-

Sort By

-

Newest

-

Newest

-

Oldest

Australia’s second-largest super fund will look to bridge the trust gap between industry funds and independent financial advisers (IFAs) as it expands further into the external advice space. Matt Willis, Aware Super’s head of business development, says the fund plans to build on the advice offering it acquired through its 2020 merger with WA Super…

LGIA Super, in the process of merging with Energy Super, last week (April 30) confirmed the appointment of National Asset Servicing as custodian for the new fund. This follows last week’s announcement that LGIA will buy the Suncorp wealth management business, making only the second industry fund to buy a retail-orientated business after First State…

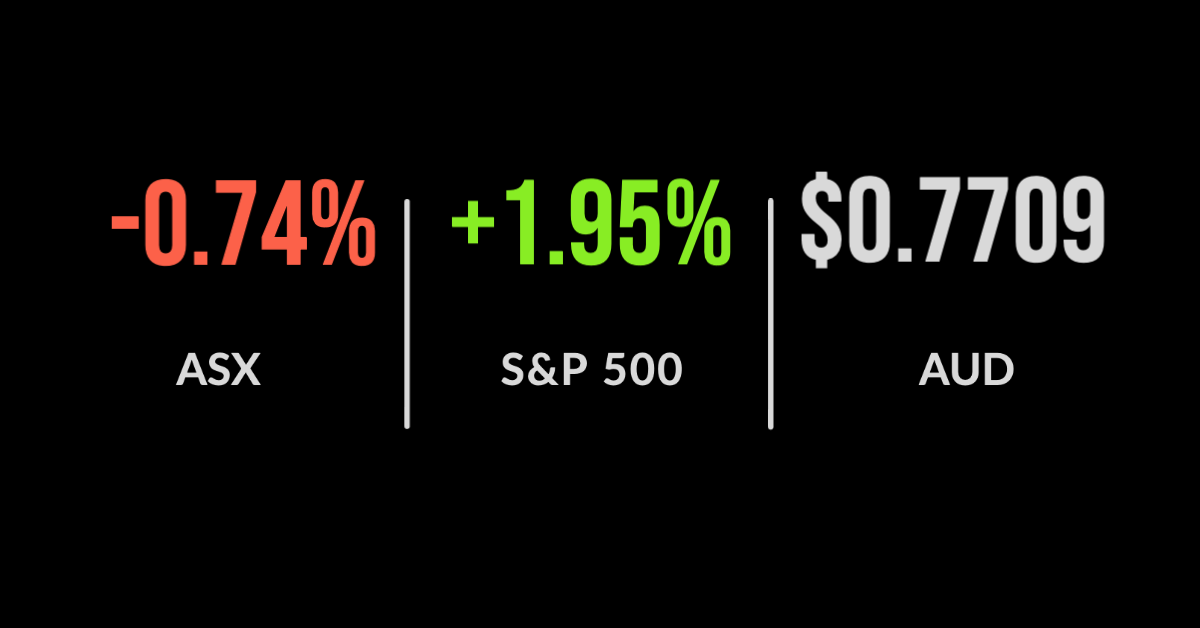

Rough day but positive finish, tech leads the way, iron ore’s new high, AMP’s new low The ASX200 (ASX:XJO) managed a small gain despite a volatile day on markets, finishing 0.1% higher on Friday taking the weekly gain to 1%. Once again, the tech sector is leading the way, jumping 4.4% over the week as it appears inflation…

“They did what they have always set out to do. They helped their members to achieve a good outcome. And they came to the party at a time it was important to do so,” said Ian Fryer as he oversaw judging of the Chant West Awards for 2021. Speaking last week (April 7) as funds…

ASX down but positive week, energy shines, asset management dispersion The ASX200 (ASX:XJO) fell 0.7% on Friday but managed to deliver a positive return for the week, finishing 0.6% higher. The commodities sector was hardest hit on Friday, falling 2.0%, with the IT sector continuing to fall as valuations are reset in response to higher bond rates….

Winning streak hits seven weeks, A2 Milk (ASX:A2M) and Mesoblast (ASX:MSB) battered The ASX200 (ASX:XJO) managed to overcome a 1.2% fall to cap off the seventh straight week of gains, adding 0.5%. The IT sector continued to lead the way behind Afterpay (ASX:APT), finishing 5.9% higher, whilst energy lost 2.4% as the US economy appeared to weaken. The biggest…

Benchmark-beating Stonehorn Global Partners, a specialist Asian equity team of ex-Macquarie personnel, has expanded its Australian team after a $300 million year. The team that gave up managing $4 billion in assets at Macquarie Equities to build their own business in 2019 have delivered exceptional returns in their Stonehorn Asia Equity All-Cap Fund, adding 18.6%,…

The well-known fund manager has launched a series of low-cost ETFs which will help further its reach into the retail investor market.

The requirement to quarantine created the perfect conditions to push virtual meetings past the tipping point to general adoption. Are they here to stay?

As the world undergoes potentially the greatest economic calamity since the 1930s, Australians of all ages are experiencing anxiety and fear about their financial wellbeing. In fact, the great majority of Australians do not have a relationship with a financial advisor. According to the latest research by AMP, the advice gap is wide and getting…