-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

Big super funds appear to have taken at least one government change to their overall operations in their stride – the compulsion to hold a member annual meeting, with the first necessary before March next year. Some, such as AustralianSuper, CareSuper and UniSuper, have already been holding regular large meetings for members for years, as…

As it turned out, the Morningstar-organised discussion between a value and a growth manager became a lot more conciliatory than would have been expected. Many investors had been wondering whether value would ever make a comeback. They need not have worried. The conference session (see other reports this edition) on global equities, “Can Value Beat…

In March and April this year, Jamieson Coote Bonds, a Melbourne boutique bond manager, suffered redemptions of about $1 billion, which were processed without difficulty. “Solvency and liquidity are what matters in the darkest days,” says partner Charlie Jamieson. Jamieson and his big competitor PIMCO, shared a session on what to do with fixed income…

Australia’s workplaces have made modest gains in the mental health and wellbeing for employees over the past 12 months, despite the impact of COVID-19, according to the largest annual survey of its kind. But, following the drastically altered work patterns from March, there has been a 9 per cent increase in the number of people…

by David Chaplin Even a blind monkey-based manager could outperform the average active fund by simply flinging darts at the stock index chart, according to US academic, Burton Malkiel, 88. His claim, first aired in his classic ‘A Random Walk Down Wall St’, has been used as anti-active ammunition ever since. Later studies actually concluded…

The New Zealand Superannuation Fund (NZS) is overhauling its 10-year old responsible investment (RI) strategy to stay on track with global best practice, after recording a 60bps gain due to its old policy. In its ‘Climate Change Report’ published last week, the NZS says the fund had launched a project dubbed ‘Resetting the Responsible Investment…

DTCC, the global industry-owned provider of infrastructure for post-trade financial services, is entering the consulting business, with a niche advice offering specific to the post-trade processing space. Post-trade processing is where DTCC (the Depository Trust & Clearing Corporation) provides much of the existing infrastructure for institutional trading, offering “build it once, use it many times”…

It’s ‘Ground Hog Day’ for the super industry, according to Michele O’Neil, the president of the ACTU. The Coalition Government is using the same arguments that then Prime Minister Tony Abbott did in 2016, when he successfully delayed the gradual increase in the Superannuation Guarantee to 12 per cent. But this time, the speakers at…

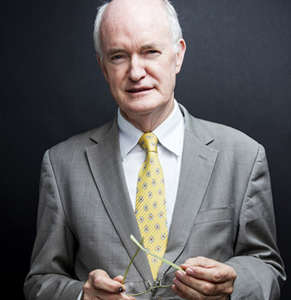

Gerard Noonan retired from his role as chair of Media Super last week (September 30) after nearly 30 years at the fund and its predecessor, Just Super. It was his last major non-executive director’s role in the super industry of the many important one’s he’s had. He will stay around for a few more months…

Australia is doing comparatively very well fighting the spread of COVID-19 and also comparatively well fighting its impact on the broad sharemarket. But there have been several quirks in sharemarket behaviour which have become evident in the latest reporting season, which may present opportunities for investors. All-in-all the season demonstrated resilience through the population’s “civil…

AXA Investment Managers is losing two senior executives who have been instrumental in marketing the firm’s integrated ESG capabilities in Australia and New Zealand. They are Craig Hurt, former Australian country head, who left last week (September 30), and Matt Christensen, the global head of impact and responsible investments. While based in the firm’s headquarters…

The launch early in February this year of Australia’s first unlisted fund to be quoted on the ASX, by Magellan group and its administrator, Mainstream, took a while to sink in, not helped by the dislocation caused by the pandemic crisis. But, as Australia, at least, is preparing to get back to business at some…