Wall Street’s hot money strategies

The survey is taken of more than 1,000 registrants at one of the biggest events on the calendar catering both asset allocators, alternatives managers and third-party marketers in the US, called ‘Gaining the Edge’. This year the event has moved from Florida to New York City, from October 31-November 18, including both virtual and in-person sessions.

Don Steinbrugge, Agecroft Partners chief executive, said last week (September 14) that the current trend in the alternatives space was towards strategies with low or negative correlations with capital markets, which do well in periods of high volatility.

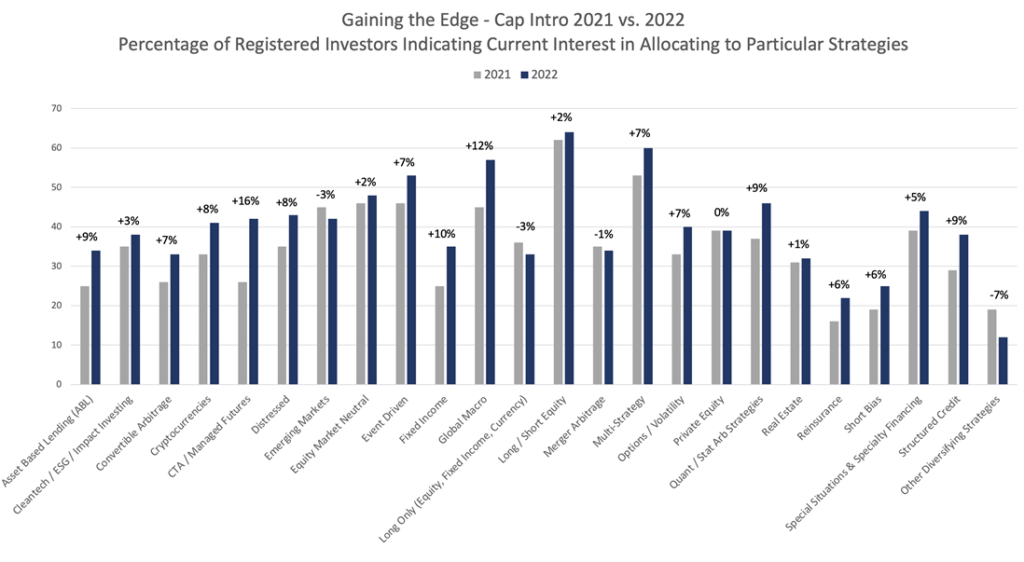

The two strategies with the biggest gains in sentiment towards new allocations compared with a year ago were CTAs, up 16 percentage points to 42 per cent of respondents, and global-macro strategy managers, up 12 points to 57 per cent.

Fixed income and structured credit have also attracted increased interest from asset allocators given the current interest rate environment, presumably with investors moving away from duration-driven bonds and into other alpha-seeking strategies.

Notwithstanding all the bad press among some prominent corporate failures in the space, crypto currency strategies showed a further rise in overall sentiment. Steinbrugge said this reflected long-term bullishness about the technology and the pool of investments, especially from institutional investors, remained small.

Two of the most traditional of the strategies included in the survey showed a fall in demand: emerging markets, down three points to 42 per cent, and long-only, down two points to 33 per cent. Most of the 24 strategies covered showed increases in demand against last year. Only four showed declines (see chart below).

Agecroft notes that the survey’s figures give each investor equal weighting. Practically speaking, strategies with higher interest from pension funds, such as CTAs and reinsurance, will likely see much higher asset flows than the survey data would indicate. In contrast, flows into cryptocurrency strategies will likely be proportionately smaller than the survey indicates as this is currently not a strategy many large institutional investors will consider in the short term.

Steinbrugge said that a high-level trend among investors was the divergence by investor type in how hedge fund strategies were being considered in the portfolio allocation process.

He said: “Many pension funds have evolved their hedge fund strategy from simply outperforming hedge fund indices to building thoughtful portfolios of diversifying strategies. This has narrowed their broad interest across strategies to a focus on strategies with low correlation to the capital markets.

“We expect pensions to have net positive inflows to the hedge fund industry as they reallocate assets away from traditional fixed income mandates into diversified hedge fund strategies. This transition is expected to enhance risk-adjusted returns to their overall portfolios.”