Yellow glow on ASX. Banks bomb out. US indices lower, energy up.

Yellow glow on ASX

Resources came to the rescue on the Australian share market on Wednesday, with surging uranium and oil and gas stocks more than compensating for a shocker from the banks.

A call from Goldman Sachs that Brent crude would average US$140 a barrel between July and September, up 17 per cent from its prevailing price of US$120 a barrel, lifted Woodside Energy $1.85, or 5.6 per cent, higher to $34.74, while Santos gained 29 cents, or 3.4 per cent, to $8.76.

Uranium stocks were also bid up after the Biden administration unveiled a US$4.3 billion ($6 billion) plan to buy the commodity directly from domestic and Western producers in a bid to wean the country off Russian imports.

BHP – whose Olympic Dam copper-gold mine in South Australia is also the world’s largest-known single deposit of uranium – rose $1.07, or 2.3 per cent, to $47.37, while Africa-based miner Paladin Energy surged 9.5 cents, or 13.5 per cent, to 80 cents.

Boss Energy, which owns the Honeymoon uranium project in South Australia, advanced 26 cents, or 11.9 per cent, to $2.45 and Bannerman Energy, which is developing the Etango uranium project in Namibia, was up 2 cents, or 9.5 per cent, to 23 cents.

Banks bomb out

Slumping share prices among the banks dragged the financials sub-index within the S&P/ASX 200 to a three-month low, down 2.9 per cent.

The banks are not enjoying this week’s bigger-than-expected rate hike, which took the official cash rate to 0.85 per cent, with Reserve Bank governor Philip Lowe indicating that more increases will come in the months ahead.

While higher interest rates boost the banks’ net interest margins, their own funding costs increase, and there’s potential for slowing lending growth amid a falling housing market.

In response, Westpac was down $1.43, or 6.1 per cent, to $21.98, CBA fell $4.49, or 4.4 per cent, to $97.47, National Australia Bank eased $1.19, or just under 4 per cent, to $28.91, and ANZ lost 56 cents, or 2.3 per cent, to $23.89.

Even worse, Bendigo and Adelaide Bank shed 76 cents, or 7.2 per cent, to $9.81.

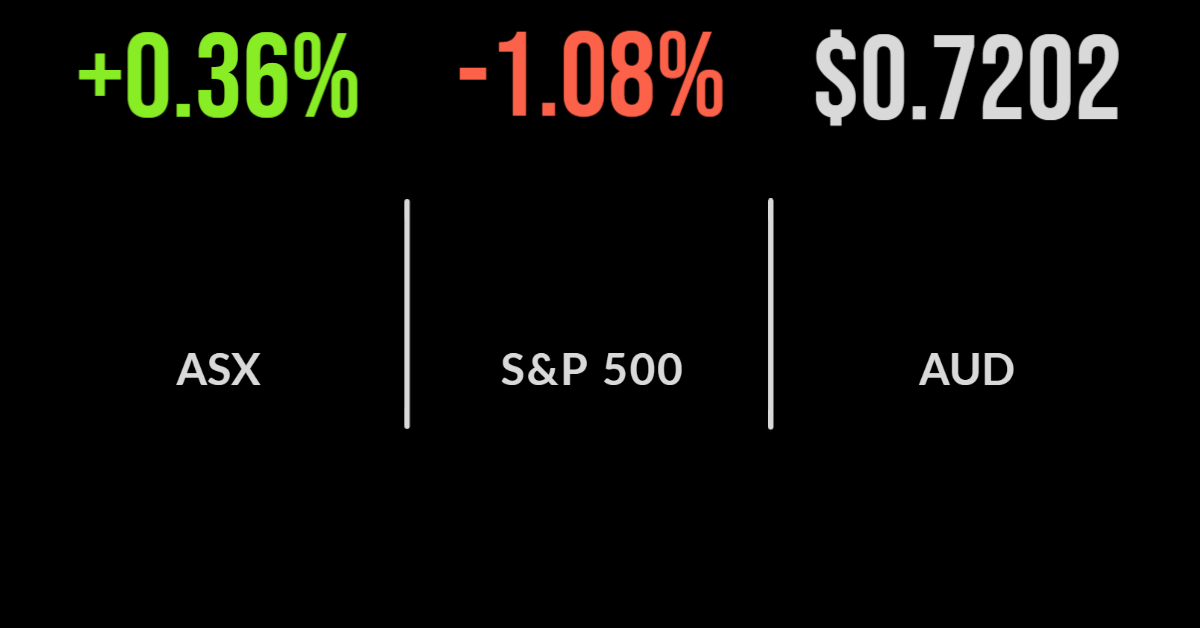

The slumping financials sector put pressure on the benchmark S&P/ASX 200 index, but with the miners and oil producers holding up strongly, the benchmark S&P/ASX200 index finished Wednesday up 25.4 points, or 0.4per cent, to 7,121.1, while the broader S&P/ASX All Ordinaries rose 28.4 points, also 0.4 per cent, to 7,347.

US indices lower, energy up

Overnight, the US markets were lower, as investors fretted over signs of a potential economic slowdown.

The Dow Jones Industrial Average shed 269.24 points, or 0.8 per cent, to close at 32,910.9 points, while the broader S&P 500 slid 44.9 points, or 1.1 per cent, to finish at 4,115.77, and the Nasdaq Composite dropped 89 points, or 0.7 per cent, to end at 12,086.3 points.

Investors are concerned that the economy is slowing and the Atlanta Federal Reserve’s GDPNow tracker appears to confirm this, showing a growth rate of just 0.9 per cent for the second quarter, down from the 1.3 per cent reported last week.

Investors are nervously awaiting Friday’s consumer price index figure for May.

As with the Australian market earlier, energy was a bright spot for the market: in the US. benchmark West Texas Intermediate crude pushing well above US$120 per barrel, the sector index closed at its highest level since August 2014.

Intel dropped more than 5% after management warned at an industry conference of weakening demand for semiconductors.