‘Wretched excess’ and index emperors: Munger takes aim

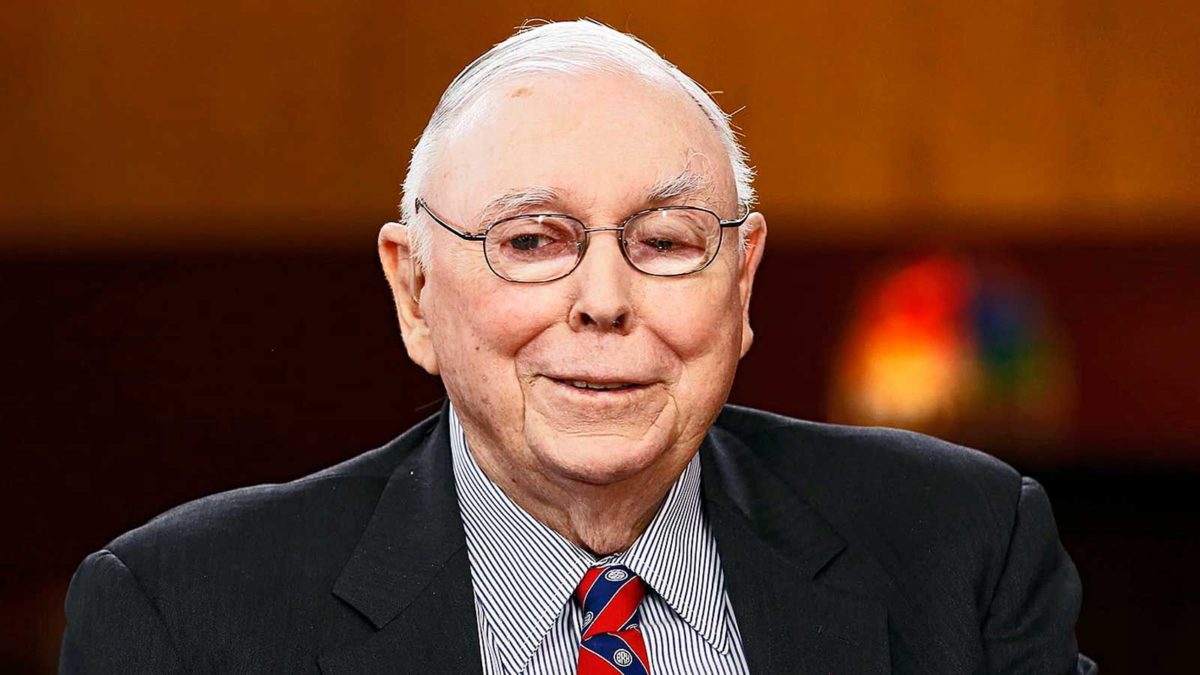

The near-centenarian investor believes that institutions like BlackRock and Vanguard will wield outsize power in the market, and that our latest period of “wretched excess” will end with a bang.

As passive investing becomes the go-to for a new wave of dumb money, Wall Street’s masters of the universe have been replaced with the emperors of the index – and they likely wield even more power, according to Berkshire Hathaway vice chairman Charlie Munger.

“We have a new bunch of emperors,” Munger told the AGM for the Daily Journal. “They’re the people who vote the shares in the index funds. Maybe we can make Larry Fink and the people at Vanguard Pope. All of a sudden, we’ve had this enormous transfer of voting power to these passive index funds.”

“That is going to change the world. I don’t know what the consequences are gonna be, but I predict it will not be good. I think the world of Larry Fink, but I’m not sure I want him to be my emperor.”

Of course, the primary arena that most ETF providers engage with companies in is ESG, something that Berkshire Hathaway is often behind the curve on. It blocked two shareholder resolutions on climate reporting at its 2021 AGM with chairman and CEO Warren Buffet warning it would impose too heavy an administrative burden on some of its smaller business and calling the resolutions “asinine”. Indeed, it was BlackRock and a number of other institutions that sponsored those climate resolutions – evidence enough that Munger would prefer that Fink was not his emperor.

Elsewhere on the call Munger continued his long-running feud with cryptocurrencies, comparing them to a “venereal disease” and saying that he regarded them as “beneath contempt”, and warned that global markets had devolved into an era of liquidity-fuelled “wretched excess”.

“Certainly, the great short squeeze in GameStop was wretched excess. Certainly, the Bitcoin thing is wretched excess,” Munger said. “I would argue that venture capitalists are throwing too much money too fast. There’s considerable wretched excess in venture capital and other forms of private equity.”

“Everybody loves it because it’s like a bunch of people at a party having so much fun getting drunk that they don’t think about the consequences….It has bad consequences. You can argue that the wretched excesses of the 1920s gave us the Great Depression and the Great Depression gave us Hitler. This is serious stuff. A lot of people like a drunken brawl and so far those are the people that are winning. A lot of people are making money out of our brawl.”

Munger also believes that the conditions surrounding that brawl – a Federal Reserve that has so far kept refilling the punch bowl at nearly every opportunity, and the increasing politicisation of economic outcomes – mean that rising inflation is unlikely to get anything like the Volcker Shocks of the 1970s.

“The conditions that allowed Volcker to do that without interference from politicians were very unusual,” Munger said. “In twenty-twenty hindsight, it was a good thing that he did it. I would not predict that our modern politicians will be as willing to permit a new Volcker to get that tough with the economy and bring on that kind of recession.”

“So I think the new troubles are likely to be different from the old troubles. You may wish you had a Volcker-style recession instead of what you’re gonna get. The troubles that come to us could be worse than what Volcker was dealing with. And harder to fix.”

But on the nature of disruption in markets, Munger – who has witnessed nearly every major bubble in modern history – was more circumspect.

“It’s very hard for me to imagine… but I would expect Microsoft, Apple, and Alphabet will be strong 50 years from now,” Munger said. “But if you’d asked me when I was young what was gonna happen to the department stores that went broke or the newspapers which were broke, and so on, I wouldn’t have predicted that either. I think it’s hard to predict how your world is going to change if you’re going to talk about 70, 80, 90 years.”

“Just imagine, they wiped out the shareholders of General Motors, they wiped out the shareholders at Kodak. Who in the hell would have predicted that? This technological change can destroy a lot of people. It’s hard to predict for sure in advance.”