-

Sort By

-

Newest

-

Newest

-

Oldest

Undersea sabotage. AI-driven breakthroughs in Brazil. Climate reality disrupting the US’ housing fantasy. Black swan spotting is hard – almost impossible – but it pays to think about the unthinkable.

The inertia that rules the retirement system means bigger ideas are needed if members are going to get the best outcome in retirement. And with millions set to retire in the next few years, time is of the essence.

Investors should keep a close eye on the new Cold War brewing between China and the US, but its outcome could still support “robust” trade and investment as strategic competition drives capital investment.

Australia’s megafunds are looking to international asset owners for ideas on how to invest what will soon be trillions in retirement savings. But banks – with their sharp focus on efficient implementation and balance sheet management – could also be a source of inspiration.

In Cliff Asness’ latest missive, a fictional asset allocator from the future looks back on the decade to 2035 to figure out which assets helped their performance and which hurt it.

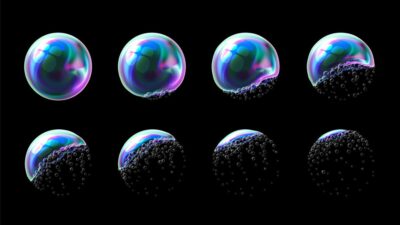

Higher starting valuations usually lead to lower returns, but the most important part of a bubble is “highly skewed psychology” – and investors remain anchored to sanity.

A second Trump presidency and the potential for a new US trade regime increases uncertainty as we head into 2025. But despite the prevailing zeitgeist of unease, emerging market investors have various reasons to be sanguine, according to Ninety One

Tweets aren’t policy, but Yarra Capital believes that financial markets are underestimating Trump’s intentions. Expect 2025 to be the year of higher debt, higher inflation and lower growth – not to mention plenty of volatility.

Private market returns are nothing to sneeze at, but investors need to consider whether their prospective allocation is worth doing the hard work to understand the liquidity and transparency issues that come with it.

The amount of money rushing into private markets asset classes has made them more efficient, and investors will need to be more selective – and peruse different opportunity sets – if they want to meet their great expectations.

Rising tensions across geopolitical fault lines have significant potential to create market shocks due to the high level of exposure Western stocks and industries have to risk hotspots, according to Verisk Maplecroft.

Big investors want to build resilience into their portfolio and “get on with their job” of generating returns for members and clients even as policy shifts, short-termism and government interventions make that job much harder.