Solid effort from Aussie market

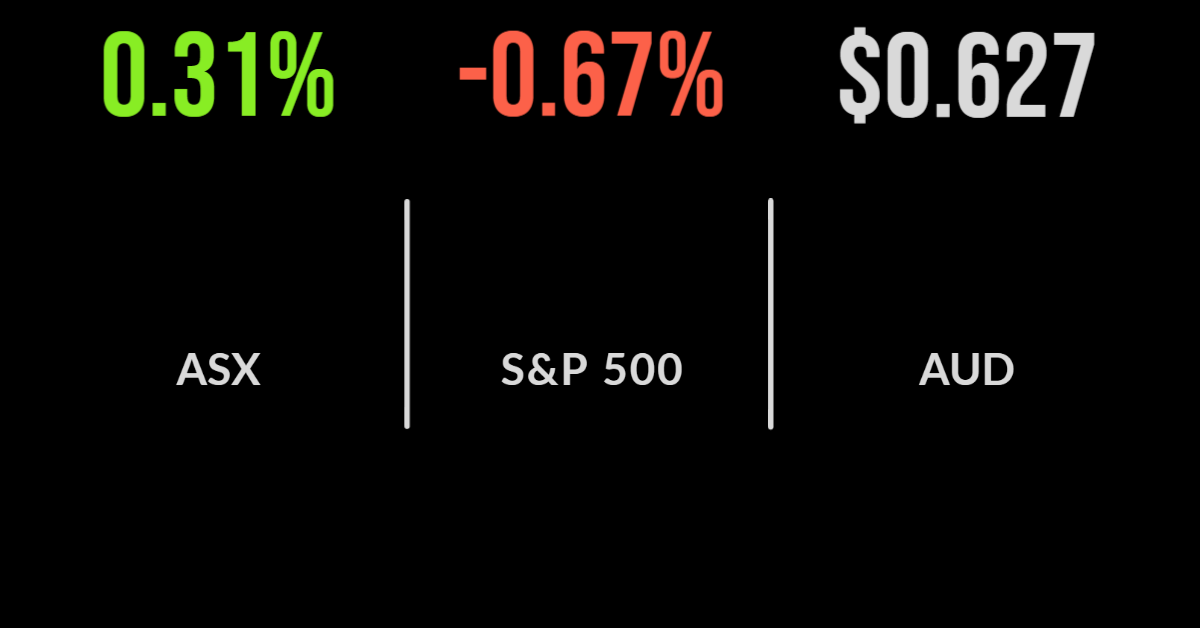

The Australian share market backed-up its Tuesday effort with a solid performance on Wednesday, with the benchmark S&P/ASX200 index gaining 20.9 points, or 0.3 per cent, to 6,800.1, while the 500-stock All Ordinaries index added 23.6 points, or 0.3 per cent, to 6,999.8.

Among the big miners, Rio Tinto eased 26 cents, or 0.3 per cent, to $94.01; South32 slipped 8 cents, or 2.1 per cent, to $3.77; iron ore heavyweight Fortescue Mining gained 14 cents, or 0.8 per cent, to $17.21; and BHP shares fell 38 cents, or 1 per cent to $39.25, after reporting a 19 per cent slide in coking (steelmaking) coal production in Queensland and a 34 per cent fall in thermal (electricity) coal production in New South Wales, in the September quarter. Labour shortages and weather disruptions were to blame, and the same issues spilled over into Whitehaven Coal’s numbers.

Whitehaven came out with a September quarter production figure that was down 37 per cent on the June quarter and 22 per cent on the same time last year, but the sharemarket was a bit more forgiving than it was with BHP: Whitehaven shares were up 11 cents, or 1.1 per cent, to $10.52, while elsewhere in coal, New Hope Corporation added 2 cents to $6.93, but Terracom retreated 2.5 cents, or 2.4 per cent, to $1.02.

Lithium leads resources

In lithium, Australian-Argentinian producer Allkem surged 73 cents, or 5 per cent, to $15.35 and fellow producer Pilbara Minerals gained 28 cents, or 5.8 per cent, to $5.08. IGO, which mines nickel and lithium, was up 79 cents, or 5.1 per cent, to $16.16. Core Lithium, which is developing the Finniss lithium project in the Northern Territory, spiked 11 cents, or 8.2 per cent, higher to $1.38, while Liontown Resources, which expects to be mining lithium at the huge Kathleen Valley project in WA in 2024, advanced 6 cents, or 3.4 per cent, to $1.84. Rare earths miner Lynas Corporation was up 16 cents, or 2.1 per cent, to $7.83.

