-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

It turns out that being a top performer can be tough as institutional clients pull money from favourites amidst broader equity de-risking.

“If you have style drift and you move into the latest hot thing, you’re gonna get whipsawed… That’s usually the death knell of a fund manager, that style drift.”

The spectre of early release still looms large over the industry, and super’s true believers want its purpose legislated to prevent Australia’s retirement savings from becoming a crisis piggy bank.

Allocations to unlisted property, diversified fixed interest, Australian and international shares had the greatest impact on whether an option passed the test or not.

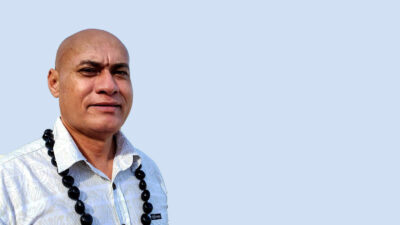

Dotted with various government funds, the Pacific Islands has emerged as a competitive space for NZ and Australian-based investment advisers.

Chicago-based V-Square Quantitative Management has expanded its separately-managed account platform with the launch of its Global Equity ESG Materiality and Carbon Transition Indexed Strategy.

Consolidation among superannuation clients is changing the nature of Citi’s business with them, and increased appetite for nation-building in Australia means plenty of opportunities in private markets.

Any time you get great valuations, “it’s always messy”. But the indiscriminate sell-off in growth small caps presents the best buying opportunity since 2008. “Historically, people think of small cap growth as the wrong place to be in a rising interest rate environment – and it is, when people first start to think about a…

Super funds are increasingly adding thematic passive products to their self-directed investment options as they face new competition from Gen Z focused start-ups – but the ultimate theme is still on the outs.

Australian Retirement Trust (ART) and QIC are continuing the trend of big funds investing in affordable housing, working in conjunction with community housing provider Brisbane Housing Company.

A big chunk of super funds are now in “limp mode” as their buffer against the performance test evaporates. And sustainable investing is getting harder when even tobacco exclusions eat up the tracking error budget.

“These financial cleansings are really important to how you set up asset markets; they’re really important for how the Fed regains credibility; and they’re very important for curbing excessive risk-taking.”