Tech paces market as oil, lithium slide, AGL board renewed

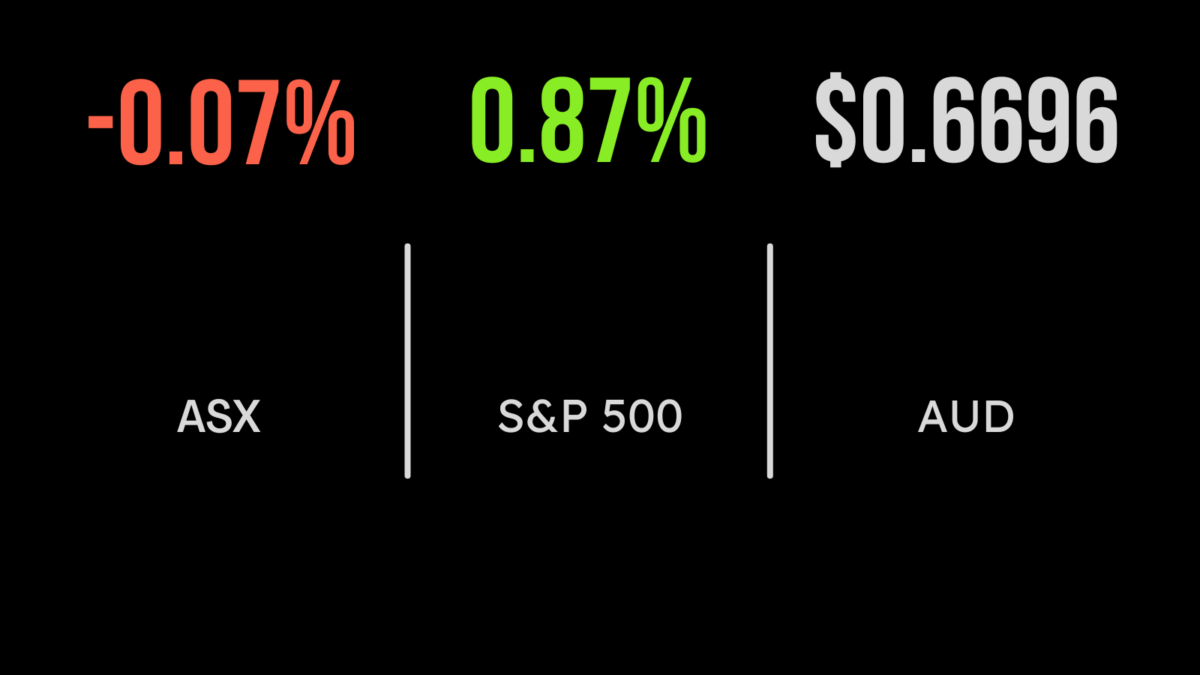

The local market fell 0.1 per cent on Tuesday under the pressure of a weaker energy sector, down 0.9 per cent, after OPEC+ cut their expectations for oil demand in 2023 and beyond; shares in Beach Energy (ASX: BPT) fell 2.8 per cent. It was a similar story for the lithium sector, with broader commodities falling 1 per cent but the likes of Core Lithium (ASX: CXO) and Allkem (AKE) which fell 15 and 12 per cent respectively. The key driver was concern over the long-term demand for the commodity as Chinese experts suggests it was set to fall from 2023. AGL (ASX: AGL) was the talk of the market with shares down 1.2 per cent on news that activist investor Mike Cannon-Brookes had successfully placed four directors on the board as he and a number of large shareholders continue to advocate for a new future for the business.

Incitec shines, CBA profit, NIM increase, United Malt guidance improved

Australia’s leading bank, the Commonwealth Bank (ASX: CBA) added 1.3 per cent after reporting a 2 per cent increase in quarterly profit to $2.5 billion. Expenses rose some 4.5 per cent, however, a 9 per cent increase in revenue was able to offset this on the back of above system growth in lending, which grew $5.1 billion. On the positive side, home loan arrears and bad debts remain muted, and the net interest margin is beginning to improve. Shares in Incitec Pivot (ASX: IPL) topped the market, gaining 5.9 per cent, after reporting a 45 per cent increase in revenue and a nearly six times increase in earnings, despite making the decision to delay the spinoff of the Dyno Nobel business. It was a similar story for United Malt Group (ASX: UMG) which delivered revenue growth of 13.9 per cent, benefitting from higher barley prices, and a 23 per cent increase in earnings to $105 million.

Market rallies on Walmart result, China stocks surge, Buffett buys into TSMC

US benchmarks all finished higher overnight despite another 8 per cent increase in producer inflation. The Nasdaq gained 1.5 per cent, the S&P500 0.9 and the Dow Jones 0.2 per cent, with Walmart (NYSE: WMT) a standout. Shares finished more than 6 per cent higher after reporting an 8.7 per cent increase in revenue, a significant beat on expectations, and same store sales growth of 8.2 per cent. Chinese stocks powered ahead with the likes of Alibaba (NYSE: BABA) gaining 11 per cent on following President Joe Biden’s meeting with Xi Jingping that suggested recent political pressure may be easing. This was also supported by news that Warren Buffett had taken a US$5 billion stake in Taiwan Semiconductors on the view that the company was becoming cheap; shares gained more than 10 per cent.