US inflation news buoys market

Australian shares followed the US market higher on Thursday after the world’s largest economy reported easing inflationary pressures, helping to lower interest rate expectations.

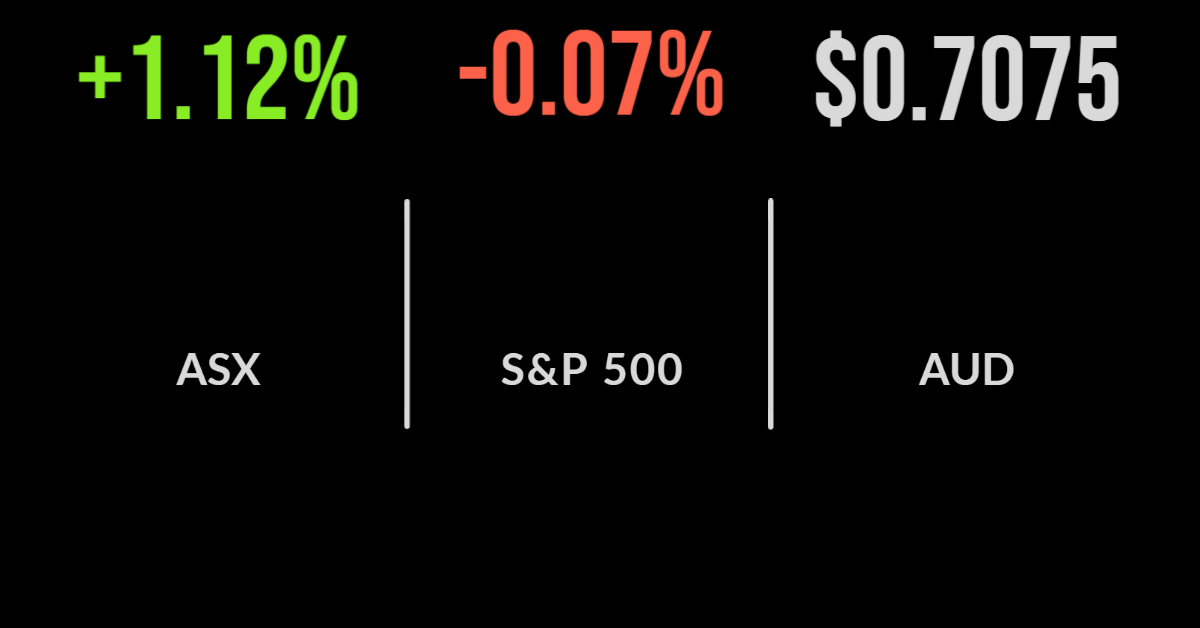

The benchmark S&P/ASX 200 gained 78.3 points, or 1.1 per cent, to close at 7,071 points, while the broader S&P/ASX All Ordinaries rose 86.7 points, or 1.2 per cent, to 7325.4 points.

Most sectors traded higher, led by the consumer discretionary stocks, which as a sub-index rose 2.2 per cent, while the utilities cohort was the biggest loser, falling 1.5 per cent.

Wealth manager AMP reported a 24.5 per cent fall in underlying half-year profit, to $117 million, and did not pay an interim dividend.

AMP Capital’s continuing operations were the only division to boast higher profits in the first half, lifting profit by 62.5 per cent, to $26 million.

However, the company did commit to returning $1.1 billion to shareholders after selling part of its asset management business.

AMP also plans to return another $750 million in the financial year 2022-23 through a combination of capital return, special dividend, or further buyback, subject to regulatory and shareholder approval. AMP shares eased 1 cent to $1.16.

Telstra slipped 5 cents, or 1.25 per cent, to $3.96 after reporting lower revenue and profit, although the numbers met both analyst expectations and the company’s earlier guidance.

The company also lifted its dividend for the first time in seven years, with a 0.5-cent boost to the final dividend, to 8.5 cents a share.

Global share registry giant Computershare fell $1.24, or 5.1 per cent, to $23, adding to its loss of 4.9 per cent on Wednesday.

Computershare posted FY22 results after the bell on Tuesday and the market has not been impressed, even though net profit rose by 23.5 per cent and management told the market to expect earnings per share (EPS) to rise by up to 55 per cent in FY23.

Meanwhile, insurance heavyweight QBE also reported falling profit, with earnings down by nearly two-thirds to $151 million, and net investment income falling from $58 million a year ago to minus $840 million.

But gross written premium was up 13.8 per cent to $11.6 billion and the company said it expects to see rising premiums flow through to revenues this year. QBE shares added 40 cents, or 3.3 per cent, to $12.54.

Lithium again the spark

Miners mostly saw across-the-board gains, with BHP up 85 cents, or 2.2 per cent, to $39.15 and Fortescue Metals up 25 cents, or 1.3 per cent, to $19.08, although Rio Tinto shed nearly 4 per cent from its high for the day, after going ex-dividend – however, the stock ended just 6.3 cents lower, at $95.28.

Battery-mineral stocks were again strong performers, with lithium project developers Lake Resources surging 27 cents, or 21 per cent, higher to $1.60, Core Lithium gaining 7 cents, or 4.8 per cent, to $1.52, Liontown Resources rising 8 cents, or 4.7 per cent and Piedmont Lithium – which is not yet producing but has a supply deal with Tesla – surging 5 cents, or 7 per cent, to 76 cents.

Of the lithium producers, Pilbara Minerals added 13 cents, or 4.4 per cent, to $3.11, Allkem gained 35 cents, or 2.9 per cent, to $12.45, and Mineral Resources advanced 74 cents, or 1.3 per cent, to $59.47.

Three of the Big Four banks rose, with only Commonwealth Bank in the red, losing 15 cents to $100.85 a day after lifting its full-year profit.

ANZ gained 44 cents, or 1.9 per cent, to $23.90, Westpac was up 28 cents, or 1.3 per cent, to $22.48, and National Australia Bank added 31 cents, or 1 per cent, to $30.53.

Producer prices back up CPI in the States

Overnight, the US market was broadly weaker despite seeming confirmation that inflation has peaked for the time being, with data showing easing producer prices, which turned negative in July for the first time since early in the pandemic on the back of lower energy prices.

The producer price index for final demand fell 0.5 per cent from a month earlier and increased 9.8 per cent from a year ago, both coming in much lower than their respective consensus estimates.

The benchmark S&P 500 index eased just under 3 points, to 4,707.3, while the 30-stock Dow Jones Industrial Average added 27.2 points, to 33,336.7 and the tech-heavy Nasdaq Composite Index closed 74.9 points lower at 12,779.9.

Gold is down US$10.20, or 0.6 per cent, at US$1,803.50 an ounce, while Brent crude oil gained US$2.30, or 2.5 per cent, to US$94.23.

The Australian dollar is slightly stronger this morning and is buying 71.05 US cents.