Three-week high for Aussie market, enjoy it while you can

Surges from CSL and BHP powered the Australian sharemarket to a three-week high on Thursday – but the market is likely to struggle today following overnight falls in the US.

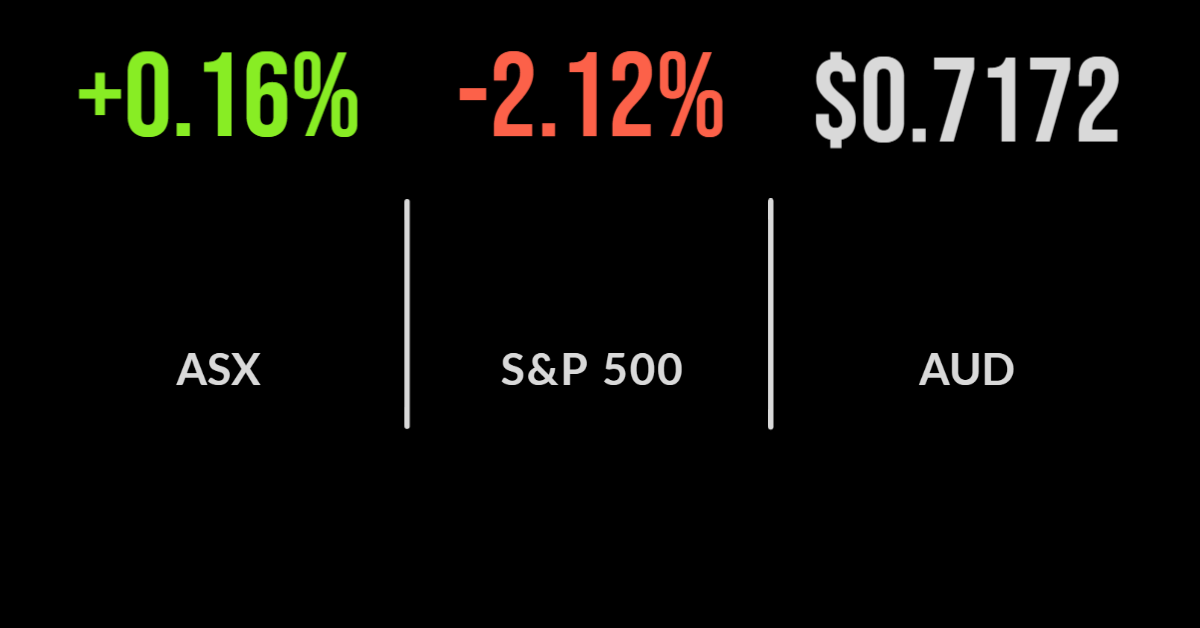

Australia’s benchmark S&P/ASX 200 Index gained 11.3 points, or 0.2%, to 7296.2, its highest level since January 20.

The healthcare sector led the rise, up just under 3%, led by CSL, which saw its strong result on Wednesday flow into broker upgrades, as Morgan Stanley, RBC Capital Markets and JPMorgan all upgraded the stock to a “buy.” CSL gained $13.31, or 5.1%, to $277.00.

Resources were also generally on the rise, with BHP adding 1.4% to $47.97 and Rio Tinto rising 1.2% to $119.94, as the iron ore price stabilised somewhat as Chinese inflation data came in lower than expected.

However, Fortescue Metals Group failed to follow suit, down 65 cents, or 3.1%, to $20.50, as the market worried about price discounts applied to its lower-grade ore.

Former BHP spin-off South32 delivered a record $US1 billion ($1.4 billion) in underlying half-year earnings on the back of rising base metals and steelmaking coal prices, and investors would perhaps have looked for more of a gain in the share price than 1.1%.

Woodside Petroleum rose 4.1% to $27.72 after turning in a terrific 2021 full-year result, with enabling a $US6 billion ($8.3 billion) turnaround in bottom-line profits from last year’s $US4 billion loss to a US$2 billion profit.

Underlying profit more than tripled to $US1.62 billion, and the final dividend was lifted from 12 US cents to US$1.05.

Chief executive Meg O’Neill described the year as “transformative” for Woodside, given the deal in November to merge with BHP’s petroleum business and the final decision to build the $16.5 billion Scarborough and Pluto-2 gas projects in Western Australia.

Wesfarmers, Telstra slump

On the downside, Wesfarmers slumped by 7.5% to $50.81 after it was forced to cut its interim dividend, following a fall in profit-driven by supply chain disruptions, rising costs and store closures driven by COVID-19.

Telstra fell 4.2% to $3.90 as its half-year revenue slid by 4.4% and net profit was slashed by one-third: the telco giant did maintain its dividend and kept its full-year guidance in place, but the market was disappointed.

Domain Holdings lifted revenue by 28% and net profit by 2.4%, but paid the price for rising cost expectations, with the shares down 6.2% to $4.37.

Block, Inc., the shares now owned by ex-Afterpay shareholders, was down 6.4%.

Intellectual property services firm IPH was the star, jumping 9.2% to $9.03 as it company reported revenue growth of 6%, with a strong performance from both its Australian and New Zealand intellectual property activities, and its Asian franchise.

Financial services firm Challenger also had a good day, up 6.7% to $6.74 after reporting a 21 per cent rise in underlying net profit and a 20% lift in assets under management and confirming its guidance for the full year.

Ukraine fears roil US markets

US markets had a poor night, as growing fears of a Russian invasion of Ukraine outweighed good news on the economic front.

President Biden warned the nation that such an invasion could come in the “next several days,” pushing the stock market to its worst trading session for the year.

The S&P 500 index fell 94.8 points, or 2.1%, to 4,380.3; the 30-stock Dow Jones Industrial Average shed 622.2 points, or 1.8%; and the tech-heavy Nasdaq Composite Index was hardest hit, surrendering 407.4 points, or 2.9%, to 13,716.7.

This overshadowed a strong quarterly earnings report from Walmart, in which revenue and profit beat expectations, showing that the US consumer is alive and well.

That story ties in with the market’s growing expectation of potential aggressive Fed tightening.