-

Sort By

-

Newest

-

Newest

-

Oldest

Appen left at the altar A bizarre blink-and-you-missed takeover approach came and seemingly went for one of the local market’s tech leaders Appen, which develops the datasets for machine learning and artificial intelligence. Canadian company Telus International sprang a $9.50 a share bid on the company, which said it would talk to Telus to try to…

Aussie market creeps higher Despite a steady diet of news of war, global slowdowns, China lockdowns, inflation and higher rates, the Australian share market managed to rise on Wednesday, as measured by the benchmark indices. The S&P/ASX200 index added 26.4 points, or 0.4 per cent, to finish at 7,155.2, while the broader S&P/ASX All Ordinaries index…

China sniffles hurt market The Australian share market was weighed down on Tuesday by concerns that COVID-19 lockdowns have hurt economic growth in China, the benchmark S&P/ASX 200 index finished down 20.1 points, or 0.3 per cent, to 7,128.8, while the broader S&P/ASX All Ordinaries closed 0.35 per cent, or 25.7 points, lower to 7,373.2. Commonwealth Bank…

Election, what Election? A change of government was yawned-off by the Australian share market on Monday; after being up by 50 points in morning trading, the benchmark S&P/ASX 200 index closed just 3.3 points higher, at 7,148.9. The broader S&P/ASX All Ordinaries rose 7.9 points, or 0.1 per cent, to 7,398.9. All four big banks declined, with…

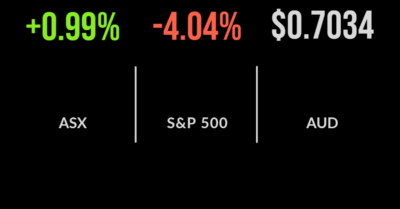

The Aussie market benefitted from the news that the Chinese Government had cut a key interest rate and a late rally in US markets to post a 1.2 per cent gain to finish the week. The result was driven by a jump in the technology and discretionary sectors, up 4.6 and 2.0 per cent after…

The local market couldn’t overcome growing concerns about stagflation, an instance when the economy slows as inflation increases, with the S&P/ASX200 falling 1.7 per cent on Thursday. The losses were broad-based, with every sector but healthcare falling, led by the consumer sectors. Healthcare gained 0.1 per cent with the discretionary and staples companies down 3.1…

The domestic market was buoyed by a jump in the iron ore price as Chinese lockdowns continue to ease with the S&P/ASX200 gaining 1 per cent on the back of a 2.5 per cent jump in the materials sector. Only the staples sector finished lower, falling 1 per cent behind a 1.1 per cent fall…

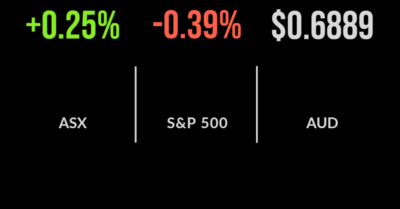

The domestic market is slowly chipping away at recent losses, with the S&P/ASX200 gaining another 0.3 per cent on Tuesday behind a rally in the energy and utilities sectors. The energy sector was buoyed another 2 per cent by a rally in the oil price amid signs that Chinese demand may recover, with both Woodside…

The local market commenced the week on a more positive note, with the S&P/ASX200 gaining 0.3 per cent on the back of a strong performance from the industrials sector, which finished 2.4 per cent higher. Technology shares also rallied behind the likes of Xero (ASX: XRO) up 2.1 and 4.4 per cent as falling bond…

The local market finished the week on a high note, gaining 1.9 per cent on the back of an incredible surge in the technology sector. The mid-session turnaround in the Nasdaq pushed the technology sector to a 6.9 per cent gain after the US-listed payment provider and owner of Afterpay, Block (ASX: SQ2) gained 15…