dow Jones with both falling 0.2 and 0.1 per cent respectively. Reporting season continues to drive day-to-day movements, along with comments from Federal Reserve members with a suggestion overnight that we may see disinflation in 2023. Economic data continues to worsen with new home construction slowing and regional business activity falling further into the negative. Shares in Chinese giant Alibaba (NYSE: BABA) gained more than 7 per cent after the company reported a better than expected loss for the year, as losses in their equity investments were offset by the recover of their core e-commerce business. Shares in NVIDIA (NYSE: NVDA) fell slightly after reporting quarterly profit of US$680 million as data centre chip sales rose by more than 30 per cent and the company reported positive signs with their falling inventory levels. Shares in Macy’s (NYSE: M) finished 15 per cent higher after the company delivered better than expected same store sales growth, up 3.1 per cent as the introduction of Toys’r’us into their department stores boosted sales.