-

Sort By

-

Newest

-

Newest

-

Oldest

The only reason private equity hasn’t suffered as much in this downturn is the discretion that sponsors have over its valuation. That’s going to change – and so is investors’ willingness to believe the impossible.

Hyperion believes that the sell-off in growth stocks in recent months has become indiscriminate, with the market failing to differentiate between trend setters and trend followers. The last few years has seen the ascendancy of high growth tech stocks in US and global markets, to the extent that many bears now believe it’s a bubble…

Active managers are more sensitive than ever to valuation risk. But in recent times it’s been a case of “go big or go home.” In recent years, Frontier has noted a narrowing in the breadth of US equity market return drivers, and short-term extremes of the same, with just a handful of tech mega-cap stocks…

A storm has hit global equity markets. But investors should ignore the blood on the floor and focus instead on the big structural changes that will underpin earnings for decades to come. “The storm that’s hit Australian equity markets in the last couple of days is a storm we’ve been sitting in for the best…

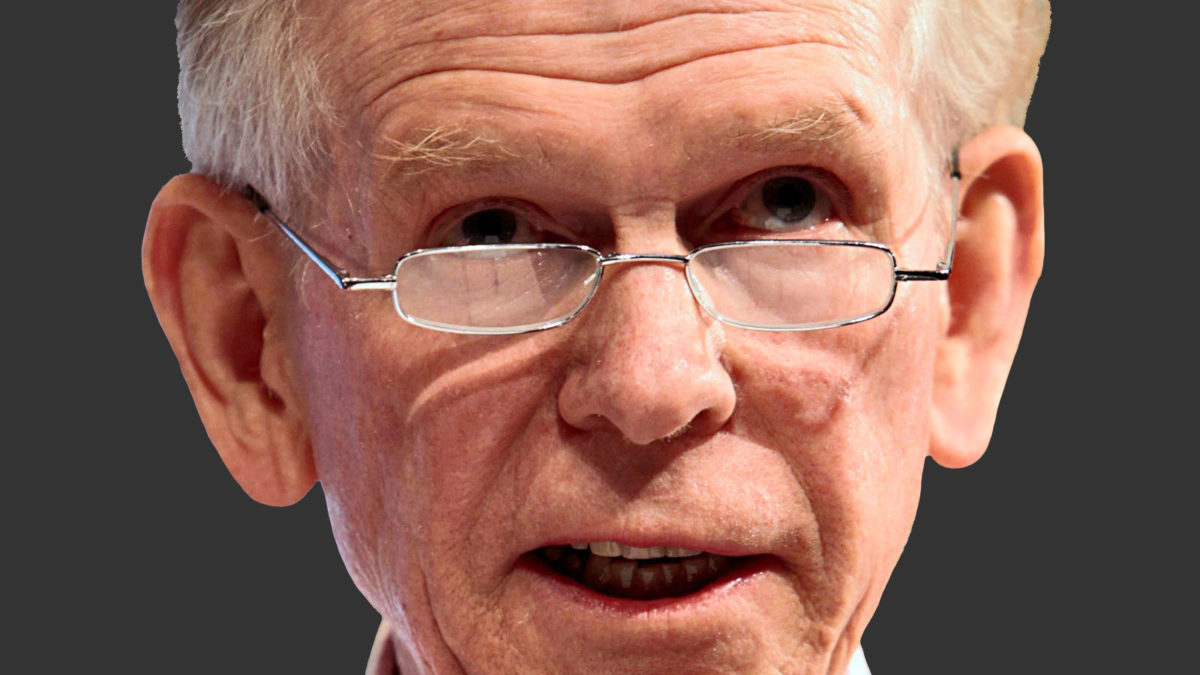

Jeremy Grantham believes the “superbubble” he’s been warning about for years is now on the brink of collapse – and that the “wild rumpus” can begin at any time. Calling the collapse of a market bubble is anybody’s game. One needs only to know that it exists – something now patently obvious to any investor…

Member engagement is starting to rise from a very low base. But the industry is still “net nowhere” when it comes to winning their hearts and minds. It’s widely acknowledged that member engagement remains unacceptably low. Try as they might, super funds can’t seem to get members to care about their retirement savings, as evidenced…

Active manages have failed to heed changing times – and changing markets. But while Hyperion doesn’t do “concept stocks”, it’s got its eyes on plenty of disruptors. The great elephant in the room for active managers has been their inability to outperform the index long-term. Around 93.4 per cent of international equity managers and 86.3…

A time of great change is upon global markets – and the ‘winners’ that everybody is backing might not be the winners at all. It’s essentially an orthodox view among fund managers that the incumbents in any industry will “win” the transition to green energy. After all, they already have the infrastructure in place, stable…

Implausible doesn’t mean impossible. But it remains to be seen whether the “creative destruction” that ARK Invest is banking on can trump the possibility that we’ve been in a bubble all along. They’re what legendary investor/prophet of doom Jeremy Grantham calls “super-crazies” – the wildly overvalued assets that start to appear shortly before the bubble…

ASX falls as Afterpay spikes, Woolworths’ spin-off, retailers rally The ASX 200 (ASX: XJO) fell 0.3%, the second straight day of losses, with consumer staples (+1.9%) and IT (+2.1%) the only real winners. The majority of the selling pressure came from healthcare and energy, falling 1.8% and 1.2% respectively, with continued weakness in CSL Limited (ASX: CSL) dragging the…