-

Sort By

-

Newest

-

Newest

-

Oldest

Adopting a robo-advice platform will increase member contributions as well as investment-option performance, while improving diversification, according to a study of French savings plans. While the buzz surrounding its introduction just over 10 years ago has abated, an increasing body of research is building on the value of robo-advice. More than a marketing tool for…

Schroders has united its alternatives capabilities under a new global structure, Schroders Capital, which now speaks for US$66 billion (A$85 billion) in listed and unlisted assets. The brand and management reporting lines were announced last week (June 7) in London. While the details probably mean more for the staff than clients, it is a further…

Karl O’Shaughnessy, former hedge fund manager and head of foreign exchange for NAB, has been battling his concerns about FX trading for more than 25 years. He is now advising institutional investors on how to improve their returns. O’Shaughnessy recently formed SuperClear FX, an advisory business which also offers wholesale clients an implementation ‘product’, which…

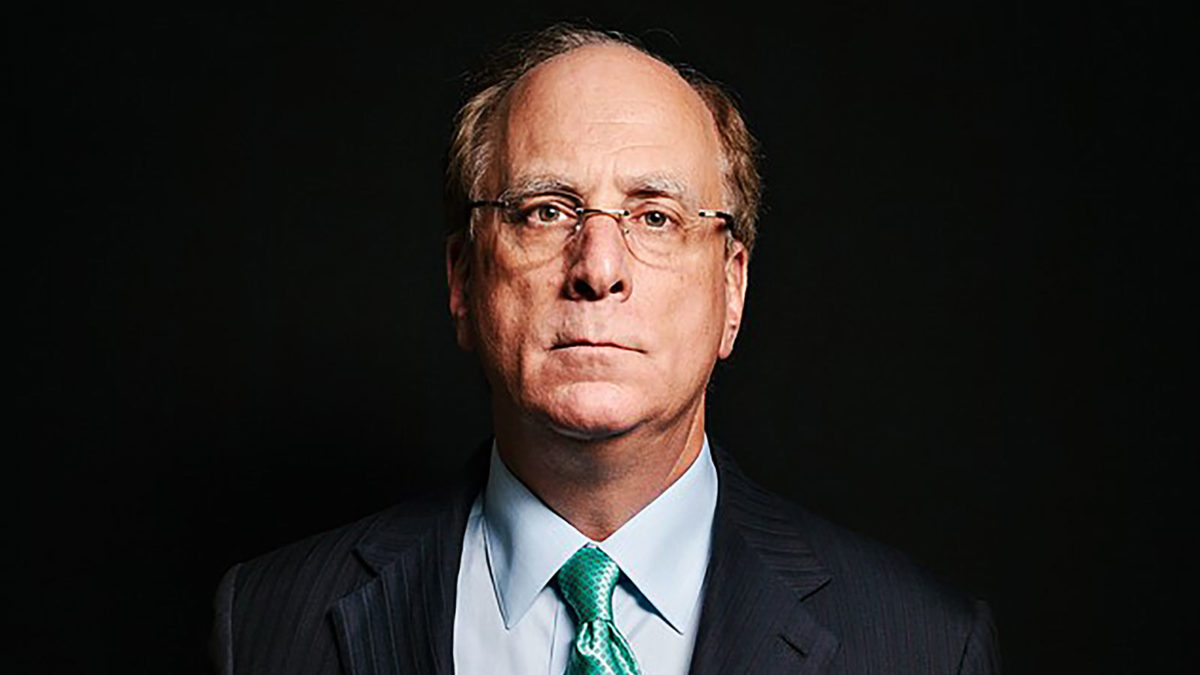

Larry Fink, BlackRock’s outspoken chief executive, has committed the firm to a cultural cleansing in the wake of alleged sexual and racial discrimination at the world’s largest fund manager. In an annual shareholder letter published last week, Fink says “certain employees have not upheld BlackRock’s standards”, putting the manager’s environmental, social and governance (ESG) credentials…

In the face of an ever-increasing wave of issues surrounding culture within funds management businesses, Frontier has become more aggressive in its approach to assessing culture within the businesses managing its client funds. Frontier, which advises on about $450 billion, has always assessed and considered culture within the context of developing manager ratings and recommendations,…

One in five Australian institutional investors has terminated a fund manager where ESG factors have been a “primary or major factor” in the decision, according to a survey by bfinance, the global research and institutional advisory business. A further 41 per cent of those Australian investors surveyed said that, while not the main reason for…

Longlead Capital Partners, the boutique long/short equities manager formed by two key players in the success of Regal Funds Management, has launched a traditional unlisted unit trust to allow better access to its strategies among Australian and New Zealand investors. Longlead, founded by Tim Campbell and Andrew West in 2014, has so far produced some…

Australia’s asset servicing market has broadened to such an extent that to call it ‘custody’ no longer does it justice. Its evolution over the past three decades, culminating in a deft handling of the pandemic’s impact, has left modern-day custodians in their strongest position ever. This, perhaps dramatic, view does not come from the custodians…

The job of global custodians is about to get a lot more important as the spread of new technologies takes hold throughout the investment world. A recent paper by Northern Trust’s asset servicing arm ‘reimagines’ the investment world in 2030, looking at what a fully digital world is likely to involve. Over the last decade,…

Almost all fund managers have adopted some form of environmental, social and governance (ESG) analysis to enhance research but its influence on real investment calls remains unclear, according to a new Russell Investments global survey. The Russell 2020 ESG study, which tapped the views of more than 400 asset managers in most regions including Australia…