-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

Warakirri Asset Management has cemented its position as the second-largest fund manager in Australian agriculture with the launch of a second fund in the buy/lease sector. The Warakirri Farmland Fund, launched last week (April 12), has been seeded by a European pension fund. It differentiates itself from the Warakirri Diversified Agriculture Fund (DAF) by being…

Amundi has revamped its old responsible investing green bond fund as a broader strategy which looks to also mitigate against societal damage from the shift to renewables. The new fund, ‘Just Transition for Climate’, retains the fixed income and credit investment strategies, with a sharper focus on carbon reduction, while integrating scores to do with…

After years of consolidation in the member administration space for big super funds, smaller and newer competitors appear to be gaining ground. FNZ and Grow have won their first clients. GROW Inc (formerly Grow Super) was selected by Vanguard as the administrator for the manager’s proposed new superannuation business, against most industry predictions, and FNZ…

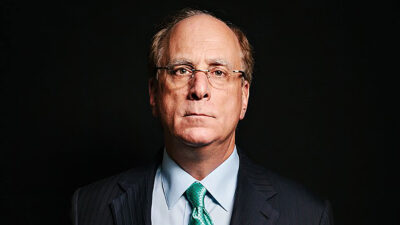

Larry Fink, BlackRock’s outspoken chief executive, has committed the firm to a cultural cleansing in the wake of alleged sexual and racial discrimination at the world’s largest fund manager. In an annual shareholder letter published last week, Fink says “certain employees have not upheld BlackRock’s standards”, putting the manager’s environmental, social and governance (ESG) credentials…

A wave of digitalisation is pushing venture capital to the fore, building capital raisings and deal-making momentum, according to the latest information and views collected by Preqin. The global research firm which specialises in alternatives, has a growing presence in the Asia Pacific region, including an office in Sydney opened last year. It held a…

Citi has incorporated ESG scores into its global securities services data platform, Citi Velocity Clarity, allowing clients to analyse the sustainability exposure of their holdings at the portfolio and security level. It’s unique to Citi and proving popular with clients. The new capability, which Citi believes is unique among major asset servicing providers, is proving popular with clients, the firm said in…

The Insurance Commission of Western Australia (ICWA) is undertaking a review of its asset servicing contract, currently with BNP Paribas Securities Services. The review is being undertaken with advice from JANA Investment Advisers, overseen by senior consultant Jo Leaper, who heads up operational consulting. Julie O’Neill, ICWA’s CIO, is overseeing the process from the client’s…

Michael Ohlsson has become a shareholder and executive director of Evergreen Consultants, the wholesale specialist asset advisory, ratings and research business co-founded by Angela Ashton in 2016. The firm has expanded rapidly in the past five years, last year launching a separate subsidiary to concentrate on ratings and research for non-mainstream products and managers, which…

The theme for this year’s Chant West Awards is ‘resilience’. With the big challenges largely thrust upon them – regulatory changes, political sniping and the COVID crisis – the last year has probably been the toughest ever for super funds. A casual observer of the industry, getting most of his or her information on changes…

“They did what they have always set out to do. They helped their members to achieve a good outcome. And they came to the party at a time it was important to do so,” said Ian Fryer as he oversaw judging of the Chant West Awards for 2021. Speaking last week (April 7) as funds…

Global investors have poured a record amount into exchange-traded funds (ETFs) during the first two months of 2021, according to industry data. UK-based consultancy firm ETFGI clocked about US$222.5 billion (A$288 billion) of net flows into the sector globally over January and February, over twice the figure for the same period in 2020, the Financial…

The NZ Superannuation Fund has won a landmark court case that could set a high bar for activist legal challenges to its investment decisions. Any action jeopardising New Zealand’s reputation was deemed most important. In the ruling handed down in the Auckland High Court this month (March 17), Justice Woolford dismissed the move by Fadel…