-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

by Johann Plé* In July, US President-elect Joe Biden announced plans to spend US$2 trillion (A$2.74 trillion) to progress the use of clean energy in areas including transportation, electricity generation and construction over the next four years. As part of a group of proposals designed to tackle the growing threat of climate change across the US, this was the first such major commitment from a US leader –…

AMP Capital’s purchase of a small social infrastructure fund from the Royal Bank of Scotland 10 years ago has become a rare beacon of hope for the troubled manager riding an ESG trend and the search for stability in an uncertain world. The AMP Capital Community Infrastructure Fund, known internally as CommIF, now has 19…

As with previous periods of market volatility and economic downturns, real assets have tended to come to the fore as havens of reliable returns. Adding lower-for-longer interest rates to the mix, this is particularly the case right now. Addressing a client webinar for the Asia Pacific region from the US last week (November 19), Justin…

Thanks largely to the mega funds of Japan, China, and Singapore, the Asia Pacific region heads the world in the concentration of the top 100 fiduciary investment organisations. And these funds are increasingly changing the philosophies and investment styles of all funds. A report published last week by the Thinking Ahead Institute (TAI), the independent…

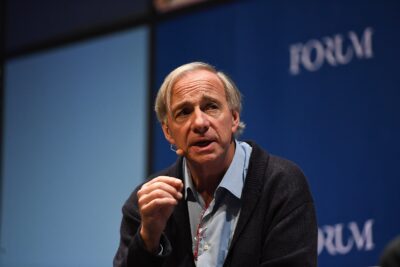

The investing world was disappointed to see the indefinite cancellation of the Ant Group float, if only because they missed seeing whether a Chinese company could take the mantle for the world’s biggest IPO for the second time. Ray Dalio was not among them. The founder of Bridgewater and one of the world’s most famous…

NAB Asset Servicing has decided to replace its outsourced compliance monitoring and reporting system, MIG 21, which was an offering by State Street Global Exchange, with another State Street-owned service. The shift follows the decision by State Street to discontinue the MIG 21 post-trade monitoring system following its purchase of Charles River in 2018, as…

by David Chaplin Stock markets have always been a win-lose situation, but the odds are skewing even further towards a handful of successful companies, according to a new analysis by Australian-based global manager Hyperion Asset Management. In bad news for value and passive investment styles, the study argues that, historically, only a small proportion of…

One of the lesser-discussed principles of responsible investing in a growing mass of information about ESG principles and practices, is that investors should adhere to ‘good tax citizenship’. What does this mean for practitioners? Researchers at Parametric, the implementation specialist manager, have grappled with the philosophical and practical elements of practicing after-tax optimisation of returns…

David Simpson, the first employee in Australia for FactSet, who opened the Sydney office in 1998, has retired from the firm to be replaced by another experienced data and technology executive, Natalia Stansall, who recently finished up at MSCI Inc after 15 years there. The transition was completed earlier this month with Stansall formally taking…

If not for the pandemic, ESG factors could have been a major trend in hedge fund and private equity investing this year, according to global advisory group EY. Alternatives managers have a way to go to satisfy investor interest in ESG. The impact of the crisis on client relationships, felt more by private equity managers…

Assets in alternative investments are expected to grow by 9.8 per cent a year over the next five years, to hit US$17 trillion (A$23.4 trillion) by 2025, according to the latest research by Preqin, the global alternatives research and data provider. Private equity will double to US$9.11 trillion and Asia will be a “huge driver”….

by Greg Bright Loftus Peak, Australian global equities boutique, has become the second manager to launch a ‘quoted managed fund’. This looks set to become a strong trend in retail distribution, with a host of managers lining up for the new form of listing and an extra administrator entering this part of the market, Link…