-

Sort By

-

Newest

-

Newest

-

Oldest

The Israel Institute of NZ lobbied to halt the exclusion of certain banking stocks from the NZ Superannuation Fund’s portfolio this year, according to recently released documents. In an Official Information Act (OIA) request on April 12, the local Israel association asked for confirmation the NZ Government’s largest super fund had told underlying managers that…

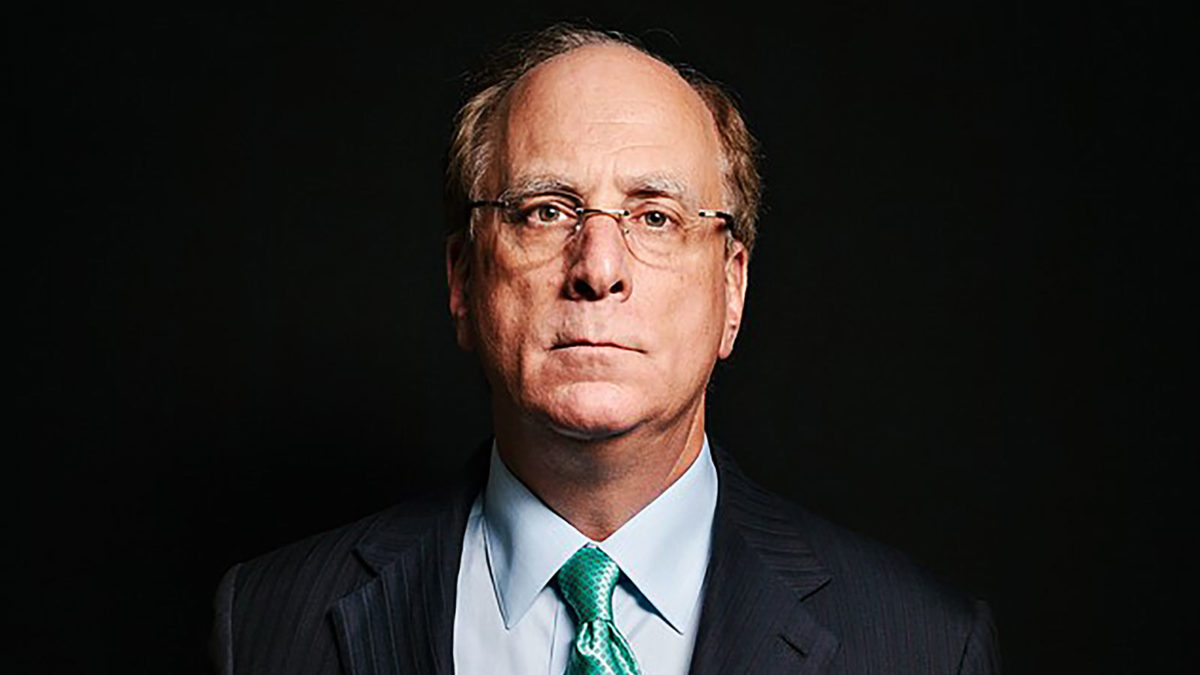

Larry Fink, BlackRock’s outspoken chief executive, has committed the firm to a cultural cleansing in the wake of alleged sexual and racial discrimination at the world’s largest fund manager. In an annual shareholder letter published last week, Fink says “certain employees have not upheld BlackRock’s standards”, putting the manager’s environmental, social and governance (ESG) credentials…

Michael Ohlsson has become a shareholder and executive director of Evergreen Consultants, the wholesale specialist asset advisory, ratings and research business co-founded by Angela Ashton in 2016. The firm has expanded rapidly in the past five years, last year launching a separate subsidiary to concentrate on ratings and research for non-mainstream products and managers, which…

Second quarter off to strong start, AMP’s CEO departs, Boral announces buyback The ASX200 (ASX:XJO) finished the week and commenced the new quarter on a strong note, finishing 0.5% higher with both IT, up 2.3%, and materials, 1.3%, contributing. It was a day for stock specific news with the worst kept secret in finance being confirmed, AMP’s CEO Francesco…

The NZ Superannuation Fund (NZS) has put new money in two US alternative asset strategies including a hedge fund operated by legendary firm Citadel and a direct private equity play in the communications infrastructure market.

US-based niche thematic fund firm Ark Investment Management has jumped ahead of global giants BlackRock and State Street in exchange-traded fund (ETF) flows in January, according to a Sovereign Wealth Fund Institute (SWFI) report. The SWFI report says Ark, which runs seven ETFs based on ‘disruptive technology’ themes, took in US$1 billion on a single…

Northern Trust has won another passive global equities gig with a bank-owned KiwiSaver fund following a mandate reshuffle at the Westpac scheme in New Zealand. Australia’s Ninety One was also a winner in the reshuffle. Along with several other changes, Northern Trust picked up a spot among six managers on the Westpac/BT international equities panel,…

Former BlackRock executive Holly Framsted is to become head of ETFs for Capital Group in the US, which plans to launch a slate of both equity and fixed income actively managed listed funds in 2022. Capital, which has about US$2 trillion (A$2.6 trillion) under management, will be adding the ETFs to about 40 mutual funds…

The latest research note from BlackRock predicts another “choppy ride” for markets in the first half of 2021 with coronavirus responses and US politics continuing as major influences. But the risk of inflation is “underappreciated”. Noting the markets had moved considerably since its annual predictions for the year ahead, published only last month (early December),…

Firmer finish for ASX, Afterpay (ASX:APT) on fire, China exports surprise The ASX200 (ASX:XJO) finished another 0.4% higher on Thursday with Afterpay (ASX:APT) a key contributor, jumping 9.7% and sending the entire tech sector up 4.7% for the session. The trigger appeared to be the listing of US competitor Affirm (NASDAQ:AFRM), which jumped 98% upon listing and seems to be bringing…