In gold, troubled producer St Barbara fell again, down 2.5 cents, or 4.8 per cent, to 50 cents, after its ugly quarterly report on Tuesday: St Barbara is down 34 per cent in the last week, and by 64.5 per cent so far in 2022.

In energy, news that US President Joe Biden will tap the Strategic Petroleum Reserve ahead of next month’s mid-term elections sent oil prices lower, with Brent crude falling to a two-week low of $US89 a barrel. Woodside retreated 33 cents, or 1 per cent, to $32.55; Santos gave up 10 cents, or 1.3 per cent, to $7.38, Beach Energy eased 1.5 cents, or 1 per cent, to $1.52 after reporting that production was down eight per cent in the September quarter, and Brazilian producer Karoon Energy dropped 7 cents, or 3.3 per cent, to $2.04.

Over in the financial sector, Westpac gave up some of Tuesday’s gains, losing 33 cents, or 1.4 per cent to $23.65, but its big-four peers all advanced. National Australia Bank added 43 cents, or 1.4 per cent, to $31.66, Commonwealth Bank improved by 70 cents, or 0.7 per cent to $100.48, and ANZ lifted 18 cents, or 0.7 per cent, to $25.83. Investment bank Macquarie Group was up 2 cents, to $162.34.

Among key industrials, CSL was $1.26, or 0.5 per cent, higher at the close, at $276.96; Telstra added 3 cents, or 0.8 per cent, to $3.88; Wesfarmers retreated 22 cents, or 0.5 per cent, to $44.68; Woolworths gained 9 cents, or 0.3 per cent, to $33.45; Coles eased 2 cents to $16.55; and Goodman Group gained 9 cents, or 0.5 per cent, to $16.71.

Embattled casino operator Star Entertainment gained 15 cents, or 5.5 per cent, to $2.87, despite copping a casino licence suspension and $100 million fine earlier in the week, and troubled funds manager Magellan Financial lost 36 cents, or 3.2 per cent, to $10.82 as funds under management continues to fall. Magellan has lost 43 per cent so far in 2022. But fellow funds manager Pendal Group surged 26 cents, or 5.5 per cent, to $4.95 as the market mulls the takeover offer from Perpetual.

Highly rated tech stock Megaport was belted to the tune of 22.1 per cent, a $1.88 loss to $6.61, after reporting its first-quarter result. It looked OK, with revenue up 37 per cent on a year ago, to $33.7 million, and a normalised EBITDA (earnings before interest, tax, depreciation and amortisation), marking its second consecutive quarterly profit at the EBITDA level – but quite simply, it seems the market expected more.

Recession fears still troubling US bond market

In the US overnight, markets retreated, with the broad S&P 500 index shedding 24.8 points, or 0.3 per cent, to 3,695.2; the 30-stock Dow Jones Industrial Average giving up 99.99 points, also 0.3 per cent, to 30,423.81; and the tech gauge, the Nasdaq Composite, losing 91.9 points, or 0.9 per cent, to close at 10,680.5. Tesla beat earnings estimates for the third quarter, but didn’t meet revenue expectations, and the shares lost 0.8 per cent, but Netflix surged more than 13 per cent after the streaming giant posted excellent earnings, revenue and subscriber-growth numbers. United Airlines spiked almost 5 per cent after its third-quarter revenue and profit also beat estimates on the top and bottom lines.

On the bond markets, the 10-year Treasury yield traded as high as 4.136 per cent, its highest level since July 23, 2008. That tells you that recession fears are still very high. European markets closed slightly lower Wednesday as traders digested new inflation data for the UK and, like their US counterparts, assessed rate hike expectations and recession fears.

Gold is down US$23.46, or 1.4 per cent, to US$1,629.08 an ounce, while in oil, Brent crude jumped US$2.38, or 2.6 per cent, to US$92.41 a barrel, and West Texas Intermediate gained 43 cents, or 0.5 per cent, to US$85.98 a barrel. The Australian dollar is buying 62.7 US cents, down from 63.1 cents at the local close on Wednesday.