-

Sort By

-

Newest

-

Newest

-

Oldest

Howard Marks, one of the investment world’s more celebrated investors, has added his voice to other celebrated investors in decrying continued use of the terms ‘value’ and ‘growth’. The co-founder and co-chair of Oaktree Capital Management, Los Angeles-based, predominantly fixed income and credit strategies, firm addressed the opening session of the CFA Societies Australia conference,…

Dutch asset management giant, Robeco, tips a mainly positive, if subdued, outlook for equities over the next five years but with a high degree of uncertainty ahead in a decade it dubs the ‘Roasting Twenties’. In its new five-year forecast returns paper, Robeco says “we expect risk-taking to be rewarded in the next five years,…

The 2020s are set to be the years of thematic investing – but so were the early 2000s. And the more things change, the more they stay the same. One of the problems in thematic investing is figuring out what’s a theme and what’s just plain old trendy. But that problem is also a problem…

Kim Catechis says he was not pessimistic when he wrote ‘Deep Water Waves’, his first major strategy report for investors through the Franklin Templeton Investment Institute. The report, published in August, sparked a series of discussions within and outside the Franklin Templeton group. If one of these is a guide, from an investor webinar held…

The first thing funds usually consider in a merger is cost to member – but that won’t necessarily be what leaves them better off. The trick is getting the alignment right. According to David Carruthers, senior consultant and head of the members solutions group at Frontier, the top priority for any fund considering a merger…

As AustralianSuper continues to grow, Mark Delaney is focusing his attention on the burgeoning private markets space and the problem of culture in megafund land. “Size can creep up on you. You stand still, and all of a sudden you’re bigger than what you think you are. I first started managing pension money 20 years…

Investors looking to arbitrage index ins-and-outs would have seen shrinking rewards for their efforts over the last 25 years based on the findings of a new S&P Dow Jones Indices (S&PDJI) paper. The S&P study found a “structural decline” in the so-called ‘index effect’ where share prices bounce up on entering key market benchmarks and…

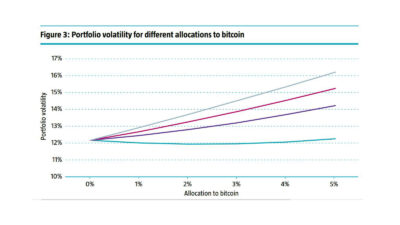

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…

China’s regulatory crackdown is just one piece of the puzzle when it comes to investing in Asia. The real game is geopolitics – and in that area, things are heating up. “I think Asia will probably look better as we move into 2022. I think the remainder of 2021 is really about timing of entry;…

The problem with high expectations is that you have to keep meeting them. And after a year where some funds returned 20 per cent, investors and super members are expecting more, more, more. Investors are relentlessly cheerful creatures. According to Schroders’ latest Global Investor Study, Australian investors (defined here as those expecting to invest the…

The tilt at Sydney airport and the privatisation of WestConnex has showcased the appetite for Australian infrastructure from super funds and offshore investors. The only problem is in meeting it. “The appetite to invest in Australia, as you’re seeing through these mega-privatisations, is huge,”says Nicole Walker, chief commercial officer at specialist alternative asset manager HRL…

Family office portfolios could see massive underperformance ahead with most well-overweight cash, according to the latest Citi Private Bank global survey of the sector. David Bailin, Citi Global Wealth chief investment officer, said about a third of family offices in the survey reported cash holdings of 20 per cent or more while a further third…